FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Broker required you to deposit $20400

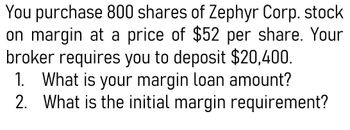

Transcribed Image Text:You purchase 800 shares of Zephyr Corp. stock

on margin at a price of $52 per share. Your

broker requires you to deposit $20,400.

1. What is your margin loan amount?

2. What is the initial margin requirement?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 2. Assume F&S offers a “Fit 50” coupon book with 50 prepaid visits over the next year. F&S has learned thatFit 50 purchasers make an average of 40 visits before the coupon book expires. A customer purchases a Fit50 book by paying $500 in advance, and for any additional visits over 50 during the year after the book ispurchased, the customer can pay a $15 visitation fee per visit. F&S typically charges $15 to nonmembers whouse the facilities for a single day.a. How many separate performance obligations are included in the Fit 50 member deal? Explain your answer.b. How much of the contract price would be allocated to each separate performance obligation? Explain youranswer.c. Prepare the journal entry to recognize revenue for the sale of a new Fit 50 book.arrow_forwardwhat will be interest paid at end of term?arrow_forwarda investor purchased a 91 day, $100,000.00 t-bill on its issue date fir $99, 441.89, after holding it for 16 days, she sold the t bill for a yeild of 2.21% what is the original yeild of the t bill? what was the t bill sold for? the investor realized the rate of return was?arrow_forward

- Please answer everything asap. DONT USE EXCEL!arrow_forward7) A businessman wants to buy a truck. The dealer offers to sell the truck for either $120,000 now, or six yearly payments of $25,000. Which of the following is closest to the interest rate being offered by the dealer? A) 5.8% B) 6.8% C) 7.8% D) 9.8%arrow_forwardFind the interest rates earned on each of the following: A. You borrow $700 and promise to pay back $749 at the end of 1 year B. You lend $700 and the borrower promises to pay you back $749 at the end of 1 year C. You borrow $85,000 and promise to pay back $201,229 at the end of 10 years D. You borrow $9,000 and promise to make payments of $2,684.80 at the end of each year for 5 yearsarrow_forward

- You plan to use a 15 year mortgage obtained from a local bank to purchase a house worth $124,000.00. The mortgage rate offered to you is 7.75%. You will make a down payment of 20% of the purchase price. a. Calculate your monthly payments on this mortgage. List in a spreadsheet the cash flow the bank expects to receive from you. Submit the spreadsheet with your answers. b. Calculate the amount of interest and principal for the 60th payment. Show your work. c. Calculate the amount of interest and principal to be paid on the 180th payment. Show your work. d. What is the amount of interest paid over the life of this mortgage?arrow_forwardYour bank offers to lend you $120, 000 at an 8.25% annual interest rate to start your new business. The terms require you to amortize the loan with 10 equal end-of-year payments. How much interest would you be paying in Year 2? a. $5,904.06. b. $8,487.08 0 c. $6,642.06• d. $7,011.07. e. $9224.68arrow_forwardmerchant receives an invoice for $8000 with terms 2/10, n/50.a) What is the maximum interest rate that the merchant could borrow money at to take advantage of the discount?b) If the bank offers a loan for 15% interest, should he accept it, and if so, what will be his savings?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education