Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

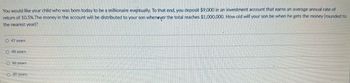

Transcribed Image Text:You would like your child who was bom today to be a millionaire eventually. To that end, you deposit $9,000 in an investment account that earns an average annual rate of

return of 10.5%. The money in the account will be distributed to your son whenever the total reaches $1,000,000. How old will your son be when he gets the money (rounded to

the nearest year)?

O 47 years

O 48 years

O 46 years

O 49 years.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Marshall and Tiana have a new grandson. How much money should they invest now so that he will have $63,000 for his college education in 18 years? The money is invested at 4.65% compounded annually.arrow_forwardYou anticipate your child will start college in 18 years. You decide to place $4,732 each year into a 4.1% interest bearing account. How much will be in the account when he begins college?arrow_forward6) Your daughter is born today, and you want her to be a millionaire by the time she is 35 years old. You open an investment account that promises to pay 16% per year. How much money must you deposit each year, starting on her 1st birthday and ending on her 35th birthday, so your daughter will have $1,000,000 by her 35th birthday? N Year I/Y Cash flow 7) The present value of the following cash flow stream is $8,500 discounted at 10 percent annually. What is the value of the missing cash flow? 1,000 PV 1 ? PMT 2 2,000 FV 3 4,000 4arrow_forward

- You want your daughter to be a millionaire. She is 3 years old today when you deposit $42,000 in an account that earns 8.2% per year. The funds in the account will be distributed to your daughter whenever the total reaches $1,000,000. How old will your daughter be when she gets the money?arrow_forwardWhen your son is born you want to determine what lump amount would you have to be paid into an account bearing interest of 10%/yr to provide withdrawals of $10,000 on each of your son's 18th, 19th, 20th, and 21st birthdayarrow_forwardToday, you turn 21. Your birthday wish is that you will be a millionaire by your 40th birthday. In an attempt to reach this goal, you decide to save $20 a day, every day until you turn 40. You open an investment account and deposit your first $20 today. What rate of return must you earn to achieve your goal?arrow_forward

- Michael Jones plans to save $5,928 every year for the next eight years, starting today. At the end of eight years, Michael will turn 30 years old and plans to use his savings toward the down payment on a house. If his investment in a mutual fund will earn him 11 percent annually, how much will he have saved in eight years when he buys his house? (Round factor values to 4 decimal places, e.g. 1.5212 and final answer to 2 decimal places, e.g. 15.25.) Future value of investment $arrow_forwardYour brother turns 35 today, and he is planning to save $7,000 per year for retirement, with the first deposit to be made one year from today. He will invest in a mutual fund that's expected to provide a return of 7.5% per year. He plans to retire 30 years from today, when he turns 65, and he expects to live for 25 years after retirement, to age 90. Assuming annual rate of return remains at 7.5% for his investment account during the retirement stage, how much can he spend each month after he retires? His first withdrawal will be made at the end of his first retirement month. a. $5,880.15 b. $7,135.48 c. $5,348.79 d. $6,166.25arrow_forwardYour evil step-uncle wishes to leave you some of his wealth. You must choose how he wills the money to you. OptionA: He ‘gives’ you $1000.00. He will invest the money on your behalf, at 7.5% per annum, compounded monthly. He will add $1000 to the account at the end of each year. At his death the accumulated sum will pass to you. Option B: He ‘gives’ you $2000.00 per year until he dies. This money is not invested, and the accumulated sum will pass to you at his death. a) If you knew Uncle was going to die in 5 years, which option would you choose? How much money would you inherit from Option A? From Option B? b) If you knew Uncle was going to die in 20 years, which option would you choose? How much money would you inherit from Option A? From Option B?arrow_forward

- The parents of a newborn decide to make deposits into an educational savingsaccount on each of their daughter's birthdays, starting with her first birthday.Assume that the educational savings account will return a constant 5.5% per year.The parents plan to deposit $2 200 on every of their daughter's future birthdays.How much money could they alternatively deposit on their daughter's birth date(today) to have the same amount available on her 18th birthday?arrow_forwardGuyton and Jessica have a new grandson. How much money should they invest now so that he will have $79,000 for his college education in 18 years? The money is invested at 4.1% compounded quarterly.arrow_forwardYour son Bob is 14 years old today. You are planning for his college education. Bob will start school on his 19th birthday. You wish to set aside some money early to send Bob to four years of school. You have decided that you will give Bob $15,000 per year for each of his first two years of college, and $20,000 per year for each of his last two years of college. You will give these amounts to Bob at the beginning of each school year. You will make 5 equal annual deposits to fund the account. The first payment will be made one year from today and the last payment will be made the day Bob leaves for college. You wish to have just enough money in the bank to fund Bob's entire education on the day that he leaves for school. Any money that is in the aCcount will continue to earn interest while Bob is in school. Because of a new program, the bank has agreed to give you a 10 percent, nominal compounded annually, return on your investments throughout the entire time period. How much do you…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education