Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

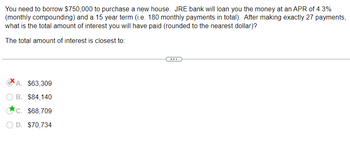

Transcribed Image Text:You need to borrow $750,000 to purchase a new house. JRE bank will loan you the money at an APR of 4.3%

(monthly compounding) and a 15 year term (i.e. 180 monthly payments in total). After making exactly 27 payments,

what is the total amount of interest you will have paid (rounded to the nearest dollar)?

The total amount of interest is closest to:

A. $63,309

B. $84,140

c. $68,709

O D. $70,734

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Suppose that you take out an unsubsidized Stafford loan on September 1 before your junior year for $45004500 and plan to begin paying it back on December 1 after graduation and grace period 27 months later. The interest rate is 6.8%. How much of what you will owe will be interest?$Round your answer to the nearest cent.arrow_forwardDiane is deciding between two personal loans. For each loan, the loan amount is $7500. Use the ALEKS loan calculator for the following. Also use the regular ALEKS calculator, as necessary. Write your answers to the nearest cent. ALEKS Loan Calculator Loan amount: $ Loan term: Interest rate: Calculate years % Monthly payment: (a) For Loan A, the interest rate is 6.15% per year and the loan term is 7 years. Find the total amount to repay Loan A. S (b) For Loan B, the interest rate is 6.15% per year and the loan term is 5 years. Find the total amount to repay Loan B. (c) For which loan would she pay less, and by how much? Loan A The total amount paid is $ less. Loan B The total amount paid is $less. X Ľarrow_forwardSuppose you obtain a 30-year mortgage loan of $193,000 at an annual interest rate of 8.6%. The annual property tax bill is $974 and the annual fire insurance premium is $496. Find the total monthly payment for the mortgage, property tax, and fire insurance. (Round your answer to the nearest cent.)$ ??arrow_forward

- Suppose you want to buy a vacant lot for your future home for $29,673. If your bank is willing to loan you the money at a 6% APR over the next 14 years how much would be your monthly payment? (Round up your answer to two decimal point)arrow_forwardYou borrow $22541 to buy a car. You will have to repay this loan by making equal monthly payments for 14 years. The bank quoted an APR of 6%. How much is your monthly payment (in $ dollars)? I'm not sure how the answer is 198.6394, Can you explain that to me on the financial calculator, please? Thank you :)arrow_forwardYou purchase a house in East Lansing, MI. You calculate the amount financed to be $203,315. You obtain a 15-year mortgage with an interest rate of 3.8% and have calculated a monthly payment of $1,062. For the following, round your answer to the nearest cent. The payment on the principle in the first month is $450.41 $403.56 $418.17 $643.83 $489.31 OOOOarrow_forward

- You are considering purchasing a new home. You will need to borrow $280,000 to purchase the home. A mortgage company offers you a 20-year fixed rate mortgage (240 months) at 9% APR (0.75% month). If you borrow the money from this mortgage company, your monthly mortgage payment will be closest to: O A. $2,015 В. $3,527 C. $4,030 D. $2,519arrow_forwardYou purchase a cottage for $185,000. You obtain a 30-year, fixed rate mortgage loan at 13.0% after paying a down payment of 30%. Of the second month's mortgage payment, how much is interest and how much is applied to the principal? (Round your answers to the nearest cent.)Interest $________Applied to Principle $__________arrow_forwardCheck My Work еВook Starting next year, you will need $20,000 annually for 4 years to complete your education. (One year from today you will withdraw the first $20,000.) Your uncle deposits an amount today in a bank paying 7% annual interest, which will provide the needed $20,000 payments. a. How large must the deposit be? Do not round intermediate calculations. Round your answer to the nearest cent. $ b. How much will be in the account immediately after you make the first withdrawal? Do not round intermediate calculations. Round your answer to the nearest cent. $arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education