Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:K

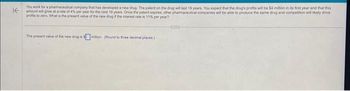

You work for a pharmaceutical company that has developed a new drug. The patent on the drug will last 19 years. You expect that the drug's profits will be $4 million in its first year and that this

amount will grow at a rate of 4% per year for the next 19 years. Once the patent expires, other pharmaceutical companies will be able to produce the same drug and competition will likely drive

profes to zero. What is the present value of the new drug if the interest rate is 11% per year?

The present value of the new drug is million (Round to three decimal places)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- What is the no arbitrage price of a risk-free investment that promises to pay $1,000 in one year? The risk-free interest rate is 3.5%. If you can purchase the investment for $950, do you have an arbitrage opportunity?arrow_forwardYou are considering a project which will cost $140,000. It is expected to bring in incomes of $45,000 per year for the next 5 years. You company's discount rate is 12%. What is the NPV of this project?arrow_forwardYou have just been offered a contract worth $1.21 million per year for 7 years. However, to take the contract, you will need to purchase some new equipment. Your discount rate for this project is 11.7%. You are still negotiating the purchase price of the equipment. What is the most you can pay for the equipment and still have a positive NPV? The most you can pay for the equipment and achieve the 11.7% annual return is $ 6.99 million. (Round to two decimal places.)arrow_forward

- Consider two interest rate scenarios for investing over next 20 years. In steady scenario A, you get interested of 4% each year. In choppy scenario B, in the first year you get that rate plus 10% but then in next year get that rate minus 10% and so forth. The average rate is the same in each scenario. But for an initial investment of $4000, how much more is A worth than B at the end of the period?arrow_forwardYou are thinking of buildinga new machine that will save you $5,000 in the first year. The machine will then begin to wear out so that the savings decline at a rate of 1% per year forever. What is the present value of the savings if the interest rate is 6% per year? The present value of the savings is $. (Round to the nearest dollar.) -12.. Ereen Sho 529.00 O Time Remaining: 00:25:34 Next etv DD DIL 80 888 FR F7 F6 F5 F4 esc F2 F3 & 2$ % @ #3 7 8. 2 3 4 P Y U W E R Qarrow_forwardA real estate property is on the market. You have estimated it will give you net cash flows of $5136 per month. You hope to sell it in 9 years for $308182. Your required return is 9.46%, how much should you be willing to pay for the property today? Answer:arrow_forward

- You are considering opening a new plant. The plant will cost $96 million upfront. After that, it is expected to produce constant profits at the end of every year (the first profits arrive at t=1). The cash flows are expected to last forever. The discount rate is 7%. At what profits amount would you breakeven in the plant investment?arrow_forwardBeckham Corp. is considering an investment which should be worth $600,000 10 years from now when it earns 7% compounded annually.Question: Rounding to the nearest whole dollar, what is the most Beckham should pay today for this investment?arrow_forwardSuppose you have $10,000 and a choice of two alternatives: A) put the money in a savings account that pays 4% per year, and B) buy a stock that has a 50% chance to gain 15% in value after 1 year, and a 50% chance to lose 5%. What will be the expected return for either alternative, and which one would you choose? Why?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education