FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

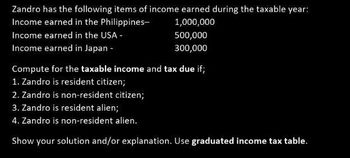

Transcribed Image Text:Zandro has the following items of income earned during the taxable year:

Income earned in the Philippines-

1,000,000

Income earned in the USA -

Income earned in Japan -

500,000

300,000

Compute for the taxable income and tax due if;

1. Zandro is resident citizen;

2. Zandro is non-resident citizen;

3. Zandro is resident alien;

4. Zandro is non-resident alien.

Show your solution and/or explanation. Use graduated income tax table.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Chuck, a single taxpayer, earns $78,800 in taxable income and $14,400 in interest from an investment in City of Heflin bonds. (Use the U.S. tax rate schedule.) Required: a. If Chuck earns an additional $40,000 of taxable income, what is his marginal tax rate on this income? b. What is his marginal rate if, instead, he had $40,000 of additional deductions? Note: For all requirements, do not round intermediate calculations. Round percentage answers to 2 decimal places. a. Marginal tax rate b. Marginal tax rate % %arrow_forwardConsidering the information below, calculate Mary tax liability (including Medicare Levy and Medicare Levy Surcharge, if applicable, and ignore any tax offsets such as LITO and LMITO): Mary is a single non-tax resident (foreign resident) of Australia in the tax year 2018-2019 and has no private health insuranceAssessable income for the year is of $95,000Total deductions for the year are $25,000arrow_forwardUSE CANADA TAX Required: Determine the maximum amount of 2018 personal tax credits, including transfers from a spouse or dependant, that can be applied against federal Tax Payable by the taxpayer in each of the following independent Cases. A calculation of Tax Payable is NOT required. Mr. Holm has Net Income for Tax Purposes of $55,000, all of which is investment income. He is single and provides support for his mother. His mother is a widow who resides in Latvia and has income of $1,100 per year. Mrs. Thomas has Net Income for Tax Purposes of $250,000, all of which is employment income. Her employer has withheld and remitted the required EI and CPP amounts. Mrs. Thomas was married on December 1, 2018. Her wife, a nursing student, had salary of $21,000 for the period from January 1 to November 30, 2018 and $3,200 for the month of December 2018. Mr. Jackson has Net Income for Tax Purposes of $75,000, all of which is rental income. He lives with his common-law wife and…arrow_forward

- This is US Tax and Law Study Guidearrow_forwardJustin Timberlake, a single taxpayer, earns $78, 200 in taxable income and $13,600 in interest from an investment in City of Los Angeles bonds. (Use the U.S. tax rate schedule.) Required: If Justin earns an additional $40,000 of taxable income, what is his marginal tax rate on this income? What is his marginal rate if, instead, he had $40,000 of additional deductions?arrow_forwardAssume a country has the following income tax rates for a single taxpayer in 2018. Maria is single and earned €50,000 in 2018.arrow_forward

- Inday is settling the estate of his Filipino husband Nicanor, who died intestate in the Netherlands where he works as an OFW. The following are the summary of the details of Nicanor’s properties in connection with the processing and payment of his estate tax: Philippines Brazil Netherlands Gross estate 5,000,000 20,000,000 15,000,000 Allowable Deductions 5,000,000 10,000,000 5,000,000 Net estate 0 10,000,000 10,000,000 Estate tax paid Php 500,000 1,500,000 How much is the ESTATE TAX PAYABLE?arrow_forwardAnswer the ff. requirementsarrow_forwardJorge and Anita, married taxpayers, earn $155,600 in taxable income and $41,400 in interest from an investment in City of Heflin bonds. Using the U.S. tax rate schedule for married filing jointly, how much federal tax will they owe? What is their average tax rate? What is their effective tax rate? What is their current marginal tax rate? Note: Do not round intermediate calculations. Round your answers to 2 decimal places.arrow_forward

- Richard has $30,000 of income from a country that imposes a 40-percent income tax and $30,000 of income from a country that imposes a 34 percent income tax. In addition to the foreign income, he has taxable income from US sources of $120,000 and a US tax liability, before credits, of $45,575. The amount of Richard’s foreign tax credit is:arrow_forwardJenna paid foreign income tax of $3,194 on foreign income of $15,968. Her worldwide taxable income was $125,000, and her U.S. tax liability was $31,000. Required: What is the amount of the foreign tax credit (FTC) allowed? What would be the allowed FTC if Jenna had paid foreign income tax of $6,400 instead?arrow_forwardSubject :- Accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education