ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

You have just been hired by the U.S. government to analyze the following scenario. Suppose the U.S. agricultural industry is concerned about the level of fruit and vegetable imports to the United States, a practice that hurts domestic producers. Lobbyists claim that implementing a tariff on imports would shrink the size of the trade deficit . The following exercise will help you to analyze this claim.

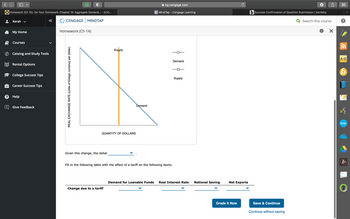

The following graph shows the demand and supply of U.S. dollars in a model of the foreign-currency exchange market.

Shift the demand curve, the supply curve, or both to show what would happen if the government decided to implement the tariff.

Given this change, the dollar_______ (appreciates/depreciates ).

Fill in the following table with the effect of a tariff on the following items:

Transcribed Image Text:<

W Homework (Ch 15): Do Your Homework: Chapter 15: Aggregate Demand... - ECO...

CENGAGE MINDTAP

Kerah ✔

My Home

Courses

Catalog and Study Tools

Rental Options

College Success Tips

Career Success Tips

Help

«

Give Feedback

Homework (Ch 14)

REAL EXCHANGE RATE (Units of foreign currency per dollar)

QUANTITY OF DOLLARS

Given this change, the dollar

Supply

Change due to a tariff

Demand

ng.cengage.com

C Mind Tap - Cengage Learning

Fill in the following table with the effect of a tariff on the following items:

Demand

Supply

Demand for Loanable Funds Real Interest Rate National Saving

Net Exports

Grade It Now

b Success Confirmation of Question Submission | bartleby

Q Search this course

Save & Continue

Continue without saving

X

+

A-Z

w

bongo

A+

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- If the U.S. Dollar appreciates, foreigners will find American goods more expensive because they have to spend less for those goods in USD, meaning with higher prices, the number of U.S. goods being exported will likely drop and leads to a reduction in the Gross Domestic Product (GDP). True or Falsearrow_forwardSuppose total Canadian exports in the month of June were $123.6 billion and total imports from foreign countries were $191.7 billion. What was the balance of trade? Instructions: Round your answer to one decimal place and include a negative sign, if necessary. billion.arrow_forwardExplain the impact on US export and import if the US dollar has depreciated in comparison with other currencies. For example, the exchange rate for the Canadian dollar was 1.36 per U.S dollar in 2003. Now in 2020, it is 1.31 Canadian dollars per U.S.dollar under this case the dollar has suffered a slight depreciation. Also, when the dollar has depreciated in the case of the Chinese Yuan from 8.27 in 2003 to 6.69 yuans in 2020 per U.S dollar. Also, when there is not either appreciation or depreciation from 2003 to 2020 which is the case of Saudi Arabia currency its exchange rate remains the same 3.75 Riyals per dollar since 2003. Then explain the impact of U.S. exports and imports under these scenarios.arrow_forward

- eBook Problem 6-03 Consider the following information: Imports Net income from foreign investments Foreign investments in U.S. Government spending abroad Exports U.S. investments abroad Foreign securities bought by U.S. U.S. securities bought by foreigners Purchase of short-term foreign securities Foreign purchases of U.S. short-term securities $244.0 73.4 8.9 4.0 170.7 21.2 5.2 2.5 5.8 8.7 Determine the balance on the U.S. current account and capital accounts. Use a minus sign to enter the amount as a negative value. Round your answers to one decimal place. Balance on current account: $ Balance on capital account: $arrow_forwardThe graph below depicts the foreign exchange market of a hypothetical economy. Exchange rate XR₂ XR₁ XR₂ Q₂ Q₁ Q₂ Quantity of dollars S₂ S₂ Multiple Choice D₂ The shift in the supply curve from S₁ to S3 is caused by. an increase in investors' confidence in foreign economies investors find it is risky to invest in other countries compared to Canada a high Canadian Interest rate relative to foreign interest rate Canadian consumers preferring domestic goodsarrow_forwardSuppose the U.S. government has just hired you to analyze the following scenario. Assume the U.S. manufacturing industry grows concerned about competition from low-cost producers overseas exporting their goods to the United States, a practice that harms domestic producers. Industry experts claim that implementing a tariff on imports would reduce the size of the trade deficit. Complete the following exercise in order to help you analyze this claim. The following graph shows the demand and supply of U.S. dollars in a model of the foreign-currency exchange market. Shift the demand curve, the supply curve, or both to show what would happen if the government decided to implement the tariff. REAL EXCHANGE RATE (Units of foreign currency per dollar) QUANTITY OF DOLLARS Given this change, the dollar Supply Change due to a tariff Demand Fill in the following table with the effect of a tariff on the following items: Demand Supply (?) Supply of Loanable Funds Real Interest Rate Net Capital…arrow_forward

- The following graph shows the market for euros in terms of dollars. The market is initially in equilibrium at $1.00 per euro and 4 billion euros. Suppose an economic downturn in the United States leads to a drop in American incomes, causing imports from Europe to decline. On the following graph, show the effect in the market for euros of an economic downturn in the United States that leads to a drop in European incomes. DOLLAR PRICE OF EUROS 2.00 1.75 1.50 1.25 1.00 0.75 0.50 0.25 0 0 1 Supply of Euros D₂ D₁ 2 3 4 5 6 QUANTITY OF EUROS (Billions of euros) 7 8 Under a system of flexible exchange rates, the dollar will depreciate $1.25 per euro. Sell dollars for euros in the foreign exchange market. Lower interest rates by way of monetary policy. Demand for Euros Subsidize the production of certain U.S. exports to Europe. Supply of Euros ? Now suppose that the United States maintains a fixed exchange rate of $1.00 per euro. Which of the following U.S. government policies would keep the…arrow_forwardThe most recent trade data can be found on the BEA site. (Links to an external site.) It shows that since the beginning of the pandemic, the U.S. trade deficit has increased decreased stayed about the samearrow_forward4. Analyzing the effects of a trade deficit Suppose the U.S. government has just hired you to analyze the following scenario. Assume the U.S. agricultural industry grows concerned about the amount of fresh fruit imports to the United States, a practice that harms domestic producers. Industry experts claim that implementing a tariff on imports would reduce the size of the trade deficit. Complete the following exercise in order to help you analyze this claim. The following graph shows the demand and supply of U.S. dollars in a model of the foreign-currency exchange market. Shift the demand curve, the supply curve, or both to show what would happen if the government decided to implement the tariff. REAL EXCHANGE RATE (Units of foreign currency per dollar) Supply QUANTITY OF DOLLARS Demand Demand Supply ?arrow_forward

- Confused and unsure how to figure out the dollar and percent amountsarrow_forwardThe image attached is what i need help with pleasearrow_forwardThe following graph shows the market for euros in terms of dollars. The market is initially in equilibrium at $2.00 per euro and 8 billion euros. Suppose an economic downturn in the United States leads to a drop in American incomes, causing imports from Europe to decline. On the following graph, show the effect in the market for euros of an economic downturn in the United States that leads to a drop in European incomes. DOLLAR PRICE OF EUROS 4.0 3.5 3.0 2.5 2.0 1.5 1.0 0.5 0 0 2 Supply of Euros Demand for Euros 4 6 8 10 12 QUANTITY OF EUROS (Billions of euros) 14 Under a system of flexible exchange rates, the dollar will per euro. 16 Increase income taxes in the United States. Lower interest rates by way of monetary policy. Demand for Euros Subsidize the production of certain U.S. exports to Europe. Supply of Euros ? Now suppose that the United States maintains a fixed exchange rate of $2.00 per euro. Which of the following U.S. government policies would keep the balance-of-payments…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education