Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

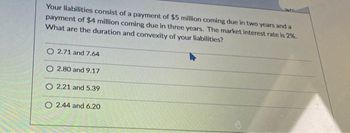

Transcribed Image Text:Your liabilities consist of a payment of $5 million coming due in two years and a

payment of $4 million coming due in three years. The market interest rate is 2%.

What are the duration and convexity of your liabilities?

O 2.71 and 7.64

O 2.80 and 9.17

O 2.21 and 5.39

O 2.44 and 6.20

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- If the one-year and two-year interest rates are 6.5% and 7% respectively, what should be the forward rate for year 2 (according to the expectations theory)? 7% 7.5% 7.75% 7.25% 6.75%. 6.5%arrow_forwardIndicate whether the given statements is true (T) or false (F): "$1,791 10 years from now is equivalent to $900 now if the interest rate equals 8% per year".arrow_forwardSuppose the interest rate on a 3-year Treasury Note is 2.25%, and 5-year Notes are yielding 4.00%. Based on the expectations theory, what does the market believe that 2-year Treasuries will be yielding 3 years from now?arrow_forward

- 2. Find the present value of $500 due in the future under each of these conditions: a. 12% nominal rate, semiannual compounding, discounted back 5 years b. 12% nominal rate, quarterly compounding, discounted back 5 years c. 12% nominal rate, monthly compounding, discounted back 1 year Hint: identify the interest rate per period and the total number of periods in each scenario first. Oarrow_forwardSuppose the term structure of interest rates is shown below: Term Rate (EAR%) 1 year 5.00% 2 years 3 years 5 years 10 years 20 years 4.50% 4.30% 4.30% 4.25% 4.15% The present value of receiving $1000 per year with certainty at the end of the next three years is closest to:arrow_forwardCurrent interest rates are i$ = 4%;i€ = 6%. Expected interest rates next year are: i$ = 7%;i € = 3%. The expected spot rate in two years is S2($/€) = 1. Use the asset market approach to compute the current spot rate S0($/€). Please type in the number without the currency signs. For example, if your answer is $1.25/€, then type in 1.25 as your final answer. Please keep at least three decimal places (up to 5 decimal places)arrow_forward

- Interest rate is 2%. When I make a deposit of 10,000 yen with the maturity of 3 years, I plan to receive an interest every year. In this case, I can receive 200 yen as an interest after 1 year, and 200 yen as an interest after 2 years. At the end of the 3r year, I can receive 10,200 yen including principal and interest. In other situation, if I make a deposit of 10,000 yen with the maturity of 3 years, I can receive 250 yen after 1 year, and 250 yen after 2 years. At the end of the 3rd year, I can receive 10,250 yen. How much is the interest rate of this opportunity? Write an answer like the example. <Example> 2.1 (%) DO NOT put % in your answerarrow_forward(Ch 11 #9) There is a loan obligation to pay $1000 one year from today and another $1000 two years from today. Assuming the annual effective rate of interest is 10%, find the following: a) Macaulay duration of the loan. b) Modified duration of the loan. c) Convexity of the loan.arrow_forwardFor each of the following cases, indicate (a) what interest rate columns and (b) what number of periods you would refer to in looking up the future value factor. (1) In Table 1 (future value of 1): Number of Annual Rate Years Invested Compounded Case A 5% 5 Annually Case B 8% 6 Semiannually Case A Case B . (a) % % (2) In Table 2 (future value of an annuity of 1): Annual Rate Number of Years Invested Compounded Case A 6% 9 Annually Case B 8% 5 Semiannually Case A Case B (b) periods periods (a) (b) % periods % periodsarrow_forward

- The discount factor corresponding to a 3-year continuously compounded interest rate is 0.765667. What is the corresponding continuously compounded interest rate? What is the corresponding quarterly compounded interest rate expressed at an annual rate?arrow_forwardIf the compounding frequency is monthly and the discount factor=0.62026, what is the value of the corresponding annual interest rate? What is the corresponding continuous compounding annual interest rate if the discount factor remains at 0.62026?arrow_forwardThe two-year interest rate is 10.4%, and the expected annual inflation rate is 5.2%. a. What is the expected real interest rate? b-1. If the expected rate of inflation suddenly rises to 7.2%, what does Fisher's theory say about how the real interest rate will change? b-2. If the expected rate of inflation suddenly rises to 7.2%, what will be the new nominal rate? Complete this question by entering your answers in the tabs below. Req A Req B1 Req B2 What is the expected real interest rate? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. Expected real interest rate %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education