Concept explainers

Earnings per Share with Convertible Securities

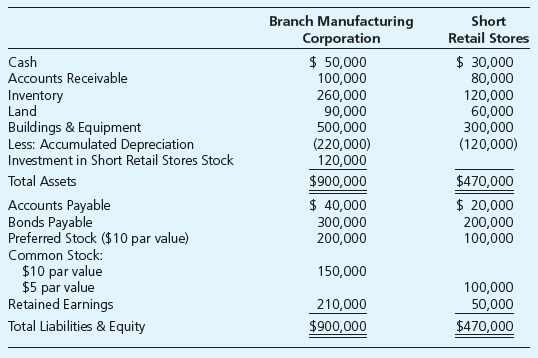

Branch Manufacturing Corporation owns 80 percent of the common shares of Short Retail Stores. The companies’

Short Retail’s 8 percent

Branch Manufacturing has 11 percent preferred stock and 12 percent bonds outstanding, neither of which is convertible. Branch reported after-tax income, excluding investment income from Short, of $100,000 in 20X4 and paid dividends of $60,000. The companies file separate tax returns and are subject to a 40 percent income tax.

Required

Compute basic and diluted EPS for the consolidated entity.

Want to see the full answer?

Check out a sample textbook solution

Chapter 10 Solutions

Advanced Financial Accounting

- Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: a. Issued 15,000 shares of 20 par common stock at 30, receiving cash. b. Issued 4, 000 shares of 80 par preferred 5% stock at 100, receiving cash. c. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at 40 per share, plus a 150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at 33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for 24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. i. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. j. Paid the cash dividends to the preferred stockholders. k. Received 27,500 dividend from Pinkberry Co. investment in (h). l. Purchased 90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of 37 5. The bonds are classified as a held-to-maturity long -term investment. m. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (g). n. Received a dividend of 0 .60 per share from the Solstice Corp. investment in (f). o. Sold 1,000 shares of Solstice Corp. at 45, including commission. p. Recorded the payment of semiannual interest on the bonds issue d in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method . q. Accrued interest for three months on the Dream Inc. bonds purchased in (I). r. Pinkberry Co. recorded total earnings of 240 ,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. s. The fair value for Solstice Corp. stock was 39. 02 per share on December 31, 2016. The investment is adjusted to fair value , using a valuation allowance account. Assume Valuation Allowance for Available-for-Sale Investments h ad a beginning balance of zero. Instructions 1. Journalize the selected transactions. 2. After all of the transaction s for the year ended December 31, 201 6, had been poste d [including the transactions recorded in part (1) and all adjusting entries), the data that follows were taken from the records of Equinox Products Inc. a. Prepare a multiple-step in come statement for the year ended December 31, 201 6, concluding with earnings per share . In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were 100,000. ( Round earnings per share to the nearest cent.) b. Prepare a retained earnings statement for the year ended December 31, 20 6. c. Prepare a balance sheet in report form as of December 31, 2016.arrow_forwardInformation from the financial statements of Ames Fabricators, Incorporated included the following: Common shares Convertible preferred shares (convertible into 88,000 shares of common) 8% convertible bonds (convertible into 30,000 shares of common) Basic Diluted Numerator $ 632,000 + Ames's net income for the year ended December 31, 2024, is $860,000. The income tax rate is 25%. Ames paid dividends of $5 per share on its preferred stock during 2024. Denominator Required: Compute basic and diluted earnings per share for the year ended December 31, 2024. Note: Do not round intermediate calculations. Enter your answers in thousands (i.e., 10,000 should be entered as 10). 100,000 = $ December 31 Earnings per Share 2024 6.32 0 100,000 33,600 $ 1,000,000 2023 100,000 33,600 $ 1,000,000arrow_forwardXYZ Company purchased 10,000 of its own shares at $14 per share. Journalize this transaction. DATE Debit Credit X/X XYZ Company sold 8,500 shares of treasury stock (from (c)) at $18 per share. Journalize this transaction. DATE Debit Credit X/X XYZ Company sold 1,500 shares of treasury stock (from (c)) at $13 per share. Journalize this transaction. DATE Debit Credit X/Xarrow_forward

- Nexis Corp. issues 2,870 shares of $8 par value common stock at $17 per share. When the transaction is recorded, what credit entry or entries are made? a.Common Stock $48,790. b.Common Stock $22,960 and Paid-in Capital in Excess of Stated Value $25,830. c.Common Stock $22,960 and Paid-in Capital in Excess of Par Value $25,830. d.Common Stock $25,830 and Retained Earnings $22,960.arrow_forwardSelected account balances of the Han Corporation as at December 31, 20x3 are as follows: Convertible bonds, 5% $31,045,617 Preferred Shares, Series A, $4, noncumulative, 60,000 shares issued and outstanding, each preferred share is convertible into 3 common 6,000,000 shares Preferred Shares, Series B, $5, cumulative, 35,000 shares issued and 3,500,000 outstanding Common shares, 3,000,000 shares issued and outstanding 42,000,000 Additional Information – The convertible bonds were issued on December 31, 20x0 and mature on December 31, 20x20, The face value of the bonds is $30,000,000. The bonds were issued to yield 4.7%. The bonds pay interest on June 30 and December 31 of each year. Each $1,000 bond is convertible into 20 common shares. In 20x3, Han purchased the shares of another company. As part of the agreement, Han agreed to issue an additional 80,000 shares on February 15, 20x4 if the net income of the other company for the year ended December 31, 20x3 was in excess of $1,000,000.…arrow_forwardAarrow_forward

- The following information was taken from the books and records of Cullumber, Inc.: 1. Net Income $391,400 2. Capital structure: a. Convertible 6% bonds. Each of the 290, $1,000 bonds is convertible into 50 shares of common stock at the present date and for the next 10 years. 290,000 b. $10 par common stock, 190,000 shares issued and outstanding during the entire year. 1,900,000 c. Stock warrants outstanding to buy 15,040 shares of common stock at $20 per share. 3. Other information: a. Bonds converted during the year None b. Income tax rate 30% c. Convertible debt was outstanding the entire year d. Average market price per share of common stock during the year $32 e. Warrants were outstanding the entire year f. Warrants exercised during the year Compute diluted earnings per sharearrow_forwardON JANUARY 1, VERMONT CORPORATION HAD 39,600 SHARES OF $10 PAR VALUE COMMON STOCK ISSUED AND OUTSTANDING. ALL 39,600 SHARES HAD BEEN ISSUED IN A PRIOR PERIOD AT $21 PER SHARE. ON FEBRUARY 1, VERMONT PURCHASED 1,020 SHARES OF TREASURY STOCK FOR $28 PER SHARE AND LATER SOLD THE TREASURY SHARES FOR $19 PER SHARE ON MARCH 1. THE JOURNAL ENTRY TO RECORD THE PURCHASE OF THE TREASURY SHARES ON FEBRUARY 1 WOULD INCLUDE A: A. CREDIT TO A GAIN ACCOUNT FOR $7,140 B. CREDIT TO TREASURY STOCK FOR $28,560 C. DEBIT TO TREASURY STOCK FOR $28,560 D. DEBIT TO A LOSS ACCOUNT FOR $7,140 NEED ENTRY IN TABLE FORMAT WHICH STATEMENT BELOW REGARDING A SHARE REPURCHASE IS TRUE? A. THE COMPANY REPURCHASING SHARES IS NOT ENTITLED TO VOTE. B. REPURCHASING SHARES SHRINK A COMPANY'S ASSETS AND EQUITY. C. A SHARE REPURCHASE GROWS A COMPANY'S ASSETS AND EQUITY. D. REPURCHASING SHARES INCREASES RETAINED EARNINGS.arrow_forwardNexis Corp. issues 1,970 shares of $9 par value common stock at $17 per share. When the transaction is recorded, credits are made to a.Common Stock, $15,760 and Retained Earnings, $17,730. b.Common Stock, $15,760 and Paid-In Capital in Excess of Stated Value, $17,730. c.Common Stock, $17,730, and Paid-In Capital in Excess of Par—Common Stock, $15,760. d.Common Stock, $33,490.arrow_forward

- Nexis Corp. issues 1,960 shares of $11 par value common stock at $15 per share. When the transaction is recorded, what credit entry or entries are made? a.Common Stock $29,400. b.Common Stock $21,560 and Paid-in Capital in Excess of Par Value $7,840. c.Common Stock $7,840 and Retained Earnings $21,560. d.Common Stock $21,560 and Paid-in Capital in Excess of Stated Value $7,840.arrow_forwardInformation from the financial statements of Henderson-Niles Industries included the following at December 31, 2021: Common shares outstanding throughout the year Convertible preferred shares (convertible into 40 million shares of common) Convertible 8% bonds (convertible into 13.5 million shares of common) S 100 65 1,000 million million million Henderson-Niles's net income for the year ended December 31, 2021, is $600 million. The income tax rate is 25%. Henderson-Niles paid dividends of $2 per share on its preferred stock during 2021.arrow_forwardThe following information was taken from the books and records of Wildhorse, Inc.: 1. Net Income $488,400 2. Capital structure: a. Convertible 6% bonds. Each of the 290, $1,000 bonds is convertible into 50 shares of common stock at the present date and for the next 10 years. 290,000 b. $10 par common stock, 220,000 shares issued and outstanding during the entire year. 2,200,000 c. Stock warrants outstanding to buy 15,520 shares of common stock at $20 per share. 3. Other information: a. Bonds converted during the year None b. Income tax rate 30% c. Convertible debt was outstanding the entire year d. Average market price per share of common stock during the year $32 e. Warrants were outstanding the entire year f. Warrants exercised during the year Nonearrow_forward

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning