Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

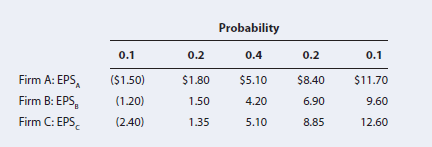

a. Given the following information, calculate the expected value for Firm C’s EPS. Data

for Firms A and B are as follows: E(EPSA) =$5.10, σA =$3.61, E(EPSB) =$4.20, and σB = $2.96.

b. You are given that σC = $4.11. Discuss the relative riskiness of the three firms’ earnings.

Transcribed Image Text:Probability

0.1

0.2

0.4

0.2

0.1

Firm A: EPS,

Firm B: EPS,

Firm C: EPS,

($1.50)

$1.80

$8.40

$11.70

(1.20)

$5.10

4.20

1.50

6.90

9.60

(2.40)

1.35

5.10

8.85

12.60

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The Beta coefficients of TSLA and JPM are 1.99 and 1.18 respectively. What does Beta measure and how is it interpreted? Explain the beta values of TSLA and JPM by providing a calculated example of how they relate to market returns.arrow_forwardBased on the information in the yellow shaded areas: a) Plot the Security Market Line (SML) b) Superimpose the CAPM’s required return on the SML c) Indicate which investments will plot on, above and below the SML?arrow_forwardBunkhouse Electronics is a recently incorporated firm that makes electronic entertainment systems. Its earnings and dividends have been growing at a rate of 36.5%, and the current dividend yield is 8.50%. Its beta is 1.33, the market risk premium is 14.50%, and the risk-free rate is 2.70%. a. Use the CAPM to estimate the firm's cost of equity. Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. b. Now use the constant growth model to estimate the cost of equity. Note: Do not round intermediate calculations. Enter your answer as a whole percent. c. Which of the two estimates is more reasonable? a. Cost of equity % % c. Which of the two estimates is more reasonable? b. Cost of equityarrow_forward

- Consider a firm with a beta of 1.57. If the market return is 6.73% and the risk-free rate is 0.90%, what is the firm's expected return according to the capital asset pricing model? Round your answer to four decimal places, e.g., enter 12.34 for 12.34%.arrow_forwardAnswer the following a) When will the different DCF methods use the same discount rate? b) The cost of debt (ka) will change as the capital structure of a firm changes. Why or why not? c) Why does the cost of equity (k.) increase as the amount of debt in the capital structure of a firm increases? Why? d) Freebie Inc.'s common stock has a beta of 1.3. If the risk-free rate is 4.5% and the expected return on the market is 12%, what is its cost of equity capital? e) Why do branded food companies command the highest EBIT multiple (about 8) and transportation companies the lowest (about 3)? f) Should a firm use its cost of capital as a hurdle/discount rate to value all internal divisions? Why or why not? g) An option can have more than one source of value. Consider a mining company. The company can mine for ores today or wait another year (or more) to mine. What real options can you identify here? h) Do you consider dividend payments by the firm in calculating cash flows? Why or why not? i)…arrow_forwardThe Expected Rate of Profit Formula looks at: A. Expected Profit & Money Invested B. Common Stock & Preferred Stock C. Expected Profit & Bonds D. All of the abovearrow_forward

- XYZ has a beta coefficient of 1.76. Estimate its cost of equity if the risk-free rate is 8% and return on the broad market index is 16%. Calculate the cost of equity.arrow_forwardConsider a company which has current trailing earnings of 6.8 per share. The expected ROE is 0.141. The required rate of return is 0.13. If the firm has a plowback ratio of 0.3, its intrinsic value using the DDM should be: 54.11 59.74 51.03 56.57 47.49arrow_forwardYou are thinking about investing in either X corp, or Y corp. Based on the following market measures, which company could be the best option based on possible return of investment? x y Price/Earnings Ratio 10.39 12.27 Earnings per Common Share 3.5 5.4 Divident Payout .464 .320arrow_forward

- The.. value.. of.. an.. ordinary.. share..Select one or more:a. Will fall if future profit forecasts are higher than expectedb. Is always at its fundamental valuec. Can rise and fall along with market sentimentd. Will rise if a firm introduces some cost saving innovationarrow_forwardTotal investment risk can be broken down into two types of risk. What are these two types of risk and which should NOT affect expected return? (b) A firm has a beta of 1.3. The expected market return is 12% and the risk-free rate is 2%. What should be the firm's equity cost of capital? Use CAPMarrow_forward3. Price/earnings ratios are ____ for firms with ____ expected earnings and ____ expected required ratesof return.a. higher; higher; higherb. lower; lower; lowerc. higher; lower; higherd. higher; higher; lowere. higher; lower; lowerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education