FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

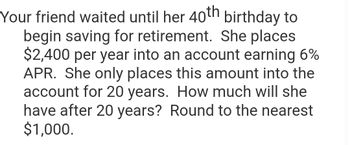

Transcribed Image Text:Your friend waited until her 40th birthday to

begin saving for retirement. She places

$2,400 per year into an account earning 6%

APR. She only places this amount into the

account for 20 years. How much will she

have after 20 years? Round to the nearest

$1,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please help me answer the following time value of money question. Chuck deposited $25 in an account that pays 4.25%, how much will be in his account in 15 years? 45 years? 110 years?arrow_forwardMary plans to retire in 20 years. She opens up a retirement account with an APR of 5.25% compounded monthly. She will invest $1,163 per month. Round the answer to two decimal places. a. How much money will be in Mary’s retirement account if she continues to make the same monthly investment for 20 years? b. By the time she retires Mary will have contributed how much of her own money overall? c. What percent of the final balance in Mary’s retirement account will be interest?arrow_forwardA couple plans to retire in 25 years. At that time, they would like to have enough money in an account so that they can receive a $3,600 every month end for 20 years. The account earns APR 5.8% and will continue to do so until there is a zero balance in the account. To achieve this goal, how much money does the couple need to have in this account by the time they retire? (calculate to cents.)arrow_forward

- After retiring, Valeria wants to be able to withdraw $36,500.00 every year from her account for 27 years. Her account earns 6% interest compounded annually.How much does Valeria need in her account when she retires? Valeria needs$_________ to have in her account when she retires.arrow_forwardFrances plans to save money for a down payment on a house using an investment account that pays an interest rate of 5.3% per year. She wants to have $425, 000 available five years from today. Frances intends to deposit an amount today and at the end of each of the next five years into her investment account (i. e. she will make a total of six deposits, all of the same amount). How much will each of these deposits be? (Enter your answer to two decimal places)arrow_forwardSharon has worked for a company with a retirement program, and today is retiring from her job with the amount of $157000 in her retirement account. She decides to withdrawal an equal amount from this account, once a year, beginning immediately, and ending 25 years from today (for a total of 26 payments). If the interest rate is 6.75%, solve for the annuity amount such that she uses up her full accumulation. $ Place your answer in dollars and cents. Do not use a dollar sign or comma as part of your answer. For example, an answer of fifty four point three eight would be placed as 54.38.arrow_forward

- You annually invest $2,000 in an individual retirement account (IRA) starting at the age of 30 and make the contributions for 15 years. Your twin sister does the same starting at age 35 and makes the contributions for 25 years. Both of you earn 7 percent annually on your investment. What amounts will you and your sister have at age 60? Use Appendix A and Appendix C to answer the question. Round your answers to the nearest dollar.Amount on your account: $ Amount on your sister's account: $ Who has the larger amount at age 60?-Select-You haveYour sister hasItem 3 the larger amount.arrow_forwardSara met with a financial planner and has determined that she will need $1,250,000 when she retires in 30 years. She has found an annuity that pays 5.65%, compounded monthly. What will she need to save each month, if a) Sara begins saving nowz?arrow_forwardIsabelle wants to save for retirement. She earns $5400 in income each month, and wishes to deposit 10% of her income into a savings acount each month. If the savings account has a nominal interest rate of 7%, compounded monthly, how much will be in the account if she retires in 35 years?arrow_forward

- A 40 year old woman puts $1500 in a retirement account at the end of each quarter through 20 years then stops making further deposits. She keeps money in her account for the next 5 years. How much will she have in her account when she retires at the age of 65 if the bank pays interest at 6.4% compounded quarterly?arrow_forwardAfter retiring, Amina wants to be able to withdraw $30,500.00 every year from her account for 25 years. Her account earns 9% interest compounded annually.How much does Amina need in her account when she retires? Amina needs$________ in her account when she retires. How much total money will Amina pull out of her account? In total, Amina will pull out $________ from her account. How much of that money is interest? The amount of money that is interest is$________ .arrow_forwardA couple wants to retire in 35 years and can save $400 every month. They plan to deposit the money at the end of each month into an account paying 3.55% compounded monthly. How much will they have at the end of the 35 years? Give your answer to the nearest dollar.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education