Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

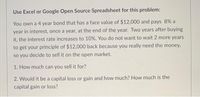

Transcribed Image Text:Use Excel or Google Open Source Spreadsheet for this problem:

You own a 4 year bond that has a face value of $12,000 and pays 8% a

year in interest, once a year, at the end of the year. Two years after buying

it, the interest rate increases to 10%. You do not want to wait 2 more years

to get your principle of $12,000 back because you really need the money,

so you decide to sell it on the open market.

1. How much can you sell it for?

2. Would it be a capital loss or gain and how much? How much is the

capital gain or loss?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A parent wants to set aside enough money in an account to pay for a child’s college tuition. Tuition is $40,000 per year for four years. The first tuition bill will be due in one year. The account earns 2% per year. How much should be deposited in the account today What is the value of a zero-coupon bond with face value of $100 and a maturity date in 20 years if the yield is 5% per year? The yield follows the bond equivalent yield carrow_forward7. After 5 years, you decide not to use the money for a car. Instead, you'll take $10,000 of it to buy a house. You find a home you love for $375,000. a. Assuming that you get an interest rate of 5.75%, plan on taking about a 30- year mortgage, and you will put a down payment of $8,000, what will your monthly payment be? (hint: find PMT, and don't forget to take out the down payment!) b. Yikes! That payment is way too much! You want to have a mortgage payment of $1200. Assuming that you get an interest rate of 5.75%, plan on taking about a 30-year mortgage, and a payment of $1200 each month, how big of a mortgage should you get? (hint: find PV. Do NOT take out a down payment.) c. After your findings in 5b, you aim for a $200,000 mortgage. Assuming you get an interest rate of 5.75%, plan on taking about a 30-year mortgage, and the mortgage is $200,000, how much will you pay over the life of the mortgage? (hint: find the PMT first) d. How much of that was interest if the loan was…arrow_forwardIf you wanted to achieve a 7% return on this bond ($10,000 face value, payable in 10 years), with a $325 interest payment (A) every 6 months for 10 years, what would you pay for the bond today (P)? Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- . You borrow $2mn at an interest rate of 5% per year to purchase a real estate property for the cost of $2.5mn. The borrowing costs are due only at the end of the year. (a) Suppose you sell the property for $2.7mn at the end of the year. What is the return on your equity? (b) Suppose the price of the property declines to $2.3mn after one year. What is the return on your equity? (c) Suppose the interest rate at which you can borrow is 1%. How do your answers change?arrow_forwardYou have just sold your house for $1,100,000 in cash. Your montgage was originaly a 30 -year mortgage with monthly payments and an intial balance of $750,000 . The mortgage is currentfy exactly 18 y years old, and you have just made a payment, If the interest nate on the mortgage is 5.25% (APR). how much cash will you have from the sale once you pay off the mortgage? (Note: Bo careful not to round any intormediate stops less than six decimal places) Cash that remains after payof of mortgage is ? (Round to the nearest dollar)arrow_forwardYou are considering a savings bond that will pay $100 in 8 years. If the interest rate is 2.2%, what should you pay today for the bond? The amount that you should pay today for the bond is $ (Round to the nearest cent.)arrow_forward

- Suppose the government decides to issue a new savings bond that is guaranteed to double in value if you hold it for 18 years. Assume you purchase a bond that costs $100. a. What is the exact rate of return you would earn if you held the bond for 18 years until it doubled in value? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. If you purchased the bond for $100 in 2020 at the then current interest rate of .22 percent year, how much would the bond be worth in 2028? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. In 2028, instead of cashing in the bond for its then current value, you decide to hold the bond until it doubles in face value in 2038. What annual rate of return will you earn over the last 10 years?arrow_forwardYou have just sold your house for $1,100,000 in cash. Your mortgage was originally a 30-year mortgage with monthly payments and an initial balance of $700,000. The mortgage is currently exactly 18% years old, and you have just made a payment. If the interest rate on the mortgage is 5.25% (APR), how much cash will you have from the sale once you pay off the mortgage? (Note: Be careful not to round any intermediate steps less than six decimal places.) Cash that remains after payoff of mortgage is $. (Round to the nearest dollar.) example Get more help. 28 B A MacBook Pro hor enter website name + Clear all & 19 Check answer XEarrow_forwardYou have decided to buy a perpetual bond. The bond makes one payment at the end of every year forever and has an interest rate of 10%. If the bond initially costs $4,000, what is the payment every year? The payment at the end of each year is $. (Round to the nearest dollar.)arrow_forward

- You have just sold your house for $900,000 in cash. Your mortgage was originally a 30-year mortgage with monthly payments and an initial balance of $800,000. The mortgage is currently exactly 18 years old, and you have just made a payment. If the interest rate on the mortgage is 6.25% (APR), how much cash will you have from the sale once you pay off the mortgage? (Note: Be careful not to round any intermediate steps less than six decimal places.) Cash that remains after payoff of mortgage is $ (Round to the nearest dollar.)arrow_forwardIf the owners choose to invest in bonds instead, they look at a $136,125 bond set to mature in 9 years with a bond rate of 2%, payable semi-annually. The market rate is 5.40%, compounded semi-annually. The owners will only purchase the bond if they can afford it with their savings $123,750, and they can get the bond at a discount because they think the market rate will go down, potentially making the bond more valuable in the future. 1. If the bond rate is 2%, will the bond be sold at a premium or a discount? Explain your answer.arrow_forwardSuppose the U.S. Treasury offers to sell you a bond for $2,000. No payments will be made until the bond matures 15 years from now, at which time it will be redeemed for $4,000. What interest rate would you earn if you bought this bond at the offer price?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education