FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

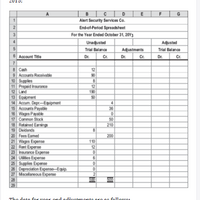

Adjustment data on an end-of-period spreadsheet

Alert Security Services Co. offers security services to business clients.

The

following end-of-period spreadsheet for the year ended October 31,

20Y3:

The data for year-end adjustments are as follows:

a. Fees earned, but not yet billed, $13.

b. Supplies on hand, $4.

c. Insurance premiums expired, $10.

d.

e. Wages accrued, but not paid, $1.

Enter the adjustment data, and place the balances in the Adjusted Trial

Balance columns.

Transcribed Image Text:B

c | D

E

F

G

1

Alert Security Services Co.

End-of-Period Spreadsheet

For the Year Ended October 31, 20Y3

4.

Unadusted

Adusted

Adjustments

Cr.

Trial Balance

Trial Balance

6 Account Title

Dr.

Cr.

Dr.

Dr.

Cr.

12

90

8

12

8 Cash

9 Accounts Receivable

10 Supplies

11 Prepaid Insurance

12 Land

13 Equipment

14 Accum. Depr-Equipment

15 Accounts Payable

16 Wages Payable

17 Common Stock

18 Retained Earnings

19 Dividends

20 Fees Eamed

21 Wages Expense

22 Rent Expense

23 Insurance Expense

24 Utes Expense

25 Supplies Expense

26 Depreciation Epense-Equip.

27 Miscelaneous Expense

28

190

50

36

50

210

200

110

12

6.

2

200

29

Th

E end

foll

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Consider the following independent situation at Dec. 31 Jounlrnalize the adjusting entry needed on Dec 31 for each situation. Use the label the journal entries ( record debits first, then credits. Select the explanation on the last line of the journal entry table. a) On Oct 1, a business collected $3600 rent in advance, debiting cash and crediting unearned revenue. The tenant was paying one year's rent in advance. On Dec 31, a business must account for the amount of rent it has earned b) salaries expense is $1000 perday Monday through Friday and the business pays employees each Friday. This year Dec 31 falls on a Thursday. c) the unadjusted balance of the office supplies account is $3500. Office supplies in hand Total $1700 d) equipment depreciation was $200 e) on July 1, when the business prepaid $1200 for a two year insurance policy.the business debited prepaid insurance and credited casharrow_forwardI. The senior accountant for Koo Graphics discovered that the company'e accounting clerk had a different method of recording the purchase cf automobile insurance. Specifically, when one-year policies were purchased on July 1, the clerk debited Insurance Expense $7200 and credited Bank $7200, A. Has the clerk done anything seriously wrong? Explain. B. Use the T-accounts in your Workbook to calculate the year-end adjustment for insurance for December 31. Journalize the adjusting entry.arrow_forwardJouralize the adjusting entries and post to the general ledger. Adjusting Entries: a, Expired insurance for the period , $500. b, Supplies on hand at the end of the month, $1,000.arrow_forward

- INSTRUCTIONS: (1) Complete the adjustments section of the worksheet [WS]. Use the following information regarding unadjusted items. (a) On September 30, the firm received its utilities bill for the month of September amounting to P14,300. This remains to be unpaid at month-end. Record an adjustment for the utilities for the month of September. Accrued Expense (b) On September 21, the firm received a 6% 90-day note for money lent to Ling Ying Wei amounting to P400,000. The remainder of the amount pertains to a 12-month 9% promissory note received on May 1, 2021. Record an adjustment for the accrued interest from both notes for the month of September. Accrued Income (c) On September 30, an inventory of Warehouse Supplies and Office Supplies showed that items costing P127,000 and P12,000 were on hand respectively. Record an adjustment for the supplies used in September. Prepaid Expense (d) On July 1, 2021, the firm purchased a six-month insurance policy for P232,000. Record an…arrow_forwardT accounts, adjusting entries, financial statements, and closing entries; optional end-of-period spreadsheetThe unadjusted trial balance of Epicenter Laundry at June 30, 2018, the end of the fiscal year, follows: The data needed to determine year-end adjustments are as follows:(A) Laundry supplies on hand at June 30 are $3,600.(B) Insurance premiums expired during the year are $5,700.(C) Depreciation of laundry equipment during the year is $6,500.(D) Wages accrued but not paid at June 30 are $1,100.Instructions1. For each account listed in the unadjusted trial balance, enter the balance in a T account.Identify the balance as “June 30 Bal.” In addition, add T accounts for Wages Payable, Depreciation Expense, Laundry Supplies Expense, Insurance Expense, and Income Summary.2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and completethe spreadsheet. Add the accounts listed in part (1) as needed.3. Journalize and post the adjusting entries. Identify the…arrow_forwardAdjustment for Insurance On December 1, a six-month liability insurance policy was purchased for $900. Analyze the required adjustment as of December 31 using T accounts, and then formally enter this adjustment in the general journal. (Trial balance is abbreviated as TB.) (Balance Sheet)Prepaid Insurance fill in the blank a8cfc50a8015fe0_2 fill in the blank a8cfc50a8015fe0_4 Bal. fill in the blank a8cfc50a8015fe0_5 (Income Statement)Insurance Expense Adj. fill in the blank a8cfc50a8015fe0_6 Page: DATE ACCOUNT TITLE DOC.NO. POST.REF. DEBIT CREDIT 1 20--Dec. 31 fill in the blank 59564e01b03df92_2 fill in the blank 59564e01b03df92_3 1 2 fill in the blank 59564e01b03df92_5 fill in the blank 59564e01b03df92_6 2arrow_forward

- Please help mearrow_forwardWhat is the proper adjusting entry at June 30, the end of the fiscal year, based on a prepaid insurance account balance before adjustment, $18680, and unexpired amounts per analysis of policies of $6100? O Debit Insurance Expense, $12580; Credit Prepaid Insurance, $12580. O Debit Insurance Expense, $6100; Credit Prepaid Insurance, $6100. O Debit Insurance Expense, $18680; Credit Prepaid Insurance, $18680. O Debit Prepaid Insurance, $12580; Credit Insurance Expense, $12580.arrow_forwardAdjusting Entries and Financial StatementsThe unadjusted trial balance for Mitchell Pharmacy appears below. The following information is available at year end for adjustments:a. An analysis of insurance policies indicates that $2,1800 of the prepaid insurance is coverage for 2020.b. Depreciation expense for 2019 is $10,130.c. Four months' interest at 10% is owed but unrecorded and unpaid on the note payable.d. Wages of $4,950 are owed but unpaid and unrecorded at December 31.e. Income taxes of $11,370 are owed but unrecorded and unpaid at December 31.Required:1. Prepare the adjusting entries.2. Prepare an income statement, a retained earnings statement, and a balance sheet using adjusted account balances.3. CONCEPTUAL CONNECTION Why would you not want to prepare financial statements until after the adjusting entries are made?arrow_forward

- Prepare adjusting journal entries, as needed, considering the account balances excerpted from the unadjusted trial balance and the adjustment data. A. supplies actual count at year end, $6,500 B. remaining unexpired insurance, $6,000 C. remaining unearned service revenue, $1,200 D. salaries owed to employees, $2,400 E. depreciation on property plant and equipment, $18,000arrow_forwardPlease prepare Journal Entries & T Accts for: 2019 December Adjusting Entries Amount o. One month of the prepaid insurance has expired. $170 p. The December portion of the rent paid on December 1 has expired. $900 q. Counted supplies and found this amount still on hand (recorded the amount used as an expense) $100 r. The amount collected in transaction m is unearned at December 31. $2,000 s. Three days of wages for December 29, 30, and 31 are unpaid. These will be paid in January. $2,900 t. One month of depreciation needs to be recorded. Estimated useful life of truck in years is: 361.111 3 u. Income taxes expense to be paid in the next fiscal year. $100arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education