ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Your supervisor has requested that you calculate the following ratios, rounded to the nearest hundredth for both 2017 and 2016

2017 2016

- Acid test

- Asset turnover

- Net Income (after tax) to the net sales

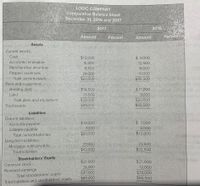

Transcribed Image Text:LOGIC COMPANY

Comparative Balance Sheet

December 31, 2016 and 2017

2017

2016

Amount

Percent

Amount

Perten

Assets

Current assets.

Cash

$12.000

$9,000

Accounts rec eivable

Merchandise inventory

Prepaid expenses

Total current assets

16.500

8,500

24,000

$61.000

12,500

14,000

10,000

$45.500

Plant and equlpment:

Building (net)

Land

Total plant and equipment

$14,500

13,500

$28.000

$89,000

$ 11,000

9,000

$20.000

Total assets

$65.500

Liablitles

Current llabilities.

Accounts payable

Salaries payable

$13,000

7,000

$ 7,000

5.000

$12.000

Total current llabilities

$20.000

Long-lem llabilities:

Mortgage note payable

Total liabilities

20,500

$32,500

22,000

$42.000

Stockholders' Equity

$21.000

$21,000

Common stock

Retained earnings

12,000

$33,000

$65.500

26,000

Total stockholders' equity

Total liabilities and stockholders' equity

$47,000

$89,000

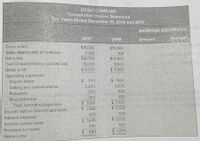

Transcribed Image Text:LOGIĆ COMPANY

Comparative Income Statement

For Years Ended December 31, 2016 and 2017

INCREASE (DECREASE).

2017

2016

Amount

Percent

Gross sales

$19,000

$15,000

Sales returns and allowances

1.000

100

Net sales

Cost of merchandise (goods) sold

Gross profit

Operating expenses:

Depreciation

Selling and administrative

Research

$18.000

12,000

$6.000

$14.900

9,000

$ 5,900

$ 700

2,200

$ 600

2,000

550

500

360

300

Miscellaneous

$3.400

$ 2,500

500

$ 2,000

$ 3,810

$2,190

Total operating expenses

Income before interest and taxes

560

Interest expense

Income before laxes

$ 1,630

640

800

Provision for taxes.

Net income

$ 990

$ 1,200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The following graph gives the labor market for laboratory aides in the imaginary country of Episteme. The equilibrium hourly wage is $10, and the equilibrium number of laboratory aides is 150. Suppose the federal government of Episteme has decided to institute an hourly payroll tax of $4 on laboratory aides and wants to determine whether the tax should be levied on the workers, the employers, or both (in such a way that half the tax is collected from each party). Use the graph input tool to evaluate these three proposals. Entering a number into the Tax Levied on Employers field (initially set at zero dollars per hour) shifts the demand curve down by the amount you enter, and entering a number into the Tax Levied on Workers field (initially set at zero dollars per hour) shifts the supply curve up by the amount you enter. To determine the before-tax wage for each tax proposal, adjust the amount in the Wage field until the quantity of labor supplied equals the quantity of labor demanded.…arrow_forwardThe year 2015 Base Year Price Index = (120) Base Year Output = (4 million) The year 2016 Current Year Price Index = (140) Current Year Output = (5 million) iii. Calculate MPC for the following data: Y1=2500C1=1500 Y2=5000 C2=2500arrow_forwardFor each of the proposals, use the previous graph to determine the new number of research assistants hired. Then compute the after-tax amount paid by employers (that is, the wage paid to workers plus any taxes collected from the employers) and the after-tax amount earned by research assistants (that is, the wage received by workers minus any taxes collected from the workers). Levied on Employers (Dollars per hour) 4 Tax Proposal 0 2 Levied on Workers (Dollars per hour) 0 4 2 Quantity Hired (Number of workers) After-Tax Wage Paid by Employers (Dollars per hour) O The proposal in which the entire tax is collected from workers O The proposal in which the tax is collected from each side evenly O The proposal in which the tax is collected from employers O None of the proposals is better than the others After-Tax Wage Received by Workers (Dollars per hour) Suppose the government doesn't want to discourage employers from hiring research assistants and, therefore, wants to minimize the share…arrow_forward

- Please ensure your response includes an accurate answer along with a thorough explanation and clear calculation. To maintain the integrity of the solution, please do not use ChatGPT or submit handwritten responses. Originality is essential, so avoid any form of plagiarism. A complete and precise answer will be appreciated with an upvote.arrow_forwardFamily Flowers employs 17 people, of whom 14 earn gross pay of $640.00 each and 3 earn gross pay of $720.00 each on a weekly basis. What is the employer's share of total social security and Medicare taxes for the first quarter of the year? (Social security tax is 6.2% of wages up to $128,400. Medicare tax is 1.45% of all wages.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education