Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

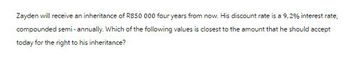

Transcribed Image Text:Zayden will receive an inheritance of R850 000 four years from now. His discount rate is a 9,2% interest rate,

compounded semi-annually. Which of the following values is closest to the amount that he should accept

today for the right to his inheritance?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Today is January 1, 2022. Roy will use a single premium to purchase an annuity today. This annuity pays $10,000 at the end of each year while Roy is alive. The estimated probability of Roy surviving for the next 4 years is stated in following table. The yield rate is assumed to be j₁ = 4.5% p.a. Calculate the premium value. Round your answer to three decimal places. Year 1 2 3 4 Probability of surviving from start of year to end of year a. $17490.442 b. $19100.000 c. $14729.264 d. $17651.074 0.83 0.62 0.46 0 Today is 1 July, 2022, Georg plans to purchase a corporate bond with a coupon rate of j2 = 3.15% p.a. and a face value of $100. This corporate bond matures at par. Its maturity date is 1 January, 2025. The yield rate is assumed to be j₂ = 4.7% p.a. Assume that this corporate bond has a 9% chance of default in any six-month period during its term. Assume, also, that, if default occurs, Georg will receive no further payments at all. Calculate Georg's purchase price. Round your answer…arrow_forwardHow much final amount would Abraham receive if he invests P100, 000 for 1 year and 3 months at 11% simple interest?arrow_forwardYour grandmother bought an annuity from Great-West Life Insurance Company for $361,220 when she retired. In exchange for the $361,220, Great-West will pay her $30,000 per year until she dies The interest rate is 6%. How long must she live after the day she retired to come out ahead (that is, to get more in value than what she paid in? -CHED She must live at least years. (Round up to the nearest whole year.)arrow_forward

- You are 22 and inherit 60000 from your grandmother If you wish to purchase a 120000 camper to celebrate your 30th nirthday what compound annual interest rate ofcreturn must you earnarrow_forwardHow much should chuck invest semiannually in his ira to have $250,000 in it when he retires in 25 years, if the interest stays 11% compounded semiannually?arrow_forwardHassan will receive the following payments at the end of the next four years: AED 50,000, AED 60,000, AED 75,000 and 80,000. Then from the end of the fourth year through the end of the ninth year, he will receive an annuity of AED 75,000. At a discount rate of 5 percent, what is the present value of all future benefits?arrow_forward

- Samantha receives a 10,000 life insurance benefit. If she uses the proceeds to buy an n-year annuity-immediate, the annual payout will be 1,824. If a 2n-year annuity-immediate is purchased, the annual payout will be 1,028. Calculate the effective annual interest rate.arrow_forwardEd Long promised to pay his son $300 semiannually for 10 years. Assume Ed can invest his money at 6% in an ordinary annuity. How much must Ed invest today to pay his son $300 semiannually for 10 years?arrow_forwardFour years ago, Leroy invested $12,600.00. Today, he has $20,700.00. If Leroy earns the same annual rate implied from the past and current values of his invsetment, then in how many years from today does he expect to have exactly $50,600.00 O 7.20 years (plus or minus 0.05 years) 7.57 years (plus or minus 0.05 years) O 6.25 years (plus or minus 0.05 years) 11.20 years (plus or minus 0.05 years) None of the above is within .05 percentage points of the correct answerarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education