Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

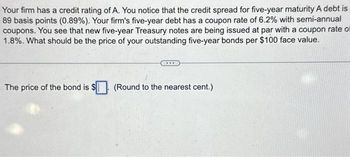

Transcribed Image Text:Your firm has a credit rating of A. You notice that the credit spread for five-year maturity A debt is

89 basis points (0.89%). Your firm's five-year debt has a coupon rate of 6.2% with semi-annual

coupons. You see that new five-year Treasury notes are being issued at par with a coupon rate of

1.8%. What should be the price of your outstanding five-year bonds per $100 face value.

The price of the bond is $

(Round to the nearest cent.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A firm sells bonds with a par value of 1000 Rupees, carry a 8% coupon rate, with a maturity period of 9 years. The bond sells at a yield to maturity of 9%. a) What is the interest payment you should receive each year? b) What is the selling price of the bond?arrow_forward(Expected rate of return and current yield) Time Wamer has bonds that are selling for $664. The coupon interest rate on the bonds is 10.35 percent and they mature in 26 years. What is the yield to maturity on the bonds? What is the current yield? a. The yield to maturity on the bond is 15.59 %. (Round to two decimal places.)arrow_forwardSuppose two firms want to borrow money from a bank for a period of one year. Firm A has excellent credit, whereas Firm B’s credit standing is such that it would pay prime + 3 percent. The current prime rate is 6.55 percent, the 30-year Treasury bond yield is 4.30 percent, the three-month Treasury bill yield is 3.47 percent, and the 10-year Treasury note yield is 4.23 percent. Now suppose that Firm B decides to get a term loan for 10 years. What is the loan rate for the firm? Firm B's loan rate % How does this affect the company’s borrowing cost? Company's borrowing cost will (increase/ remain the same / decrease) .arrow_forward

- Bonds often pay a coupon twice a year. For the valuation of bonds that make semiannual payments, the number of periods doubles, whereas the amount of cash flow decreases by half. Using the values of cash flows and number of periods, the valuation model is adjusted accordingly. Assume that a $1,000,000 par value, semiannual coupon US Treasury note with three years to maturity has a coupon rate of 6%. The yield to maturity (YTM) of the bond is 9.90%. Using this information and ignoring the other costs involved, calculate the value of the Treasury note: $567,545.29 $765,735.71 $900,865.54 $1,081,038.65 Based on your calculations and understanding of semiannual coupon bonds, complete the following statement: Assuming that interest rates remain constant, the T-note’s price is expected to ( Increase, Decrease).arrow_forwardYour firm has a credit rating of A. You notice that the credit spread for five-year maturity A debt is 89 basis points (0.89%). Your firm's five-year has semi-annual coupons and a coupon rate of 6%. You see that new five-year Government of Canada bonds are being issued with a YTM of 3%. What should the price of your outstanding five-year bonds be? Assume a par value of $100. The price of your outstanding five-year bonds should be $ (Round to the nearest cent.)arrow_forwardGrowthSec Ltd has raised $10M in debt funding by issuing 100 5 year bonds with a face value of $100,000 each. The bonds pay semi-annual coupons at 6% p.a. If the yield to maturity is 7% p.a., what will be the price of each bond? If after one year the bond is trading at a premium, what must have happened to market interest rates? Why has this impacted the bond price?arrow_forward

- Bonds often pay a coupon twice a year. For the valuation of bonds that make semiannual payments, the number of periods doubles, whereas the amount of cash flow decreases by half. Using the values of cash flows and number of periods, the valuation model is adjusted accordingly. Assume that a $1,000,000 par value, semiannual coupon US Treasury note with two years to maturity has a coupon rate of 4%. The yield to maturity (YTM) of the bond is 8.80%. Using this information and ignoring the other costs involved, calculate the value of the Treasury note: $913,697.55 $1,096,437.06 $776,642.92 $575,629.46 Based on your calculations and understanding of se The T-note described in this problem is selling at a discount premium pupon bonds, complete the following statement:arrow_forwardBonds often pay a coupon twice a year. For the valuation of bonds that make semiannual payments, the number of periods doubles, whereas the amount of cash flow decreases by half. Using the values of cash flows and number of periods, the valuation model is adjusted accordingly. Assume that a $1,000,000 par value, semiannual coupon US Treasury note with five years to maturity has a coupon rate of 6%. The yield to maturity (YTM) of the bond is 9.90%. Using this information and ignoring the other costs involved, calculate the value of the Treasury note: $534,907.72 $849,059.88 $1,018,871.86 $721,700.90 Based on your calculations and understanding of semiannual coupon bonds, complete the following statement: The T-note described in this problem is selling at a .arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education