Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

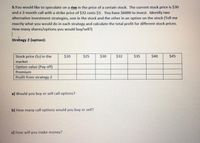

Transcribed Image Text:5.You would like to speculate on a rise in the price of a certain stock. The current stock price is $30

and a 3-month call with a strike price of $32 costs $3. You have $6000 to invest. Identify two

alternative investment strategies, one in the stock and the other in an option on the stock (Tell me

exactly what you would do in each strategy and calculate the total profit for different stock prices.

How many shares/options you would buy/sell?)

Strategy 2 (option):

Stock price (ST) in the

$20

$25

$30

$32

$35

$40

$45

market

Option value (Pay off)

Premium

Profit from strategy 2

a) Would you buy or sell call options?

b) How many call options would you buy or sell?

c) How will you make money?

Transcribed Image Text:5.You would like to speculate on a rise in the price of a certain stock. The current stock price is $30

and a 3-month call with a strike price of $32 costs $3. You have $6000 to invest. Identify two

alternative investment strategies, one in the stock and the other in an option on the stock (Tell me

exactly what you would do in each strategy and calculate the total profit for different stock prices.

How many shares/options you would buy/sell?)

Strategy 1 (stock):

Stock price (ST) in the market

Profit from strategy 1

$25

$30

$32

$35

$40

$45

a) Would you buy or sell stocks?

b) How many stocks would you buy or sell?

c) How will you make money?

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- how is price oc preffered stock gottenarrow_forwardHigher a stock’s volatility, why does the higher the probability of large increases or decreases in market price?arrow_forward3) Understanding if a stock is undervalued or overvalued will influence if the investor will invest in the stock at the current moment of the analysis. T/Farrow_forward

- If markets are in equilibrium, which of the following conditions will exist? a. Each stock's expected return should equal its required return as seen by the marginal investor. b. All stocks should have the same expected return as seen by the marginal investor. c. The expected and required returns on stocks and bonds should be equal. d. All stocks should have the same realized return during the coming year. e. Each stock's expected return should equal its realized return as seen by the marginal investor.arrow_forwardExplain how to find the value of a stock given itslast dividend, its expected growth rate, and itsrequired rate of return.arrow_forwardSummarize the major factors affecting stock price?arrow_forward

- What effect do increasing inflation expectations have on the required returns of investors in common stock?arrow_forwardHow will the change in required return influence the price of a stock? How will the dividend growth rate influence the price of a stock?arrow_forwardA stock's internal rate of return (IRR) is the discount rate that cause the present value of future dividends and the price at which a stock is expected to be sold to equal the current price of the stock. O True O False Carrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education