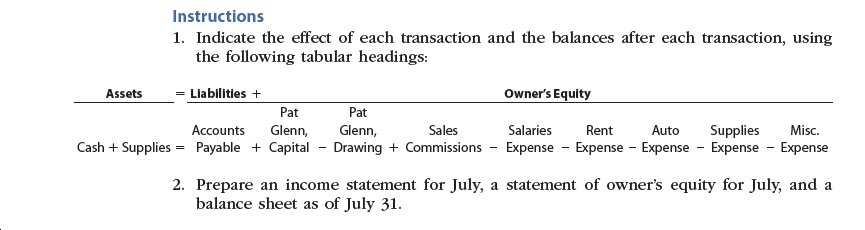

On July 1, 2019, Pat Glenn established Half Moon Realty. Pat completed the following transactions during the month of July:

a. Opened a business bank account with a deposit of $25,000 from personal funds.

b. Purchased office supplies on account, $1,850.

c. Paid creditor on account, $1,200.

d. Earned sales commissions, receiving cash, $41,500.

e. Paid rent on office and equipment for the month, $3,600.

f. Withdrew cash for personal use, $4,000.

g. Paid automobile expenses (including rental charge) for the month, $3,050, and miscellaneous expenses, $1,600.

h. Paid office salaries, $5,000.

i. Determined that the cost of supplies on hand was $950; therefore, the cost of supplies used was $900.

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 4 images

- Domingo Company started its business on May 1, 2019. The following transactions occurred during the month of May and the following entries were recorded. A. The owners invested $1,000 from their personal account to the business account. B. Paid rent $500 with check #101. C. Initiated a petty cash fund $500 with check #102. D. Received $1,000 cash for services rendered. E. Purchased office supplies for $158 with check #103. F. Purchased computer equipment $2,200, paid $1,350 with check #104, and will pay the remainder in 30 days. G. Received $800 cash for services rendered. H. Paid wages $800, check #105. I. Petty cash reimbursement: office supplies $256, maintenance expense $108, postage expense $75, miscellaneous expense $55. Cash on hand $18. Check #106. J. Increased petty cash by $30, check #107. A. Cash 1,000 Domingo, Capital 1,000 В. Rent Expense 500 Cash 500 C. С. Petty Cash 500 Cash 500 D. Cash 1,000 Services Income 1,000 Е. Office Supplies 158 Cash 158 F. Computer Equipment…arrow_forwardOn December 31, 2018, the balance sheet of Roberts Realty reported total assets of $200,000. The following transactions occurred during the month of January 2019: 1. The business purchased land for $250,000, paying $100,000 cash and issuing a note payable for the balance. 2. The business collected accounts receivable totaling $45,000. 3. The business sold land (which had cost $50,000) for $60,000 cash. 4. The business paid off $50,000 of Notes Payable. What is the amount of the company's total assets on January 31, 2019? Select one: a. $460,000 b. $455,000 c. $310,000 d. $365,000arrow_forwardThe following are the transactions of Spotlighter, Incorporated, for the month of January. a. Borrowed $4,390 from a local bank on a note due in six months. b. Received $5,080 cash from investors and issued common stock to them. c. Purchased $1,900 in equipment, paying $650 cash and promising the rest on a note due in one year. d. Paid $750 cash for supplies. e. Bought and received $1,150 of supplies on account. Required: Post the effects to the appropriate T-accounts and determine ending account balances. Show a beginni Debit Beginning Balance Ending Balance Debit F Cash Equipment Credit Credit Debit Beginning Balance Ending Balance Debit Supplies Accounts Payablearrow_forward

- Please provide the following journal entries for these transactions, you can draw the T- Accounts or journal entries; A) Mortgage Company funded a loan for $100,000 and the company only advance 98% of the loan through financing (Warehouse Line). Remaining 2% is gathered from Companys funds. B) The same loan was sold to investor at 102 % 15 days later, please prepare the journal entries. C) The Company has expenses at the end of the month in the amount of $20,000 but has not paid until 30 days later. Please prepare journal entries at the end of the month and 30 days payment. D) The company received funds and has a trust liability account for borrowers in the amount of $10,000. 30 days later the trust liability is being transferred to the final investors. E) Company Prepaid Insurance for 12 months and paid in January for $1,200. You are now in the March 31 st of the year.arrow_forwardThe first project for the semester will involve the following items to turn in: 1) Journal entries for financial transactions I will provide you. 2) An adjusted trial balance. 3) An Income statement. 1) On December 1 of 2019 Harold Hammer deposited $ 15,100 in a bank account in the name of Huaning Corporation in exchange for shares of common stock in the corporation. 2) On December 1 of 2019 Huaning Corporation purchased supplies on account for $ 226 . 3) On December 4 of 2019 Huaning Corporation received cash of $ 384 for product sold to the customer. 4) On December 5 of 2019 Huaning Corporation paid the vendor for the December 1st purchase of supplies. 5) On December 6 of 2019 Huaning Corporation purchases supplies on account for $ 469 .6) On December 8 of 2019 Huaning Corporation sells product for $ 445 on account to a customer.7) On December 9 of 2019 Huaning Corporation sells product for $ 462 on account to a customer. 8) On December 10 of 2019 Huaning Corporation paid, in…arrow_forwardInner Resources Company started its business on April 1, 2019. The following transactions occurred during the month of April. A. The owners invested $9,000 from their personal account to the business account. B. Paid rent $750 with check #101. C. Initiated a petty cash fund $550 with check #102. D. Received $850 cash for services rendered. E. Purchased office supplies for $180 with check #103. F. Purchased computer equipment $8,500, paid $1,600 with check #104 and will pay the remainder in 30 days. G. Received $1,200 cash for services rendered. H. Paid wages $560, check #105. I. Petty cash reimbursement: Office supplies $200, Maintenance Expense $140, Miscellaneous Expense $65. Cash on Hand $93. Check #106. J. Increased Petty Cash by $100, check #107. Prepare the journal entries. If an amount box does not require an entry, leave it blank. A. В. E. F. G. Н. II II II 1I I II II I II II 1I I1 III II II D.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education