FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

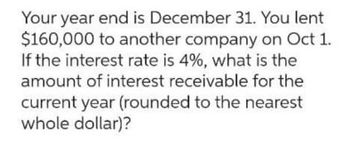

Transcribed Image Text:Your year end is December 31. You lent

$160,000 to another company on Oct 1.

If the interest rate is 4%, what is the

amount of interest receivable for the

current year (rounded to the nearest

whole dollar)?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ee.121.arrow_forwardHinton Inc. borrowed$35,000for 7 years at a simple interest rate of6.1%. The interest was to be paid monthly. (a) Find the monthly interest payment. (Round your final answer to two decimal places.)$ (b) Find the total amount of interest paid.arrow_forwardIf you deposit $368.00 into an account paying 15.46% annual interest compounded quarterly, how many years until there is $76,431.00 in the account?arrow_forward

- how much interest will an account earn if you deposited $435 at the end of every six months for 7 years and the account earned 4.75% compounded semi-annually?arrow_forwardYour year end is December 31. You lent $120,000 to another company on Oct 1. If the interest rate is 4%, what is the amount of interest receivable for the current year (rounded to the nearest whole dollar)?arrow_forwardYou borrowed some money at 8 percent per annum. You repay the loan by making three annual payments of $163 (first payment made at t = 1), followed by five annual payments of $452, followed by four annual payments of $709. How much did you borrow? Round your answer to 2 decimal places: record your answer without commas and without a dollar sign. Your Answer: Answerarrow_forward

- Bank pays an annual interest of 4% on 2-year CDs and you deposit $10,000. What is your balance two years later?arrow_forwardYou put $8000 into an account earning 3%. After 2 years, you make another deposit into the same account. Seven years later ( that is, 9 years after your original $8000 deposit), the account balance is $21000. What was the amount of the deposit at the end of year 2?arrow_forwardOnce per year Ritchie Rich deposits an amount of $800 in an account which pays 10% interest per year, compounded annually, with additional deposits of $800 continually made at the end of the year. If B, is the balance in the account, in dollars, immediately after Ritchie makes the nth deposit, then we can write B₁ = $800. (a) Complete the table to find the following. Report to the nearest $0.01. i) the balance, B, of the account on the day immediately after the second deposit. ii) the balance, B₁, of the account on the day immediately after the third deposit. iii) the balance, B₁, of the account on the day immediately after the fourth deposit 71 (Number of deposits) 1 2 OO B= $321158.22 (b) Suppose Ritchie makes 38 deposits. What is the balance of the account on the day immediately after the 38th deposit? 0 B$29923.47 B$29123.47 B= $264031.59 B, ($) $800 $ Number O B$291234.75 (It is more than $880.) $ Number S Number Q (c) Suppose Ritchie makes 438 deposits. Which is true about the…arrow_forward

- Complete the following table: Selling price $231,000, Down payment $46,200, Amount mortgage $184,800, Rate 7.00%, Years 15, Monthly payment $1,661.35. What is the interest and principal on first payment? What is the balance at end of month?arrow_forwardA person deposits $2750 in an account that yields 3.5% interest compounded annually. Set up a recurrence relation for the amount in the account at the end of n years.b) Find an explicit formula for the amount in the account at the end of n years.c) How much money will be in the account after 25 years?arrow_forward4. You borrowed $31,305 on January 1st. The annual interest rate is 7%. Interest is compounded annually. No annual payments are made but you will repay principal and interest in full at the end of nine years. What amount will you repay? Round your answer to two decimal places.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education