FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

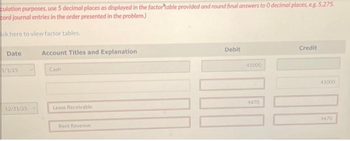

Transcribed Image Text:culation purposes, use 5 decimal places as displayed in the factortable provided and round final answers to 0 decimal places, e.g. 5,275.

cord journal entries in the order presented in the problem.)

ck here to view factor tables.

Date

1/1/25

12/31/25

Account Titles and Explanation

Cash

Lease Receivable

Rent Revenue

Debit

41000

9470

Credit

41000

9470

Transcribed Image Text:2

Your answer is partially correct.

On January 1, 2025, Carla Vista Animation sold a truck to Sandhill Finance for $41,000 and immediately leased it back. The truck was

carried on Carla Vista's books at $34,000. The term of the lease is 5 years, there is no bargain purchase option, and title does not

transfer to Carla Vista at lease-end. The lease requires five equal rental payments of $9.470 at the end of each year (first payment on

January 1, 2026). The appropriate rate of interest is 5%, the truck has a useful life of 5 years, with no expected residual value at the end

of the lease term

Prepare Carla Vista's 2025 journal entries. (List all debit entries before credit entries. Credit account titles are automatically indented when

the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. For

calculation purposes, use 5 decimal places as displayed in the factor table provided and round final answers to O decimal places, eg. 5,275,

Record journal entries in the order presented in the problem)

Click here to view factor tables.

Date:

Account Titles and Explanation

Debit

Credit

Cut 204 Homework Bule Leaseback Transactions

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Dineshbhaiarrow_forwardOn January 1, 2020, Most Inc. leases a machine used in its operations. The annual lease payment is $20,000 due on December 31 of 2020, 2021, 2022, and 2023. The fair value of the machine on January 1, 2020 is $69,302. The machine has no residual value. Most could borrow on a four-year collateralized loan at 6%. If the lease is accounted for as a finance lease, Most’s December 31, 2020 balance sheet would show a right-to-use asset and a finance lease liability of Select one: a. Right-to-use asset $51,976; Finance lease liability $ 53,460 b. Right-to-use asset $53,460; Finance lease liability $ 55,273 c. Right-to-use asset $60,000; Finance lease liability $ 60,000 d. Right-to-use asset $49,355; Finance lease liability $ 57,343arrow_forwardEx.13.arrow_forward

- 13. Concord Corporation manufactures drones. On December 31, 2019, it leased to Althaus Company a drone that had cost $162,000 to manufacture. The lease agreement covers the 5-year useful life of the drone and requires five equal annual rentals of $54,800 payable each December 31, beginning December 31, 2019. An interest rate of 6% is implicit in the lease agreement. Collectibility of the rentals is not probable.Prepare any journal entry for Concord on December 31, 2019. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Account Titles and Explanation Debit Creditarrow_forwardSkysong enters into an agreement with Traveler Inc. to lease a car on December 31, 2019. The following information relates to this agreement. 1. The term of the non-cancelable lease is 3 years with no renewal or bargain purchase option. The remaining economic life of the car is 3 years, and it is expected to have no residual value at the end of the lease term. 2. The fair value of the car was $14,100 at commencement of the lease. 3. Annual payments are required to be made on December 31 at the end of each year of the lease, beginning December 31, 2020. The first payment is to be of an amount of $5,148.50, with each payment increasing by a constant rate of 5% from the previous payment (i.e., the second payment will be $5,519.36 and the third and final payment will be $5,795.30). 4. Skysong’ incremental borrowing rate is 8%. The rate implicit in the lease is unknown. 5. Skysong uses straight-line depreciation for all similar cars. (a)Prepare Skysong’ journal…arrow_forwardWhispering Steel Company, as lessee, signed a lease agreement for equipment for 5 years, beginning December 31, 2020. Annual rental payments of $54,000 are to be made at the beginning of each lease year (December 31). The interest rate used by the lessor in setting the payment schedule is 6%; Whispering's incremental borrowing rate is 8%. Whispering is unaware of the rate being used by the lessor. At the end of the lease, Whispering has the option to buy the equipment for $5,000, considerably below its estimated fair value at that time. The equipment has an estimated useful life of 7 years, with no salvage value. Whispering uses the straight-line method of depreciation on similar owned equipment. Click here to view factor tables.arrow_forward

- On January 1, 2021, Rick's Pawn Shop leased a truck from Corey Motors for a seven-year period with an option to extend the lease for three years. Rick's had no significant economic Incentive as of the beginning of the lease to exercise the 3-year extension option. Annual lease payments are $16,500 due on December 31 of each year, calculated by the lessor using a 4% Interest rate. The agreement is considered an operating lease. (FV of $1. PV of $1, FVA of $1, PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare Rick's Journal entry to record for the right-of-use asset and lease llability at January 1, 2021. 2. Prepare the Journal entries to record Interest and amortization at December 31, 2021. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare Rick's journal entry to record for the right-of-use asset and lease liability at January 1, 2021. (If no entry is requir transaction/event,…arrow_forwardBlossom, Inc. leases a piece of equipment to Wildhorse Company on January 1, 2025. The contract stipulates a lease term of 5 years, with equal annual rental payments of $8,880 at the end of each year. Ownership does not transfer at the end of the lease term, there is no bargain purchase option, and the asset is not of a specialized nature. The asset has a fair value of $48,000, a book value of $43,000, and a useful life of 8 years. At the end of the lease term, Blossom expects the residual value of the asset to be $12,000, and this amount is guaranteed by a third party. Assuming Blossom wants to earn a 5% return on the lease and collectibility of the lease payments is probable, record its journal entry at the commencement of the lease on January 1, 2025. (List all debit entries before credit entries. Credit account titles are automaticallyarrow_forwardRexon Company leases non-specialized equipment to Ten-Care Company beginning January 1, 2019. The lease terms, provisions, and related events are as follows: 1. The lease term is 8 years. The lease is noncancelable and requires equal rental payments to be made at the end of each year. 2. The cost of the equipment is $500,000. The equipment has an estimated life of 8 years and has a zero estimated value at the end of that time. 3. The equipment has a fair value of $500,000. 4. Ten-Care agrees to pay all executory costs directly to a third party. 5. The lease contains no renewal or bargain purchase option. 6. The interest rate implicit in the lease is 10%. 7. The initial direct costs are insignificant and assumed to be zero. 8. It is probable that Rexon will collect the lease payments plus any amount necessary to satisfy a residual value guarantee. Required: 1. Next Level Assuming that the lease is a sales-type lease from Rexon’s point of view, calculate the…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education