FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

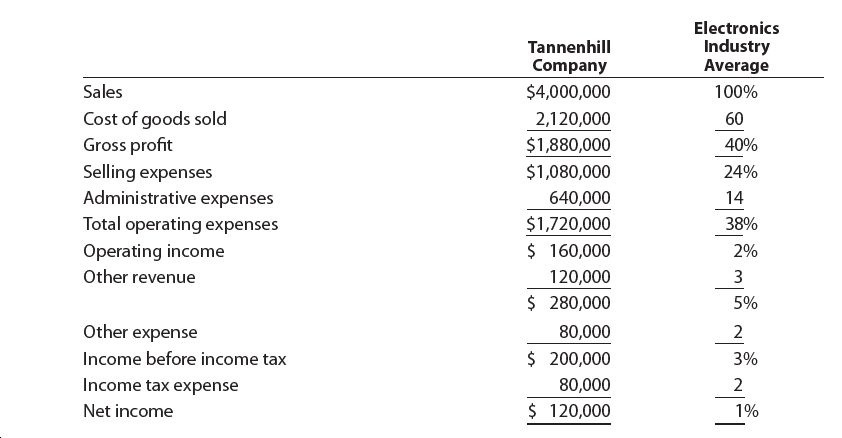

Revenue and expense data for the current calendar year for Tannenhill Company and for the electronics industry are as follows. Tannenhill’s data are expressed in dollars. The electronics industry averages are expressed in percentages.

Please see the attachment for details:

a. Prepare a common-sized income statement comparing the results of operations for Tannenhill Company with the industry average. Round to the nearest whole percentage.

b. As far as the data permit, comment on significant relationships revealed by the comparisons.

Transcribed Image Text:Electronics

Industry

Average

Tannenhill

Company

Sales

$4,000,000

100%

Cost of goods sold

Gross profit

2,120,000

$1,880,000

40%

Selling expenses

$1,080,000

24%

Administrative expenses

640,000

14

Total operating expenses

$1,720,000

38%

$ 160,000

Operating income

2%

Other revenue

120,000

3

$ 280,000

5%

Other expense

80,000

2

$ 200,000

Income before income tax

3%

Income tax expense

80,000

2

$ 120,000

Net income

1%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Forecast Income Statement and Balance Sheet Following are the income statement and balance sheet for Medtronic PLC. Note: Complete the entire question using the following Excel template: Excel Template. Then enter the answers into the provided spaces below with two decimal places. Medtronic PLC Consolidated Statement of Income $ millions, For Fiscal Year Ended April 26, 2019 Net sales $30,557 Costs and expenses Cost of products sold 9,155 Research and development expense 979 Selling, general, and administrative expense 10,418 Amortization of intangible assets 1,764 Restructuring charges, net 83 Certain litigation charges, net 166 Other operating expense, net 258 Operating profit 7,734 Other nonoperating income, net (157) Interest expense 1,444 Income before income taxes 6,447 Income tax provision 547 Net income 5,900 Net income loss attributable to noncontrolling interests (19) Net income attributable to Medtronic $5,881…arrow_forwardPrepare common size income statements Which company earns more net income? Which companies net income has a higher percentage of its net sales revenue?arrow_forwardThe financial statements of Dandy Distributors Ltd. are shown on the "Fcl. Stmts." page. 1 Based on Dandy's financial statements, calculate ratios for the year ended December 31, 2020. Assume all sales are on credit. Show your work. 2 From these ratios, analyze the financial performance of Dandy.arrow_forward

- Use the following selected data from Business Solutions's income statement for the three months ended March 31, 2022, and from its March 31, 2022, balance sheet to complete the requirements. Computer services revenue $ 25, 364 Net sales (of goods) 18, 138 Total sales and revenue 43, 502 Cost of goods sold 15, 644 Net income 19, 551 Quick assets 90, 356 Current assets 97, 288 Total assets 121, 816 Current liabilities 820 Total liabilities 820 Total equity 120, 996 Required: Compute the gross margin ratio (both with and without services revenue) and net profit margin ratio. Compute the current ratio and acid - test ratio. Compute the debt ratio and equity ratio. What percent of its assets are current? What percent are long term?arrow_forwardWhat is the current assets for each company? What are the short term investments for each company? What is the average account receivable for each company? What is the average inventory for each company?arrow_forwardA single-step income statement follows. Present the information in a multistep income statement, and indicate what insights can be obtained from the multistep form as opposed to the single-step form.arrow_forward

- Suppose the following historical data is from the consolidated income statements filed by a media corporation. *attached chart* B: Prepare a vertical analysis of the costs and expenses for 2013. (Round percentages to one decimal place.) *chart attached*arrow_forwardUsing the attached financial statements attached, ratios need to be calculated for all boxes that are greyed out. Please provide details of how these ratios are calculated.arrow_forwardA condensed income statement for Weber Associates and a partially completed vertical analysis follow. Required: 1. Complete the vertical analysis by computing each missing line item as a percentage of net revenues. TIP: In the prior year, Cost of Goods Sold was 31 percent of Net Revenues, computed as ($1,397 ÷ $4,571). 2. Does Cost of Goods Sold, as a percentage of Net Revenues, represent better or worse performance in 2019 as compared to 2018? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Complete the vertical analysis by computing each missing line item as a percentage of net revenues. TIP: In the prior year, Cost of Goods Sold was 31 percent of Net Revenues, computed as ($1,397 ÷ $4,571). (Decreases should be indicated by a minus sign. Round your answers to the nearest whole percent.) Net Revenues Cost of Goods Sold Research and Development Expense Sales and Marketing Expense General and Administrative Expense Income from Operations Other…arrow_forward

- How do I make a tabular format, to provide the revenues, gross profit, income from operations, net income, and earnings per share for the most recent three fiscal years. For the two most recent fiscal years, compute and indicate the annual percentage growth (or decline) in each of these numbers?arrow_forwardIncome statements illustrate what revenues the firm collects, the expenses required to support revenues, and the firm's profitability over a specified period of time. While balance sheets are a "snapshot" of the firm's status on a specific date, income statements reflect performance over a period of time. Publicly held companies generate income statements every quarter (three months) and for their annual report. INCOME STATEMENT (Thousands of dollars) Net revenues - Cost of goods sold - Operating expenses - Research & development expense Operating costs excluding depreciation - Depreciation and amortization expense Operating income (EBIT) - Interest expense Taxable income - Taxes Net income - Preferred dividends Net income available to common shareholders Dividends Addition to retained earnings The gross margin for this fictional company is: O 14.7% O 9.2% 18.2% 60.3% O 33.3% $ $ On the income statement, interest expense is $ Wages are considered a(n) $ $ In this example, the firm pays…arrow_forwardCreate a comparative financial statement from the following:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education