FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

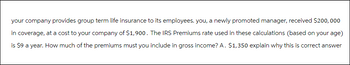

Transcribed Image Text:your company provides group term life insurance to its employees. you, a newly promoted manager, received $200,000

in coverage, at a cost to your company of $1,900. The IRS Premiums rate used in these calculations (based on your age)

is $9 a year. How much of the premiums must you include in gross income? A. $1,350 explain why this is correct answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A retired 78-year-old individual is unmarried, has no dependents, and holds a part- time job that pays $3,000 per year. The individual also has corporate bonds that pay interest income each year. What is the minimum amount of interest the corporate bonds must pay for this individual to be required to file income taxes for 2021? $9,551 O $11,251 O $12,551 $21,801arrow_forwardPlease Solve In 15mins I will Thumbs-uparrow_forwardNote:hand written solution should be avoided.arrow_forward

- Edwards Company just hired another employee - Jane. The Edwards Company provides supplemental retirement benefits to its employees realizing the insufficiency of the Social Security benefits for a comfortable retirement life. Edwards has asked you to perform the necessary computations pertaining to the retirement benefits for Jane. Jane's current salary is $40,000. Jane will be entitled to this supplementary retirement benefits after 20 years of work- the start of the 21st year. The retirement plan will last for 25 years. Per company practices. Jane will be granted with a year-end salary increase of 2% per year effective Jan. 1st of each year that she works. The amount of annual retirement benefit is going to be 45% of Jane's salary right before the start of the retirement and will be paid at the start of each year, Any invested funds for pension will earn 4% compounded annually. Click here to use Excel. Compute Jane's annual retirement benefit Example of Answer: 4000.20 Two decimal…arrow_forward3arrow_forward! Required information [The following information applies to the questions displayed below.] Clyde is a cash-method taxpayer who reports on a calendar-year basis. This year Paylate Corporation has decided to pay Clyde a year-end bonus of $1,000. Determine the amount Clyde should include in his gross income this year under the following circumstances. (Leave no answer blank. Enter zero if applicable.) c. Paylate Corporation mailed the check to Clyde before the end of the year (and it was delivered before year-end). Although Clyde expected the bonus payment, he decided not to collect his mail until after year-end. Amount to be included in gross incomearrow_forward

- 1. Student graduates and is employed receiving an annual salary of $70,000. Student will receive a 50% employer match on their retirement contributions up to 6% of their annual salary. Assume, student takes advantage of this match to the maximum amount for student’s 35 year working career. How much will student have at the end of his/her career? Assume student earns 7% on their retirement investments. Assume Student did not receive an employer match, but did the same thing. How much would student have in retirement savings upon retirement? 2. Student is now 35 and has $100,000 in retirement savings. Student withdrawals $75,000 early. Student then reenters the workforce and begins saving again for retirement at age 38. Student then works another 30 years. Student has $7,000 in retirement savings for those 30 years. How much money will student have upon retirement at age 68? Assume student makes 7% on their retirement savings. Assume similar student has $100,000 at age 35 and then…arrow_forwardAnthony earns $750.00 per week. He has a cash taxable benefit of $25.00 per week. Calculate the net taxable income for the week. Your answer: Previous Next Mark Question 4 of 70 123 Item: 52-109 Review Screenarrow_forwardSteve Grayson, is self-employed age 43. He has established a SEP-IRA for himself several years ago. In 2019, Steve had a $1,000 excess contribution to his SEP-IRA. In 2020. his net earnings from the business are $80,000. He uses the maximum contribution rate for his SEP-IRA account. What amount would Steve's contribution be for 2020. a.) $14,870 b.) $0 c.) $13,870 d.) $57,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education