Concept explainers

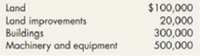

Classification of Costs Associated with Assets the following account balances were included in Bromley Company's

During 2019, the following transactions occurred:

1.Land was acquired for $70,000 for a future building site. Commissions of $4,000 were paid to real estate agent.

2. A factory and land were acquired from Kent development company by issuing 20,000 shares of $3 par common stock. At that time, the stock. At that time, the stocl was selling for $10 per share on the New york stock exchange. The independently appraised values of the land and the factory were $60,000 and $180,000 respectively.

3.Equipment was acquired at a cost of $120,000. In addition, sales tax, freight costs, and installation costs were $7,000, $10,000 and $16,000, respectively. During installation, the equipment was damaged, and $2000 was spent for repairs.

4.A new parking lot was installed at a cost of $30,000.

5.Half the land purchased in Item 1 was prepared as a building site. Costs of $26,000 were incurred to clear the land, and the timber recovered was sold for $3,000. A new building was built for $60,000. Architect's fees relating to construction were $18,000 and imouted intrest on equity funds used during construction was $15,000. No debt is outstanding.

6.Costs of $20,000 were incurred to improve some leased office space. The lease will terminate in 2021 and is not expected to be renewed.

7. A group of new machines was purchased under royalty agreement that provides for payment of annual royalties based on units produced. The invoice price of the machines was $30,000, Freight costs were $2,000, and royalty payments for 2019 were $12,000.

Required:

Prepare

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

- The plant asset and accumulated depreciation accounts of Pell Corporation had the following balances at December 31, 2023: Plant Asset Accumulated Depreciation $ 480,000 245,000 2,150,000 1,184,000 215,000 Land Land improvements Building Equipment Automobiles Transactions during 2024 were as follows: a. On January 2, 2024, equipment was purchased at a total invoice cost of $325,000, which included a $6,800 charge for freight Installation costs of $40,000 were incurred in addition to the invoice cost. b. On March 31, 2024, a small storage building was donated to the company. The person donating the building originally purchased it three years ago for $32,000. The fair value of the building on the day of the donation was $21,000. c. On May 1, 2024, expenditures of $63,000 were made to repave parking lots at Pell's plant location. The work was necessitated by damage caused by severe winter weather. The repair doesn't provide future benefits beyond those originally anticipated. d. On…arrow_forwardArrangement of the Income Statement Powers Wrecking Service demolishes old buildings and other structures and sells the salvaged materials. During 2019, Powers had $425,000 of revenue from demolition services and $137,000 of revenue from salvage sales. Powers also had $1,575 of interest income from investments. Powers incurred $243,200 of wages expense, $24,150 of depreciation expense, $48,575 of supplies expense, $84,000 of rent expense, $17,300 of miscellaneous expense, and $43,900 of income taxes expense.arrow_forward1.How much is the carrying amount of property, plant and equipment as of December 31, 2020?a. P435,160 c. P763,440b. P729,840 d. P860,400arrow_forward

- Selected accounts included in the property, plant, and equipment section of Splish Corporation’s balance sheet at December 31, 2019, had the following balances. Land $378,000 Land improvements 176,400 Buildings 1,386,000 Equipment 1,209,600 During 2020, the following transactions occurred. 1. A tract of land was acquired for $189,000 as a potential future building site. 2. A plant facility consisting of land and building was acquired from Mendota Company in exchange for 25,200 shares of Splish’s common stock. On the acquisition date, Splish’s stock had a closing market price of $37 per share on a national stock exchange. The plant facility was carried on Mendota’s books at $138,600 for land and $403,200 for the building at the exchange date. Current appraised values for the land and building, respectively, are $289,800 and $869,400. 3. Items of machinery and equipment were purchased at a total cost of $504,000. Additional costs were incurred as…arrow_forwardInformation related to plant assets, extractable natural resources, and intangibles at the end of 2020 for Whispering Energy is as follows: buildings £1,020,000, accumulated depreciation-buildings £650,000, goodwill £410,000, coal mine £499,000, and accumulated depletion-coal mine £108,000. Prepare a partial statement of financial position of Whispering Energy for these items. (List Property, plant and equipment in order of coal mine and buildings.) WHISPERING ENERGY Statement of Financial Position (partial) > >arrow_forwardBrown Company paid cash to purchase the assets of Coffee Company on January 1, 2019. Information is as follows: Total cash paid $4,500,000 Assets acquired: Land $800,000 Building $700,000 Machinery $800,000 Patents $700,000 The building is depreciated using the double-declining balance method. Other information is: Salvage value $70,000 Estimated useful life in years 20 The machinery is depreciated using the units-of-production method. Other information is: Salvage value, percentage of cost 10% Estimated total production output in units 100,000 Actual production in units was as follows: 2019: 20,000 2020: 20,000 2021: 30,000 The patents are amortized on a straight-line basis. They have no salvage value. Estimated useful life of patents in years 40 On December 31, 2020, the value of the patents was estimated to be $100,000 Where applicable, the company uses the ½ year rule to calculate depreciation and amortization expense in the years of acquisition and disposal. Its fiscal year-end is…arrow_forward

- Hardev l gadubhaiarrow_forwardAccording to the footnotes, what was the initial total acquisition cost of the Property, Plant, and Equipment that Newell Brands owns as of December 31, 2020?arrow_forwardplease need help with must must explanation , narrations , computation for each entry and for each calculation , parts answer in text formarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education