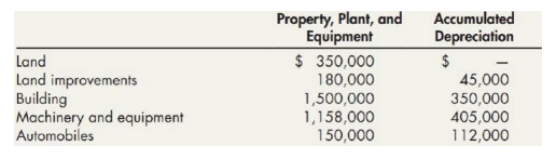

Pell Corporation's Property, Plant, and Equipment and

Depreciation

Depreciation method and useful lives:

. Land improvements: Straight-line; 15 years.

. Building: 150%-declining-balance; 20 years.

. Machinery and equipment: Straight-line; 10 years.

. Automobiles: 150%-declining-balance; 3 years.

. Depreciation is computed to the nearest month. No salvage values are recognized.

Transactions during 2019:

1. On January 2, 2019, machinery and equipment were purchased

at a total invoice cost of $260,000, which included a $5,500 charge

for freight. Installation costs of $27,000 were incurred.

2. On March 31, 2019, a machine purchased for $58,000 on January 3, 2015, was sold for $36,500.

3. On May 1,2019, expenditures of $50,000 were made to repave

parking lots at Pell's plant location. The work was necessitated by

damage caused by severe winter weather.

4. On November 2, 2019, Pell acquired a tract of land with an

existing building in exchange for 10,000 shares of Pell's $20 par

common stock, which had a market price of $38 a share on this

date. Pell paid legal fees and title insurance totaling $23,000. The

last property tax bill indicated assessed values of $240,000 for land

and $60,000 for building. Shortly after acquisition, the building was razed at a cost of $35,000 in anticipation of new building

construction in 2020.

5. On December 31, 2019, Pell purchased a new automobile for

$15,250 cash and trade-in of an automobile purchased for $18,000

on January 1, 2018. The new automobile has a cash value of

$19,000.

Required:

1. Prepare a schedule analyzing the changes in each of the plant

assets during 2019, with detailed supporting computations.

Disregard the related Accumulated Depreciation accounts.

2. For each asset classification, prepare a schedule showing

depreciation expense for the year ended December 31, 2019.

3. Prepare a schedule showing the gain or loss from each asset

disposal that Pell would recognize in its income statement for the

year ended December 31, 2019.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

- On June 1, 20--, a depreciable asset was acquired for $3,600. The asset has an estimated useful life of five years (60 months) and no savage value. Using the straight-line depreciation method, caculate the book value as of December 31, 20--.arrow_forwardEquipment was acquired at the beginning of the year at a cost of $78,840. The equipment was depreciated using the straight-line method based upon an estimated useful life of 6 years and an estimated residual value of $7,860. a. What was the depreciation expense for the first year?$fill in the blank 4b6aeefb5057020_1 b. Assuming the equipment was sold at the end of the second year for $59,600, determine the gain or loss on sale of the equipment.$fill in the blank 4b6aeefb5057020_2 c. Journalize the entry to record the sale. If an amount box does not require an entry, leave it blank or enter "0". - Select - - Select - - Select - - Select - - Select - - Select - - Select - - Select -arrow_forwardDuring the current year, Fortini Company disposed of three different assets. The company's accounts reflected the following on January 1 of the current years, prior to the disposal of the assets: Accumulated Depreciation (straight line) $15,750 (7 years) Original Residual Asset Machine A Machine B Machine C Cost $21,000 50,000 Value $3,000 4,000 75,000 3,000 Estimated Life 8 years 10 years 12 years 36,800 (8 years) 60,000 (10 years) The machines were disposed of in the following ways: a. Machine A: Sold on January 1 of the current year for $5,000 cash. b. Machine B. Sold on April 1 for $10,500; received cash, $2,500, and a note receivable for $8,000, due on March 31 of the following year, plus 6 percent interest. c. Machine C: Suffered irreparable damage from an accident on July 2. On July 10, a salvage company removed the machine at no cost. The machine was insured, and $18,000 cash was collected from the insurance company. Required: 1. Prepare all journal entries related to the…arrow_forward

- On December 31, Strike Company has decided to discard one of its batting cages. The equipment had an initial cost of $204,000 and has accumulated depreciation of $183,600. Depreciation has been recorded up to the end of the year. Which of the following will be included in the entry to record the disposal? a.Gain on Disposal of Asset, credit, $20,400 b.Equipment, credit, $204,000 c.Loss on Disposal of Asset, debit, $183,600 d.Accumulated Depreciation, debit, $204,000arrow_forwardTamarisk Cole Inc. acquired the following assets in January of 2018. Equipment, estimated service life, 5 years; salvage value, $15,500 $546,500 Building, estimated service life, 30 years; no salvage value $639,000 The equipment has been depreciated using the sum-of-the-years’-digits method for the first 3 years for financial reporting purposes. In 2021, the company decided to change the method of computing depreciation to the straight-line method for the equipment, but no change was made in the estimated service life or salvage value. It was also decided to change the total estimated service life of the building from 30 years to 40 years, with no change in the estimated salvage value. The building is depreciated on the straight-line method. (a) Prepare the general journal entry to record depreciation expense for the equipment in 2021. (b) Prepare the journal entry to record depreciation expense for the building in 2021. (Round answers to 0 decimal places,…arrow_forwardKHS&R's Construction bought a truck on 1/1/ at a cost of $31,000, an estimated salvage (residual) value of $3,000, and an estimated useful life of 4 years. The truck is being depreciated on a straight-line basis. At the end of year 3, what amount will be reported for accumulated depreciation? Fill in the blank with your calculated number. DO NOT include commas, $ signs, period, decimal points, etc., just enter the raw number. Webcourses will add commas to your answer automatically. For example, if you calculated the answer to be $24,123, you would only input: 24123 ASUS f4 f5 f6 X f7 f8 f9 f10 f11 4. 5 C R Y 60 08 图arrow_forward

- Marcus purchased a equipment which was an depreciable asset for P38,000 on January 1, 2017. The estimated salvage value is P6,000, and the estimated useful life is 4 years. The sum-of-the-years' digits method is used for depreciation. What is depreciation expense for the year 2019? A. 8,000. B. 11,400. C. 6,400. D. 12,800.arrow_forwardVaughn Company purchased machinery on January 1, 2025, for $92,000. The machinery is estimated to have a salvage value of $9,200 after a useful life of 8 years. (a) Compute 2025 depreciation expense using the double-declining-balance method. Depreciation expense eTextbook and Medialarrow_forwardA company used straight-line depreciation for an item of equipment that cost $16,950, had a salvage value of $4, 200 and a six-year useful life. After depreciating the asset for three complete years, the salvage value was reduced to $1,695 but its total useful life remained the same. Determine the amount of depreciation to be charged against the equipment during each of the remaining years of its useful life:$3, 780. $6.485$1,275$4,200.$2,960.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education