Concept explainers

Change in principle; change in inventory cost method

• LO20–2

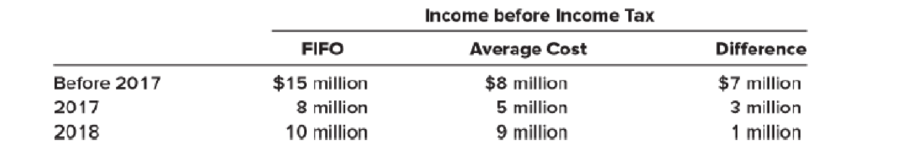

Millington Materials is a leading supplier of building equipment, building products, materials and timber for sale, with over 200 branches across the Mid-South. On January 1, 2018, management decided to change from the average inventory costing method to the FIFO inventory costing method at each of its outlets. The following table presents information concerning the change. The income tax rate for all years is 40%.

Required:

1. Prepare the

2. Determine the net income to be reported in the 2018–2017 comparative income statements.

3. Which other 2017 amounts would be reported differently in the 2018–2017 comparative income statements and 2018–2017 comparative

4. How would the change be reflected in the 2018–2017 comparative statements of shareholders’ equity? Cash dividends were $1 million each year. Assume no dividends were paid prior to 2017.

Want to see the full answer?

Check out a sample textbook solution

Chapter 20 Solutions

Intermediate Accounting

- Oo.96 Subject :- Accountarrow_forwardMillington Materials is a leading supplier of building equipment, building products, materials, and timber for sale, with over 200 branches across the Mid-South. On January 1, 2024, management decided to change from the average inventory costing method to the FIFO inventory costing method at each of its outlets. The following table presents information concerning the change. The income tax rate for all years is 25 %. Income before Income Tax FIFO Average Cost Difference Before 2023 $ 23 million $ 16 million $ 7 million 2023 24 million 13 million 11 million 2024 18 million 17 million 1 million Required: 1. Prepare the journal entry to record the change in accounting principle. 2. Determine the net income to be reported in the 2024-2023 comparative income statements. 4. Indicate the affect of the change in the 2024-2023 comparative statements of shareholders' equity assuming cash dividends were $6.00 million each year and that no dividends were paid prior to 2023.arrow_forwardA21-20 Retrospective Policy Change (LO 21-3, 21-4, 21-6) Armstrong Ltd. has used the average cost (AC) method to determine inventory values since the company was first formed in 20X3. In 20X7, the company decided to switch to the FIFO method, to conform to industry practice. Armstrong will still use average cost for tax purposes. The tax rate is 40%. The following data have been assembled: Net income, as reported, after tax Closing inventory, AC 20x3 $82,000* 20X4 $98,800* 20X5 51,600 68,400 Closing inventory, FIFO Dividends 60,200 7,600 86,600 10,600 $327,600* 84,800 78,200 10,600 20X6 $385,600* 137,800 127,200 14,600 20X7 $182,800** 169,200 189,800 20,600 *Using the old policy, average cost **Using the new policy, FIFO. *Using the old policy, average cost **Using the new policy, FIFO. Required: Prepare the comparative retained earnings section of the statement of changes in shareholders' equity for 20X7, reflecting the change in accounting policy. ARMSTRONG LIMITED Comparative…arrow_forward

- QUESTION 13 ABC Corporation sells just one product. At the end of fiscal year 2017, ABC applies the lower-of-cost-or market (LCM) rule and writes down the value of inventory from historical cost of $10,000 to current market value of $9,700. Which of the following will result from this write-down? O a. ABC's owners' equity decreases by $300. O b. ABC's total assets decrease by $300. O C. ABC's gross profit remains the same. O d. Both a and b are true.arrow_forwardPlease do not give solution in image format thankuarrow_forward34arrow_forward

- Please do not give solution in image format thankuarrow_forwardA D F G H Problem #3 Robin Rotelle Corp. began operations late in 2020 and adopted the conventional retail method. Because there was no beginning inventory for 2020 and no markdowns during 2020, the ending inventory as of Dec. 31, 2020 was $525,000 using either the conventional retail or LIFO retail methods. At the end of 2021 Robin wants to compare the results of applying the conventional and LIFO retail methods. The following data is available for computations: Cost Retail Inventory Dec. 31, 2020 525,000 1,312,500 2021 Purchases 1,917,825 4,100,000 2021 Net markups 16,000 2021 Net markdowns 202,071 2021 Net Sales 3,690,000 2021 Price Index 108 Required: Compute the cost of the 2021 ending inventory under the a conventional retail method b LIFO retail method Dollar-value Lifo Retail Method (2020 is "Base-year") 11 02 D3arrow_forward10arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning