Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

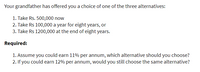

Transcribed Image Text:Your grandfather has offered you a choice of one of the three alternatives:

1. Take Rs. 500,000 now

2. Take Rs 100,000 a year for eight years, or

3. Take Rs 1200,000 at the end of eight years.

Required:

1. Assume you could earn 11% per annum, which alternative should you choose?

2. If you could earn 12% per annum, would you still choose the same alternative?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Assume the total cost of a college education will be $350,000 when your child enters college in 15 years. You presently have $67,000 to invest.What annual rate of interest must you earn on your investment to cover the cost of your child’s college education?arrow_forwardMarian Plunket owns her own business and is considering an investment. If she undertakes the investment, it will pay $5,440 at the end of each of the next 3 years. The opportunity requires an initial investment of $1,360 plus an additional investment at the end of the second year of $6,800. What is the NPV of this opportunity if the interest rate is 1.6% per year? Should Marian take it?arrow_forwardAssume that you just inherited an annuity that will pay you $10,000 per year for 10 years, with the first payment being made today. A friend of your mother offers to give you $60,000 for the annuity. If you sell it, what rate of return would your mother’s friend earn on his investment? If you think a “fair” return would be 6%, how much should you ask for the annuity? What keys do I need to enter in a financial calculator to get the answers of (13.70%, $78,016.92)/ only show me the keys to enter in a financial calculaotr. not excel and not algebraarrow_forward

- You believe you will need to have saved $480,000 by the time you retire in 30 years in order to live comfortably. You also believe that you will inherit $115,000 in 5 years. a) If the interest rate is 6% per year, what is the future value of your inheritance at retirement? b) How much additional money must you save to meet your retirement goal, assuming you save your entire inheritance?arrow_forwardYou are scheduled to receive $45,000 in two years. When you receive it, you will invest it for 8 more years at 6 percent per year. How much will you have in 10 years? Multiple Choice $80,588.15 $75,309.32 $68,137.01 $51,341.32 $71,723.16arrow_forwardYou have 30 years left until retirement and want to retire with $2.6 million. Your salary is paid annually, and you will receive $76,000 at the end of the current year. Your salary will increase at 3 percent per year, and you can earn a return of 9 percent on the money you invest. If you save a constant percentage of your salary, what percentage of your salary must you save each year? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Perentage of Salary:______________arrow_forward

- A.) You want to have $350,000 saved up by the time you retire in 30 years, How much would you need to deposit each month into a savig account earning 6.5% annual interest to achieve this goal? Round to the nearest cent, if necessary. Excel formula: Your answer:arrow_forwardIt does not have to be a long explanation.arrow_forwardAfter retirement, you expect to live for 25 years. You would like to have $90,000 in income each year. How much should you have saved in your retirement account to receive this income if the annual interest rate is 9 percent per year? (Assume that the payments start one year after your retirement.) Multiple Choice $884,032.16 $99.986.08 $2,250,000.00 $1,456,153.94arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education