FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

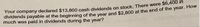

Transcribed Image Text:Your company declared $13,800 cash dividends on stock. There were s6,400 m

dividends payable at the beginning of the vear and $2,800 at the end of the year. How

much was paid in dividends during the year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Electronic world inc paid out $24 million in total common dividends and reported $255.6 million of retained earnings at year-end. The prior year's retained earnings were $173.8 million. What was the net income? Assume that all dividens delcared were actually paid.arrow_forwardA.What is stockholders' equity? B.Cary Jones corp stockholders' equity totaled 99,000 at the beginning of the year. During the year, net income was 29,000, dividends of 5,000 were declared and paid, and 27,000 of common stock was issued at par value. Calculate total stockholders' equity at the end of the year?arrow_forwardBolton Corporation had additions to retained earnings for the year just ended of $248,000. The firm paid out $187,000 in cash dividends, and it has ending total equity of $4.92 million. The company currently has 150,000 shares of common stock outstanding. a. What are earnings per share? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What are dividends per share? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. What is the book value per share? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) d. If the stock currently sells for $80 per share, what is the market-to-book ratio? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) e. What is the price-earnings ratio? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) f. If the…arrow_forward

- The opening balance of retained earnings for a company was $1328424. During the year it earned a net income of $509389 and shareholders invested an additional $613909 for shares. The ending balance of retained earnings was $1645010. How much did the company pay out in dividends during the year? Select one: a. $192803 b. $0 c. $806712 d. $104520arrow_forwardDetermine Fisher’s return on stockholders’ equity if its Year 1 earnings after tax are $9,000(000). Round your answer to two decimal places. %arrow_forwardDove, Inc., had additions to retained earnings for the year just ended of $635,000. The firm paid out $80,000 in cash dividends, and it has ending total equity of $7.30 million. a. If the company currently has 670,000 shares of common stock outstanding, what are earnings per share? Dividends per share? What is book value per share? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b. If the stock currently sells for $30.00 per share, what is the market-to-book ratio? The price-earnings ratio? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) c. If total sales were $10.6 million, what is the price-sales ratio? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. b. C. Earnings per share Dividends per share Book value per share Market-to-book ratio Price-earnings ratio Price-sales ratio times times timesarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education