Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

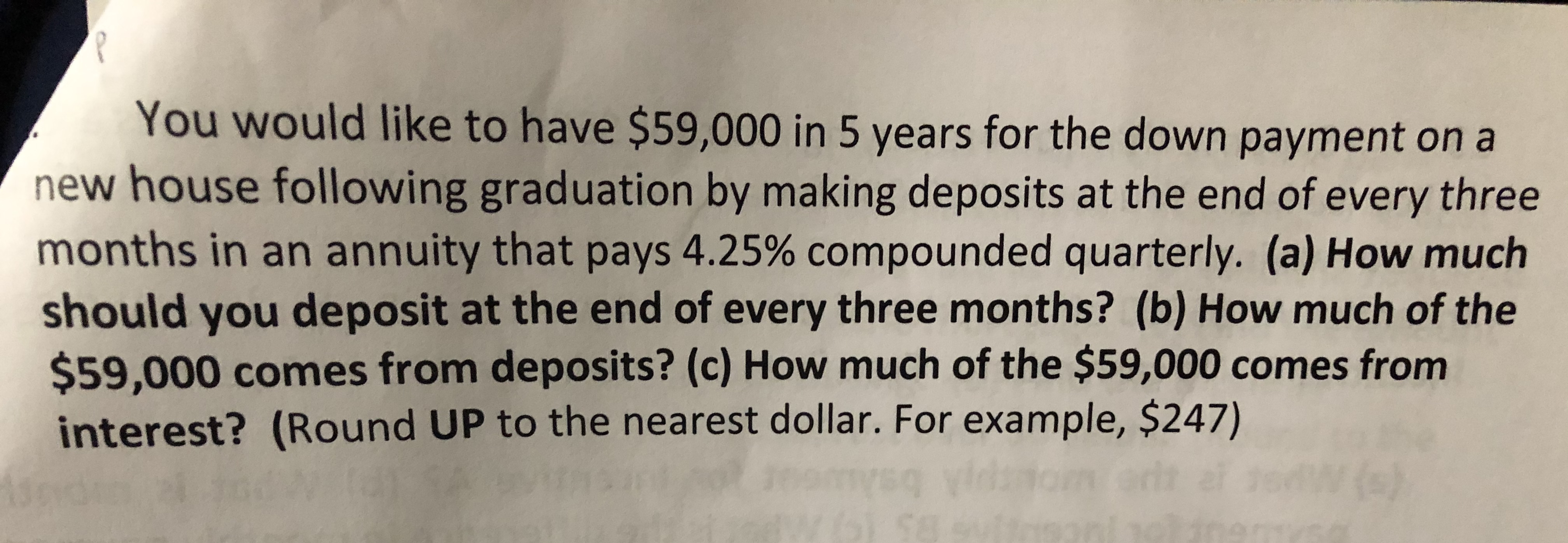

Transcribed Image Text:You would like to have $59,000 in 5 years for the down payment on a

new house following graduation by making deposits at the end of every three

months in an annuity that pays 4.25% compounded quarterly. (a) How much

should you deposit at the end of every three months? (b) How much of the

$59,000 comes from deposits? (c) How much of the $59,000 comes from

interest? (Round UP to the nearest dollar. For example, $247)

()

af

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- (Comprehensive problem) You would like to have $54,000 in 16 years. To accumulate this amount, you plan to deposit an equal sum in the bank each year that will earn 6 percent interest compounded annually. Your first payment will be made at the end of the year. a. How much must you deposit annually to accumulate this amount? b. If you decide to make a large lump-sum deposit today instead of the annual deposits, how large should this lump-sum deposit be? (Assume you can earn 6 percent on this deposit.) c. At the end of five years, you will receive $20,000 and deposit this in the bank toward your goal of $54,000 at the end of year 16. In addition to the lump-sum deposit, how much must you deposit in equal annual amounts, beginning in year 1 to reach your goal? (Again, assume you can earn 6 percent on your deposits.) a. How much must you deposit annually to accumulate this amount? (Round to the nearest cent.)arrow_forwardA person borrows an amount for a new house and s/he is going to make monthly payments of 8,000 $ for the next 10 years. The nominal annual interest rate is quoted as 12%. (Assume the first instalment is going to be paid 1 month after s/he borrows.) a. Find the amount borrowed by this person. b. How much does this credit worth at the end of the last payment date? c.lf this person decides on closing his/her loan after paying the 34th instalment, how much should s/he pay? It is given that the closing fee of this credit is 1,453 $.arrow_forward(Annuity payments) To buy a new house, you must borrow $150,000. To do this, you take out a $150,000, 35-year, 11 percent mortgage. Your mortgage payments, which are made at the end of each year (one payment each year), include both principal and 11 percent interest on the declining balance. How large will your annual payments be? The amount of your annual payment will be $ **** (Round to the nearest cent.)arrow_forward

- You deposit $1,000 into an account every six months to help with your down payment savings for a home. How much will you have at the end of seven years if the account has a monthly compound annual percentage rate of 14%? (Tip: first figure out the effective semiannual interest rate.)arrow_forwardYou invest $1,000 in a certificate of deposit that matures after ten years and pays 5 percent interest, which is compounded annually until the certificate matures. How much interest will you earn if the interest is left to accumulate? How much interest will you earn if the interest is withdrawn each year? Why are the answers to a and b different?arrow_forwardYou would like to have $37,000 in 5 years for the down payment on a new house following college graduation by making deposits at the end of every three months in an annuity that pays 4.25% compounded quarterly. How much should you deposit at the end of every three months? How much of the $37,000 comes from deposits and how much comes from interest?arrow_forward

- How much would you still owe at the end of the first year, after you have made the first payment?arrow_forwardSuppose that you take out an unsubsidized Stafford loan on September 1 before your junior year for $45004500 and plan to begin paying it back on December 1 after graduation and grace period 27 months later. The interest rate is 6.8%. How much of what you will owe will be interest?$Round your answer to the nearest cent.arrow_forwardAn insurance settlement of $3 million must replace Trixie Eden's income for the next 30 years. What income will this settlement provide at the end of each month if it is invested in an annuity that earns 8.1%, compounded monthly? (a) Decide whether the problem relates to an ordinary annuity or an annuity due. ordinary annuityannuity due (b) Solve the problem. (Round your answer to the nearest cent.) $arrow_forward

- You are planning to make monthly deposits of $500 into a retirement account that pays 7.7 percent interest compounded monthly. If your first deposit will be made one month from now, how large will your retirement account be in 30 years?arrow_forwardYou are working for a finance firm and a client comes to you and wants to know how much money they should put in an annuity (which earns 2.885% interest compounded quarterly) at the end of each three months for the next 36 years. Their goal is that when they retire at the end of 36 years, they would like the quarterly withdrawals from the annuity to total $68,000 per year and that the annuity is to last for the next 23 years. You are to determine the amount which your client needs to deposit into the annuity at the end of each three months for the next 36 years so that they can meet their retirement goal. Do the following: Show all your work that you used to answer this problem. Label the steps and important values as you solve the problem. Note that when you use the TVM Solver, show the all variables and the values you entered (into the variables) and solved for. Find the total amount of interest client will earn (from the time they start contributing to the account to when they…arrow_forwardAn investor deposits $100 into his credit union account that pays interest at the rate of 3.25% per year (payable at the end of each year). He leaves the money and all accrued interest in the account for 7 years. How much will he have at the end of the 7 years? What is the future value in SEVEN years if you receive $300 in two years and $500 at the end of five years? Assume an annual compound rate of 8.5%. What is the value of $2000after one year, if bank compounding half yearly and offered rate is 10%? What is the value of $2000 after one year if bank compounding quarterly and offered rate is 10%? What is the value of $2000after one year if bank compounding monthly and offered rate is 10%?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education