FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

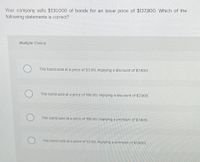

Transcribed Image Text:Your company sells $130,000 of bonds for an issue price of $137,800. Which of the

following statements is correct?

Multiple Cholce

The bond sold at a price of 53.00, Implying a discount of $7,800.

The bond sold at a price of 106.00, Implying a discount of $7,800.

The bond sold at a price of 106.00, Implying a premlum of $7,800.

The bond sold at a price of 53.00, Implying a premlum of $7,800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A Treasury bond due in 1 year has a yield of 3.5%, while a Treasury bond due in 5 years has a yield of 7.5%. A bond due in 5 years issued by High Country Marketing Corp. has a yield of 13%, while a bond due in 1 year issued by High Country Marketing Corp. has a yield of 5%. The default risk premium on the 5-year bonds issued by High Country Marketing Corp. is _________. Note: Express your answers in strictly numerical terms. For example, if the answer is 5%, write 0.05"arrow_forwardAn OMR 80,000 bond issue sold for 98. Therefore, the bonds were: Select one: a. Sold at a discount because the stated rate of interest was lower than the effective rate. b. Sold at a premium because the stated rate of interest was higher than the yield rate. c. Sold for the OMR 80,000 face amount less OMR 10,000 of accrued interest. d. Sold at a discount because the effective interest rate was lower than the coupon ratearrow_forward5. Compute the price of $94,580,761 received for the bonds by using the tables shown in Present Value Tables. (Round to the nearest dollar.) Present value of the face amount Present value of the semiannual interest payments Price received for the bondsarrow_forward

- You purchased a $20,000 bond when there was 17 years to maturity. The bond has a coupon rate of 4.48 %. At the time of purchase the yield to maturity was 2.98%. How much did you pay for the bond? Enter your answer in blank #1. (Round) your answer to 2 decimal places and include the $ sign. Enter your answer in the form $1,234.56.) • Was the bond purchased at a premium or a discount? Enter "premium" or "discount" in blank #2. • What was the amount of premium or discount on the bond? Enter your answer in blank #3. (Round your answer to 2 decimal places and include the $ sign. Enter your answer in the form $1,234.56.) Blank #1 Blank #2 Blank # 3arrow_forwardYou are offered an 6 year bond issued by Fordson, at a price of $943.22. The bond has a coupon rate of 9% and pays the coupon semiannually. Similar bonds in the market will yield 10% today. Do you buy the bonds at the offered price? Yes the bond is offered at a premium. O No, the bond offered is worth less than $943.22. Yes, the bond offered is being sold at a discount. O There is not enough information to determine.arrow_forwardA bond with $898,000 face value that pays 10% coupon is issued at 102 1/2, i.e., 102.5% of its face value. Is this bond issues at premium of discount? And what is the amount of cash received as a result of issuing this bond? a. Premium; $920,450 b. Discount; $673,500 c. Premium; $987,800 d. PAR Value; $898,000 A B C Darrow_forward

- Valdez Corporation has bonds on the market with 11.5 years to maturity, a YTM of 7.2 percent, a par value of $1,000, and a current price of $1,054. The bonds make semiannual payments. What must the coupon rate be on these bonds? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. Coupon rate %arrow_forwardFind the total proceeds (in $) from the sale of 30 bonds with a coupon rate of 6.75 and a current price of 96.975. (Round your answer to the nearest cent.) The commission charge is $4.00 per bond. The date of the transaction is 145 days since the last interest payment.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education