ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

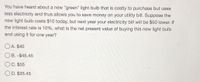

Transcribed Image Text:You have heard about a new "green" light bulb that is costly to purchase but uses less electricity and thus allows you to save money on your utility bill. Suppose the new light bulb costs $10 today, but next year your electricity bill will be $50 lower. If the interest rate is 10%, what is the net present value of buying this new light bulb and using it for one year?

- A. $40

- B. -$45.45

- C. $55

- D. $35.45

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Answer manually not by excelarrow_forwardSuppose that a 2-year zero-coupon bond with face value $1,000 currently sells at $840, while a 1-year zero-coupon bond with face value $1,000 currently sells at $920. You are considering the purchase of a 2-year coupon bond that pays coupon annually. The face value of this coupon bond is $1,000 and coupon rate is 12% per year. Required: a. What is the yield to maturity of the 2-year zero-coupon bonds? b. What is the current price of the 2-year coupon bond? c. What is the forward rate of the second year? d. If the expectation hypothesis is accepted, what are (1) the expected price of the coupon bond at the end of the first year and (2) the expected holding period return on the coupon bond over the first year? e. Will the expected rate of return be higher or lower if you accept the liquidity preference hypothesis?arrow_forwardQuestion 2. Based on the following cash flow diagram, calculate the value of X with the interest rate of 10%. 150$ 150$ 15o$ 150$ 150$ 150$ 150$ 75$ 10 11 X= ?arrow_forward

- 2. Suppose there is a plot of land in Balik Pulau which the state government is considering developing. The first proposal is to use the land to create an open-space camping area and another proposal is to develop into a cultural heritage area. The open space camping area is expected to last 12 years while the cultural heritage area is expected to have a life span of 20 years. The net present value of the open space camping area is RM4.5 million while the net present value of the cultural heritage area is RM3 million. Assume the discount rate is 5%. a) Using the roll-over method, which project will be chosen? b) Using the equivalent annual net benefit (EANB) method, which project will be chosen?arrow_forward5 Question Let Y be the present value of an 11-year term continuous annuity of $1 per year for an insured aged.x. Let х,п Y be the present value of a whole life continuous annuity of $1 per year for an insured aged.x. Given a constant force of interest, 8, show that: ()]))/(barrow_forwardQuestion 1 Due to health reasons, Dave is considering early retirement. He currently has $700,000 in a self- managed retirement fund. He thinks he will need S40,000 per year during retirement. He intends to invest his retirement in a low-risk mutual fund which return 1.5% per year. How many years can he live off this retirement fund without the need to look for a job?arrow_forward

- 5arrow_forward1. Assume you graduate with a student loan total of $28,000. You are going to pay off this loan with monthly payments for the next 8 years. The monthly interest rate is 0.25%. What is your monthly payment amount? (Answer is not 3,539.49)arrow_forwardAutomobile repair shops typically recommend that their customers change their oil and oll filter every 4.500 miles. Your automobile user's manual suggests changing your oil every 6,500-8,000 miles. If you drive your car 87,750 miles each year and an oil and filter change costs S34, how much money would you save each year if you had this service performed every 6.500 miles? Your savings will be $ per year. (Round to the nearest cent.Y Enter your answer in the answer boxarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education