Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Help me fast.....I will give good rating....

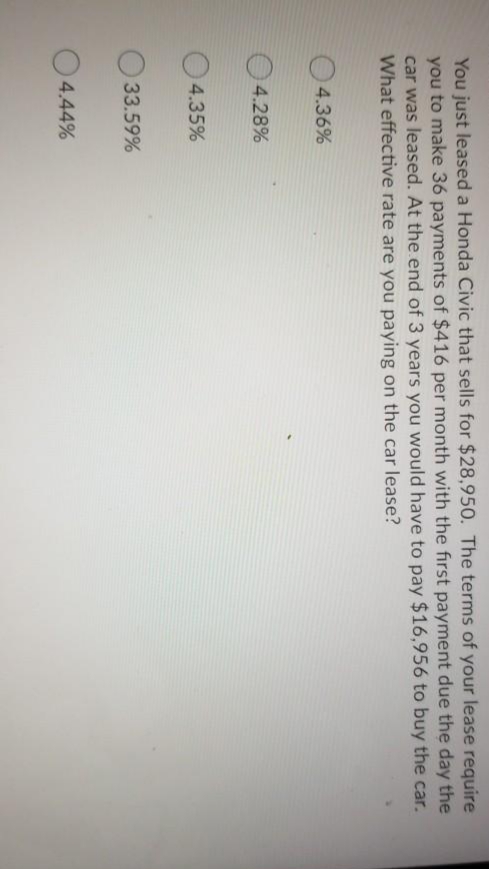

Transcribed Image Text:You just leased a Honda Civic that sells for $28,950. The terms of your leaše řēquire

you to make 36 payments of $416 per month with the first payment due the day the

car was leased. At the end of 3 years you would have to pay $16,956 to buy the car.

What effective rate are you paying on the car lease?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Use the Regression tool on the accompanying wedding data, using the wedding cost as the dependent variable and attendance as the independent variable. Complete parts a through o. Click the icon to view the wedding data. ine siope indicates that for eacn increase or 1 in attendance, the predicted weading cost is estimated to increase by a value equal to o₁.. OC. It is not appropriate to interpret the slope because it is outside the range of observed attendances. OD. The slope indicates that for each increase of 1 in wedding cost, the predicted attendance is estimated to increase by a value equal to b Interpret the Y-intercept of the regression equation. Choose the correct answer below. X Wedding Attendance and Cost Wedding Cost 58700 Attendance OA. The Y-intercept indicates that a wedding with an attendance of 0 people has a mean predicted cost of $bo OB. The Y-intercept indicates that a wedding with a cost of $0 has a mean predicted attendance of by people. OC. It is not appropriate to…arrow_forwardPlease give all part answer??? Definitely I will give good rating.arrow_forwardWhat is answer for question b)arrow_forward

- A trin ratio of less than 1.0 is considered as a a. Bearish signal by some technical analysts, a bullish signal by other technical analysts and bullish signal by some fundamentalists O b. Bullish signal by some fundamentalists O c. Bearish signal by some technical analysts and a bullish signal by other technical analysts O d. Bullish signal O e. Bearish signalarrow_forwardUse the Regression tool on the accompanying wedding data, using the wedding cost as the dependent variable and attendance as the independent variable. Complete parts a through c. Click the icon to view the wedding data. OA. The Y-intercept indicates that a wedding with an attendance of 0 people has a mean predicted cost of $bo B. The Y-intercept indicates that a wedding with a cost of $0 has a mean predicted attendance of by people. OC. It is not appropriate to interpret the Y-intercept because it is outside the range of observed wedding costs. D. It is not appropriate to interpret the Y-intercept because it is outside the range of observed attendances. Identify and interpret the meaning of the coefficient of determination in this problem. Select the correct choice below and fill in the answer box to complete your choice. (Round to three decimal places as needed.) Wedding Attendance and Cost Wedding Cost Attendance 58700 300 54000 350 45000 150 OA. The coefficient of determination is…arrow_forwardWhich of the following returns is best described as a guess and is based on an individual's expected outcomes and probability of those outcomes? This was also described as your "guess at the beginning of the semester". Realized Expected Required Promsiedarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education