Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

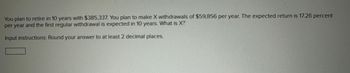

Transcribed Image Text:You plan to retire in 10 years with $385,337. You plan to make X withdrawals of $59,856 per year. The expected return is 17.26 percent

per year and the first regular withdrawal is expected in 10 years. What is X?

Input instructions: Round your answer to at least 2 decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- You plan to retire in 5 years with $429,887. You plan to withdraw $67,100 per year for 12 years. The expected return is X percent per year and the first regular withdrawal is expected in 6 years. What is X? Input instructions: Input your answer as the number that appears before the percentage sign. For example, enter 9.86 for 9.86% (do not enter .0986 or 9.86%). Round your answer to at least 2 decimal places. percentarrow_forwardYou plan to retire in 3 years with $911,880. You plan to withdraw $X per year for 18 years. The expected return is 18.56 percent per year and the first regular withdrawal is expected in 3 years. What is X? Input instructions: Round your answer to the nearest dollar. 99 $arrow_forwardYou plan to save $41,274 per year for 4 years, with your first savings contribution later today. You then plan to make X withdrawals of $41,502 per year, with your first withdrawal expected in 4 years. What is X if the expected return per year is 8.28 percent per year? Input instructions: Round your answer to at least 2 decimal places.arrow_forward

- Please make sure you're using the right formula and rounding correctly I have asked this question four times and all the answers have been incorrect.arrow_forwardSuppose that you will deposit $184 at the end of each month for the next 24 years into an account with an APR of 11% and monthly compounding. How much money will be in the account at the end of the 24 years? Round your final answer to two decimals. Show formula in Excel.arrow_forwardUse up to 6 decimal places during solving for the answer. Write all numerical final answers round off up to TWO (2) decimal places. 1. If I invest 32.195 today and expect a reimbursement every end of 6th month with a ROR of 0.13 compounded semi-annually for 3 years. How much will ! expect to receive every June and December of every year.arrow_forward

- You want to have $5 million when you retire in 30 years. You feel that you can save $750 per month until you retire. What APR do you have to earn in order to achieve your goal? Enter your answer as a percentage rounded off to two decimal places. Do not enter % in the answer box.arrow_forwardYou believe you will spend $44, 000 a year for 16 years once you retire in 32 years. If the interest rate is 7% per year, how much must you save each year until retirement to meet your retirement goal? Note: Do not round intermediate calculations. Round your answer to 2 decimal places.arrow_forwardYou have $20,800.51 in a brokerage account, and you plan to deposit an additional $3,000 at the end of every future year until your account totals $280,000. You expect to earn 14% annually on the account. How many years will it take to reach your goal? Round your answer to two decimal places at the end of the calculations.arrow_forward

- Suppose you want to have $500,000 for retirement in 30 years. Your account earns 9% interest. How much would you need to deposit in the account each month? Submit Question H Q Searcharrow_forwardSuppose today you signed a contract for a special assignment over the next 6 years. You will be paid $11492 at the end of each year. If your required rate of return is 11%, what is this contract worth today? (Show your answer to the nearest cent. Round your answer to the nearest 2 decimal places. DO NOT round until after all calculations have been completed and you have reached your final answer.)arrow_forwardAfter learning about the time value of money, you decided to open a retirement account. You will invest $475 each month. It earns an annual interest rate of 10.8% per year. Your first deposit will be made one month from now. What is the value of your account in 33 years? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Retirement account valuearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College