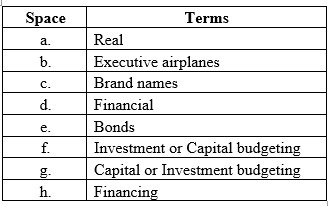

Investment and financing decisions Read the following passage: “Companies usually buy (a) assets. These include both tangible assets such as (b) and intangible assets such as (c). To pay for these assets, they sell (d) assets such as (e). The decision about which assets to buy is usually termed the (f) or (g) decision. The decision about how to raise the money is usually termed the (h) decision.”

Now fit each of the following terms into the most appropriate space: financing, real, bonds, investment, executive airplanes, financial, capital budgeting, brand names.

To determine: The ways the following terms fit into the given appropriate spaces.

Explanation of Solution

The ways the following terms fit into the given appropriate spaces are as follows:

Want to see more full solutions like this?

Chapter 1 Solutions

Principles of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

- Which one of the following activities best exemplify capital structure decisions. For this exercise you will be choosing more than one option for your answer: Determine the most adequate mixture of debt and equity to be maintained.Obtain a short-term loan to purchase materials.Identify two capital investment projects.Determine the cost of each source of capital.Determine the return of a potential project.Calculate the cash flows for a project.Assess the terms of loans and evaluate potential long-term financing options.arrow_forward1. Discuss the reasons why capital rationing may arise 2. Discuss the meaning of the term “relevant cash flow” in the context of investment appraisal, giving examples to illustrate your discussion.arrow_forwardWhich of the following are the key factors when determining asset allocation for an investment? I. Time an investor has until he needs to use the money from the investment (time horizon) II. Risk preferences (tolerance for risk) III. Current financial situation a. I., II., & III. b. I. & III. c. II. & III. d. I. & II.arrow_forward

- What is the MOST important variable of the financial planning process? Select one: a. The costs b. The capacity of the fixed asset c. The pro forma income statement d. The sales forecastarrow_forwardBradley Co. is expanding its operations and is in the process of selecting the method of financing this program. After some investigation, the company determines that it may (1) issue bonds and with the proceeds purchase the needed assets or (2) lease the assets on a long-term basis. Without knowing the comparative costs involved, answer these questions: a. What might be the advantages of leasing the assets instead of owning them? b. What might be the disadvantages of leasing the assets instead of owning them? c. In what ways will the Statement of Financial Position be differently affected by leasing the assets as opposed to issuing bonds and purchasing the assets?arrow_forwardBriefly explain the meaning of working capital and working capital management. Also explain the relationship of current asset policy with liquidity, profit and risk. Which policy do you think is good?arrow_forward

- A characteristic of the payback method is that it: (See your Chapter 25 notes, page 9) Uses accrual accounting inflows in the numerator of the calculation Uses the estimated expected useful life of the asset in the denominator of the calculation Incorporates cash flows received after the payback period has been reached Is based on accounting income Incorporates the time value of money Ignores total project profitabilityarrow_forwardWhich of the following statements is true for historical cost valuations? (Select one or more) a. Present value of cash flows using historical interest rates is an item in which cash receipts or cash payments will occur over time, these future cash flows are then discounted at the interest rate in effect at the time of the initial transaction. Balance sheet examples include notes receivable and notes payable. b. Acquisition cost is the amount paid initially to acquire the asset, examples include prepayments, land, and intangibles with indefinite lives. c. Acquisition cost is the amount paid initially to acquire the asset, examples include amounts invested in research and development for intellectual property. d. Adjusted acquisition cost is the amount paid initially to acquire an asset less accumulated depreciation and amortization, examples include equipment and intangible assets with limited lives.arrow_forward“By applying capital to investments with long-term benefits, the company is attempting to produce value. This value is dependent on expected future cash flows as well as on the cost of funds.” 1. Explain this statement with regards to the role of cost of capital in financial management decisions.arrow_forward

- Use the information provided to answer the questions.Use the information provided below to calculate the following. Where applicable, use the presentvalue tables provided in APPENDICES 1 and 2 that appear after QUESTION 5. QUESTION) Calculate the Accounting Rate of Return (on average investment) of Project B (expressed to twodecimal places). INFORMATION Zeda Enterprises has the option to invest in machinery in projects A and B but finance is only available to invest inone of them. You are given the following projected data:Project A Project BInitial cost R300 000 R300 000Scrap value R40 000 0Depreciation per year R52 000 R60 000Net profitYear 1 R20 000Year 2 R30 000Year 3 R50 000Year 4 R60 000Year 5 R10 000Net cash flowsYear 1 R90 000Year 2 R90 000Year 3 R90 000Year 4 R90 000Year 5 R90 000 Additional informationThe discount rate used by the company is 12%. Transcribed Image Text:Number of Periods 1 2 3 4 5 6 7 8 m 10 11 12 13 14 15 1% 2% 0.9901 0.9804 0.9709 3% 3.9020 3.8077…arrow_forwardThe process by which management plans, evaluates, and controls long-term investment decisions involving fixed assets is called capital investment analysis. True O Falsearrow_forwardExplain briefly what the terms working capital and working capital management imply. Explain the link between current asset policy and liquidity, profit, and risk as well as any other considerations. Which policy do you believe is the best?arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education