Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

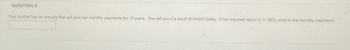

Transcribed Image Text:QUESTION 8

Your mother has an annuity that will give her monthly payments for 14 years. She tell you it is worth $124357 today. If her required return is 11.56%, what is the monthly payment?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The Ward family wants to save money to travel the world. They purchase an annuity with a quarterly payment of $181 that earns 4.7% interest, compounded quarterly. Payments will be made at the end of each quarter. Find the total value of the annuity in 11 years.arrow_forwardAmy purchases an annuity that will give her payments of R at the end of each quarter for seven years. She will receive the first of these payments in 1.5 years. If Amy paid $50,000 for this annuity and will earn a nominal rate of interest of 6% compounded quarterly,(a) write the equation of value (using the appropriate actuarial notation) for this annuity at the time of purchase. Be sure to indicate the effective rate per payment period being used.(b) find the value of R.arrow_forwardMinu deposits $950 at the end of each quarter for 6 years in an account that earns 11.8% per year compounded quarterly. At the end of 6 years she has $32 501.04. What would the amount of the annuity be if she doubles the time period to 12 years?arrow_forward

- How much should Timothy's dad invest into a savings account today, to be able to pay for Timothy's rent for the next six years if rent is $850 payable at the beginning of each month? The savings account earns 3.50% compounded monthly. Round to the nearest centarrow_forwardSehar has accumulated $245,000 in her retirement savings plan. When she retires in exactly 4 years from today, she will purchase an annuity that will provide end-of-month payments for 20 years. If her funds earn 6% compounded quarterly during both the period of deferral and the annuity period, how much will her Sehar’s monthly payments be during retirement?arrow_forwardSara deposits $500 per month into an annuity. The annuity earns 5%.interest.compounded monthly. If she does this for 30 years, how much is in the annuity? Round to nearest whole dollar. S Enter a number, Submit Answerarrow_forward

- Connie wants to have an annuity payment of $2,150 at the END of every three months. How much should she deposit now at 12% interest, compounded quarterly, to yield this payment for 4 years? (Use Table 12-2 in your text.) $21,401.10$27,006.37 $27,816.57$31,986.56arrow_forwardShelly deposits the $2000 she got as a birthday gift from her grandmother into an account earning 3.6% interest compounded monthly. She decides to also deposit $200 at the end of each month into the same account. How much will be in the account in 10 years?arrow_forwardKhalil has decided to start an ordinary annuity.he plans to deposit $500 into this account each month at 2.4 % annual interest compounded monthly. How much will he have in this account in 20 years?arrow_forward

- Connie wants to have an annuity payment of $2,200 at the END of every three months. How much should she deposit now at 6% interest, compounded quarterly, to yield this payment for 7 years? (Use Table 12-2 in your text.) $39,380.31$49,998.78 $50,748.76$55,587.71arrow_forwardTo help out with her retirement savings, Linda invests in an ordinary annuity that earns 6.6% interest, compounded annually. Payments will be made at the end of each year. Continue How much money does she need to pay into the annuity each year for the annuity to have a total value of $97,000 after 17 years? Do not round intermediate computations, and round your final answer to the nearest cent. If necessary, refer to the list of financial formulas. 50°F Mostly cloudy Es O 2 2 W 0 3 E 4 X R O S F6 % 5 € T Y F8 & 7 a 7 U 27 D * 00 Submit Assignmen 2022 McGraw Hill LLC. All Rights Reserved. Terms of Use | Privacy Center | Accessibility F10 D X I 9 2 F11 PDF F12 NumLk Prt Sc ^ Pause Br +arrow_forwardAnnie would like a retirement income of $4,000 per month (beginning of month payments) for 23 years once she retires. How much must she have in her retirement account on the day she retires if the account can earn 4% compounded semi-annually? Your Answer: Answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education