Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

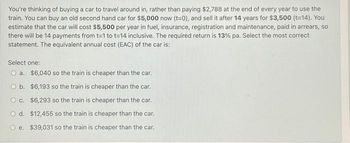

Transcribed Image Text:You're thinking of buying a car to travel around in, rather than paying $2,788 at the end of every year to use the

train. You can buy an old second hand car for $5,000 now (t=0), and sell it after 14 years for $3,500 (t=14). You

estimate that the car will cost $5,500 per year in fuel, insurance, registration and maintenance, paid in arrears, so

there will be 14 payments from t=1 to t=14 inclusive. The required return is 13% pa. Select the most correct

statement. The equivalent annual cost (EAC) of the car is:

Select one:

O a.

$6,040 so the train is cheaper than the car.

O b.

O c.

$6,193 so the train is cheaper than the car.

$6,293 so the train is cheaper than the car.

O d. $12,455 so the train is cheaper than the car.

Oe. $39,031 so the train is cheaper than the car.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- You start saving up to buy your dream house. The house is valued at $620,000 right now. You think you can buy the house in 7 years. The housing market is inflating at 3.0% a year. How much will the house cost in 7 years? Show work.arrow_forwardYou have decided to buy a house! The house you have decided on has a list price of $380,000. You will put 15% down and finance the rest If the bank offers 3.25% APR compounded monthly on a 20 year loan, what will the monthly payments be? How much did you pay in total for the house?arrow_forwardYou are shopping for a car and read the following advertisement in the newspaper: "Own a new Spitfire! No money down. Four annual payments of just $18,000." You have shopped around and know that you can buy a Spitfire for cash for $64,800. What is the interest rate the dealer is advertising (what is the rate that equates the PV of the payments to today's cash price of the car)? Assume that you must make the annual payments at the end of each year. C The rate that equates the PV of the payments to today's cash price of the car is %. (Enter your response as a percent rounded to two decimal places.)arrow_forward

- You found your dream home! The down payment is $29,000. However, you still need 40% of the down payment plus required improvements will cost another 18% (First: what total % of the down payment do you need? _____). You borrow the money from your Savings & Loan, but you must pay it back within 10 years at an interest rate of 14%. Using this amount as your principal P, calculate the future value A using:2) Simple Interestarrow_forwardSuppose you want to buy a new car that costs $32,900. You have no cash-only your old car, which is worth $4000 as a trade-in The dealer says the interest rate is 5% add-on for 5 years Find your total cost, for the new car plus interest The total cost, for the new car plus interest, is $ (Simplify your answer.) GEOTEarrow_forward1.) Starting with $15,000, how much will you have in 10 years if you can earn 6 percent on your money? 2.) If you can earn only 4 percent? If the average new home costs $275,000 today, how much will it cost in 10 years if the price increases by 5 percent each year? 3.) If you can earn 4 percent, how much will you have to save each year if you want to retire in 35 years with $1 million?arrow_forward

- An apartment will generate $8,000 a year for 5 years, after which you expect to sell the property for $100,000. What is the maximum you should pay for the property if your cost of money is 10% ?arrow_forwardYour old car costs you $300per month in gas and repairs. If you replace it, you could sell the old car immediately for $2,000. To buy a new car that would last seven years, you need to pay out $12,200 immediately. Gas and repairs would cost you only $100 per month on the new car. Interest is 9%compounded monthly. Should you buy a new car (Alternative 1) or keep your old car (Alternative 2)? Compute the net present value of each alternative and determine which alternative should be accepted or rejected according to the net present value criterion. What will be the net present value for Alternative 1 (Round the final answer to the nearest dollar as needed. Round all intermediate values to six decimal places as needed.) What will be the net present value for Alternative 2. (Round the final answer to the nearest dollar as needed. Round all intermediate values to six decimal places as needed.) What will be the preferred alternative.arrow_forwardYou are thinking about buying a house, and you have one in mind that costs $600,000. The bank is offering 6% loans and requires a 15% down payment. What is the most you can borrow? What will your monthly payment be on a 30 year loan? How much principal will you still owe after 6 years?arrow_forward

- Suppose that you are thinking about buying a car and have narrowed down your choices to two options. The new-car option: The new car costs $26,000 and can be financed with a four-year loan at 7.75%. The used-car option: A three-year old model of the same car costs $16,000 and can be financed with a four-year loan at 5.28%. What is the difference in monthly payments between financing the new car and financing the used car? (Round to the nearest cent as needed.)arrow_forwardYou're trying to save to buy a new $68,000 sports car. Currently, you have saved $36840 which is invested at 4.9 percent annual interest. How many years will it be before you purchase the car assuming the price of the car remains constant?arrow_forwardYou have saved $3,000 for a down payment on a new car. The largest monthly payment you can afford is $300. The loan will have a 9% APR based on end-of-month payments. What is the most expensive car you can afford if you finance it for 48 months? Do not round intermediate calculations. Round your answer to the nearest cent.$ What is the most expensive car you can afford if you finance it for 60 months? Do not round intermediate calculations. Round your answer to the nearest cent. $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education