Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

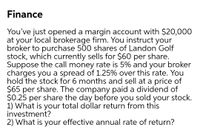

Transcribed Image Text:Finance

You've just opened a margin account with $20,000

at your local brokerage firm. You instruct your

broker to purchase 500 shares of Landon Golf

stock, which currently sells for $60 per share.

Suppose the call money rate is 5% and your broker

charges you a spread of 1.25% over this rate. You

hold the stock for 6 months and sell at a price of

$65 per share. The company paid a dividend of

$0.25 per share the day before you sold your stock.

1) What is your total dollar return from this

investment?

2) What is your effective annual rate of return?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- At your full-service brokerage firm, it costs $125 per stock trade. How much money do you receive after selling 200 shares of Time Warner, Inc. (TMX), which trades at $29.54?arrow_forwardAn investor buys $17 thousand dollars of ABT stock at $20 per share, using 58% initial margin. The broker charges 6% APR compounded daily on the loan, and requires a 35% maintenance margin. The stock pays $0.85 per share dividend each year. If the stock is sold at the end of the year at $21 per share, what is the investor's rate of return?arrow_forwardYou purchase 800 shares of CUW at $71.51 using your full margin which as an initial margin of 70% (or 0.70). The maintenance margin is 45% (or 0.45). At what price will you get your margin call?" (Neglect any interest on the cash loan)arrow_forward

- Suppose that Kaka Plc currently is selling at $50 per share. You buy 900 shares using $22,050 of your own money, borrowing the remainder of the purchase price from your broker. The rate on the margin loan is 7%. Required If the maintenance margin is 20%, how low can Kaka Plc’s price fall before you get a margin call? (Round your answer to 2 decimal places.)arrow_forwardA stock is selling for $83 per share. One-month European calls and puts on the stock with the strike price of $80 are selling for $6 and $3, respectively. Kevin creates a straddle by buying 100 calls and 100 puts. What is his net profit if the stock price is $85 one month later? O A loss of $600 O A gain of $400 O A loss of $400 O A loss of $900arrow_forwardYou have a margin account and deposit Rs.90,000. Assuming the prevailing marginrequirement is 20%, commissions are ignored and D.G.K Cement stock is selling atRs.55 per share while Askari Cement stock is selling at Rs. 85 per share. You invest 40%of your investment in D.G.K cement while remaining is deposited in Askari cement.a. How many shares of each stock can you purchase using the maximum allowablemargin if you invest in both?b. What is your total and percentage profit (loss) if:1. the price of D.G.K Cement Rises to Rs.65 per share while Askari Cement stockrises to Rs. 97 per share?2. the price of D.G.K Cement reduces to Rs.42 per share while Askari Cementstock reduces to Rs. 76 per share?c. If you invest all money in D.G.K cement ONLY and the maintenance margin is 25%,to what price can D.G.K Cement stock fall before you will receive a margin call?d. If you invest all money in Askari cement ONLY and the maintenance margin is 25%,to what price can Askari cement stock fall before you…arrow_forward

- Verify and answer my questionarrow_forwardSuppose MajTrk has a front-end load fee of 7%. If you purchase 100 shares of this fund at the NAV, you will pay a commission of . If, in one month, you sell the shares, you pay a redemption fee at that time. If you are interested only in funds without any fee, you to use additional online resources to find no-load funds, because using only the quotations as listed in the table, it is to determine the amount of any front-end load fee that the fund may charge.arrow_forwardYou want to purchase IBM stock at $130 from your broker using as little of your own money as possible. If initial margin is 50% and you have $19, 600to invest, how many shares can you buy?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education