FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

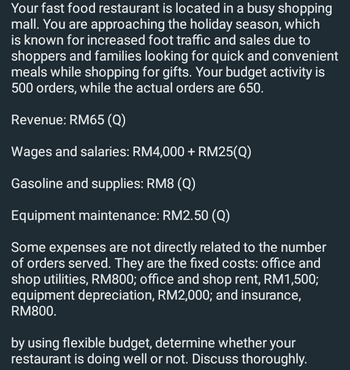

Transcribed Image Text:Your fast food restaurant is located in a busy shopping

mall. You are approaching the holiday season, which

is known for increased foot traffic and sales due to

shoppers and families looking for quick and convenient

meals while shopping for gifts. Your budget activity is

500 orders, while the actual orders are 650.

Revenue: RM65 (Q)

Wages and salaries: RM4,000 + RM25(Q)

Gasoline and supplies: RM8 (Q)

Equipment maintenance: RM2.50 (Q)

Some expenses are not directly related to the number

of orders served. They are the fixed costs: office and

shop utilities, RM800; office and shop rent, RM1,500;

equipment depreciation, RM2,000; and insurance,

RM800.

by using flexible budget, determine whether your

restaurant is doing well or not. Discuss thoroughly.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Refer to the following data of Good Food Snack House (in the photo) _____22. What is their Cash Conversion Cycle if their Operating Cycle is 135 days?A. 104 days B. 105 days C. 106 days D. 107 days _____23. What is the Average Inventory of Good Food Snack House?A. Php 1,067,570 B. Php 1,607,057 C. Php 1,765,070 D. Php 5,017,657arrow_forwardNozama.com Inc. sells consumer electronics over the Internet. For the next period, the budgeted cost of the sales order processing activity is $179,400, and 13,800 orders are estimated to be processed. a. Determine the activity rate of the sales order processing activity. per sales order b. Determine the amount of sales order processing cost that Nozama.com would receive if it had 7,900 sales orders.arrow_forwardNozama.com Inc. sells consumer electronics over the Internet. For the next period, the budgeted cost of the sales order processing activity is $250,000 and 50,000 sales orders are estimated to be processed. a. Determine the activity rate of the sales order processing activity. b. Determine the amount of sales order processing cost associated with 30,000 sales orders.arrow_forward

- Please help mearrow_forwardThe Thai Noodle, a local Thai restaurant, expects sales to be $220,000 in January. Its average customer restaurant bill is $20. Only 20% of the restaurant bills are paid with cash; 50% are paid with credit cards and 30% with debit cards. The transaction and debit card issuers are as follows: Credit cards: $0.20 per transaction + 3% of the amount charged Debit cards: $0.30 per transaction + 1% of the amount charged Read the requirements. Requirement 1. How much of the total sales revenue is expected to be paid in cash? The total sales revenue expected to be paid in cash is 44,000 Requirement 2. How many customer transactions does the company expect in January? In January, the number of transactions the company expects is 11,000 Requirement 3. How much of the total sales revenue is expected to be paid with credit cards? The total sales revenue expected to be paid with credit cards is $ 110,000 Requirement 4. How many customer transactions will be paid for by customers using credit cards?…arrow_forwardA7 please help......arrow_forward

- Edward Food Processing Company is a wholesale distributor of biscuits in Holborn.The Company has achieved steady growth over the past few years while Biscuitprices have been on the increase. The Company is planning its budget for the nextfinancial year. Presented below are the data used to project the current year’s aftertax income of £110,400. £Average Sales Price per Box 4.00Average variable costs per Box Cost of Biscuits 2.00 Profit on sale 0.40 Total 2.40Annual fixed cost Selling 160,000 Administrative 280,000 Total 440.000Expected annual sales volume (390,000 boxes) £1,560,000Tax rate 20%Biscuit manufacturers have announced that they will increase prices of theirproducts by an average of 15% in the coming year due to increase in material andlabour costs. Edward Food Processing expects same rates or levels as the currentyear Required: (b) Calculate the Sales price per box that the company must charge to cover the15% increase in the costs of biscuits and still maintain the…arrow_forwardJulianna Abdallah owns and operates FirstCakes, a bakery that creates personalized birthday cakes for a child's first birthday. The cakes, which sell for $40 and feature an edible picture of the child, are shipped throughout the country. A typical month's results are as follows: Sales revenue $840,000 Variable expenses 630,000 Contribution margin 210,000 Fixed expenses 112,000 Operating income $ 98,000 a.What is FirstCakes' contribution margin per unit? b.What is FirstCakes' monthly breakeven point in units? c.What is FirstCakes' contribution margin ratio? d.What is FirstCakes' monthly breakeven point in sales dollars?arrow_forwardEdward Food Processing Company is a wholesale distributor of biscuits in Holborn.The Company has achieved steady growth over the past few years while Biscuitprices have been on the increase. The Company is planning its budget for the nextfinancial year. Presented below are the data used to project the current year’s aftertax income of £110,400. Average Sales Price per Box 4.00Average variable costs per Box Cost of Biscuits 2.00 Profit on sale 0.40 Total 2.40Annual fixed cost Selling 160,000 Administrative 280,000 Total 440.000Expected annual sales volume (390,000 boxes) £1,560,000Tax rate 20%Biscuit manufacturers have announced that they will increase prices of theirproducts by an average of 15% in the coming year due to increase in material andlabour costs. Edward Food Processing expects same rates or levels as the currentyear. (a) Calculate Break-even point in boxes of biscuits for the current year. (b) Calculate the Sales price per box that the company must charge to cover the15%…arrow_forward

- Red Canyon T-shirt Company operates a chain of T-shirt shops in the southwestern United States. The sales manager has provided a sales forecast for the coming year, along with the following information: Quarter 1 Quarter 2 Quarter 3 Quarter 4 Budgeted unit sales 47,000 74,000 37,000 74,000 Each T-shirt is expected to sell for $22. The purchasing manager buys the T-shirts for $9 each. The company needs to have enough T-shirts on hand at the end of each quarter to fill 32 percent of the next quarter’s sales demand. Selling and administrative expenses are budgeted at $94,000 per quarter plus 10 percent of total sales revenue. Required:1.Determine budgeted sales revenue for quarters 1, 2, and 3.2. Determine budgeted cost of merchandise purchased for quarters 1, 2, and 3.3. Determine budgeted cost of good sold for quarters 1, 2, and 3.4. Determine selling and administrative expenses for quarters 1, 2, and 3.5. Complete the budgeted income statement for quarters 1, 2, and…arrow_forwardBeached is a retail outlet situated in a very popular tourist town not far from Canberra. It is very popular during school holidays, with the peak tourist season being in December and January. Sales consist of cash sales to retail customers (70%) and credit sales to tourist operators (30%). Credit sales are collected 20% in the month of sale, 60% in the month following the sale and 20% in the second month following the sale. Opening Accounts Receivable are $120,000. Inventory is marked-up 70% on cost and inventory opening balances are required to be 60% of the month's expected sales. Inventory is purchased on credit with 40% paid in the month following the purchase and the remainder paid two months following the purchase. Opening Accounts Payable is $80,000. Using tha above information, prepare the following: 1. Prepare a cash receipts budget for the six months 2. Prepare a cash payments budget for the six months 3. Prepare a budgeted pfofit and loss to Gross Profit for the six months…arrow_forwardYou have been hired by the McClosky Corporation and they manufacture industrial dye. Milestone 3:I. Budgeted Balance SheetJ. Cash BudgetK. Budget Presentation and please address the following questions:(1) The sales manager would like to increase the sales price by 10 next quarter, what will be the projected revenues be for the 2nd quarter. (2) The production manager would like to purchase new equipment for next quarter due to the fact that their competitor has purchased equipment which cost $50,000. Will the company be able to make the purchase or will you need more information?(3) The CEO feels that the cash budget is not necessary, please explain to the CEO why cash budgeting is important to the organization.(4) Please explain the to the management team how a competitor’s actions can affect business planning.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education