EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

6

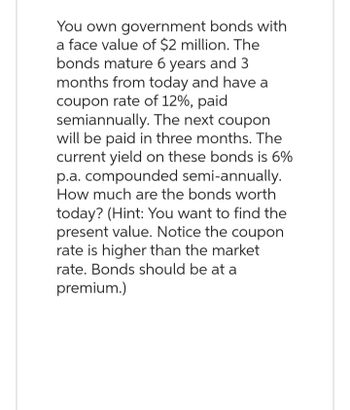

Transcribed Image Text:You own government bonds with

a face value of $2 million. The

bonds mature 6 years and 3

months from today and have a

coupon rate of 12%, paid

semiannually. The next coupon

will be paid in three months. The

current yield on these bonds is 6%

p.a. compounded semi-annually.

How much are the bonds worth

today? (Hint: You want to find the

present value. Notice the coupon

rate is higher than the market

rate. Bonds should be at a

premium.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A government bond matures in 7 years, makes annual coupon payments of 5.1% and offers a yield of 3.1% annually compounded. Assume face value is $1,000. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) a. Suppose that one year later the bond still yields 3.1%. What return has the bondholder earned over the 12-month period? Rate of return b. Now suppose that the bond yields 2.1% at the end of the year. What return did the bondholder earn in this case? Rate of returnarrow_forwardA government bond matures in 6 years, makes annual coupon payments of 4.4% and offers a yield of 2.4% annually compounded. Assume face value is $1,000. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) a. Suppose that one year later the bond still yields 2.4%. What return has the bondholder earned over the 12-month period? b. Now suppose that the bond yields 1.4% at the end of the year. What return did the bondholder earn in this case?arrow_forwardA six-year government bond makes annual coupon payments of 5% and offers a yield of 3% annually compounded. Assume face value is $1,000. a. Suppose that one year later the bond still yields 3%. What return has the bondholder earned over the 12-month period? b. Now suppose that the bond yields 2% at the end of the year. What return did the bondholder earn in this case? Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- You buy a bond and hold it for one year. According to the information below... What is your holding period return? (Keep in mind you received coupon payments over the course of the year and that you get one year closer to maturity after the year passes by) Face Value: $1,000 YTM1 (Yield of comparable bonds) at date of purchase: 4% YTM2 (Yield of comparable bonds) at date of sale, end of the year: 6% Coupon: 4% Maturity: 26 years Aarrow_forwardConsider a bond (with par value = $1,000) paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. Required: a. Find the bond's price today and six months from now after the next coupon is paid. b. What is the total (6-month) rate of return on the bond? Complete this question by entering your answers in the tabs below. Required A Required B Find the bond's price today and six months from now after the next coupon is paid. Note: Round your answers to 2 decimal places. Current price Price after six months $ $ 1,052.42 1,044.52arrow_forwardA 10-year government bond has face value of OR 200 and a coupon rate of 6% paid semiannually. Assume that the interest rate is equal to 8% per year. What is the bond’s price? What is the reason for the difference in price on an annual and semiannually basis? Discuss the role of financial managers.arrow_forward

- You wish to sell a bond that has a face valueof $5,000. The bond bears an interest rate of 7.5%,which is payable quarterly. Six years ago, the bondwas purchased at $4,800. At least a 9% annual returnon the investment is desired. What must be the minimum selling price of the bond now in order to makethe desired return on the investment?arrow_forwardOver the next three years, the expected path of 1-year interest rates is 4, 1, and 1 percent. Today you buy $1 of one-year bond and when it matures you plan to use the money you receive to reinvest in one-year bond again. If the expectations theory of the term structure is true, then your expected rate of return for buying a two-year bond today is ______% (round to the neares integer)arrow_forwardIf investors holding our 4-year bonds (Bond #1) receive interest income annually forfour years, plus the face value of the bonds at maturity,a. If the expected rate of return on our bonds is 10%, what is the duration ofBond #1? Given the following projected income stream for Bond #1: year coupon interest face value 1 100 2 100 3 100 4 100 1,000 total income in yeear 4 400 1,000arrow_forward

- You're considering a bond with a maturity of 10 years, face value of 1,000. The surface interest rate of these bonds is 9% and interest (coupon) is paid twice a year. What is the current price of this bond if you require an annual effective interest rate of 8.16% (not a nominal interest rate!)?arrow_forwardThe Garcia Company’s bonds have a face value of $1,000, will mature in 10 years, and carry a coupon rate of 17.6 percent. Assume interest payments are made semiannually. How would your answer change if the required rate of return is 11.4 percent? (Round final answer to nearest dollar amount.) Present value $Type your answer herearrow_forwardYOUR BANK is thinking to issue a regular coupon bond (debenture) with the following particulars: Maturity = 3 years, Coupon rate = 9%, Face value = $1,500, Coupon payments are annual and paid at the end of a year. In the fixed-income securities market, the yield curve for the bond similar to the one issued by YOUR BANK is flat and it is 7.500% per annum continuously compounded. As per you, what should be the issue (offer) price per bond of YOUR BANK in US dollars?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT