Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

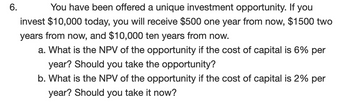

Transcribed Image Text:6.

You have been offered a unique investment opportunity. If you

invest $10,000 today, you will receive $500 one year from now, $1500 two

years from now, and $10,000 ten years from now.

a. What is the NPV of the opportunity if the cost of capital is 6% per

year? Should you take the opportunity?

b. What is the NPV of the opportunity if the cost of capital is 2% per

year? Should you take it now?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You have been offered a very long-term investment opportunity to increase your money one hundredfold. You can invest $500 today and expect to receive $50,000 in 40 years. Your cost of capital for this (very risky) opportunity is 19%. What does the IRR rule say about whether the investment should be undertaken? What about the NPV rule? Do they agree? The IRR of this investment opportunity is %. (Round to two decimal places.) Carrow_forwardPlease answer the question. The details of the question are attached in the image below.arrow_forwardYou have an opportunity to invest $106 000 now in return for S00,100 in one yoar and $30 400 in two years If your cost of capital is 8 9% what is the NPV of this investment? The NPV will be S (Round tó the nearest cent)arrow_forward

- Economics Your friend is inviting you to this exciting investment opportunity. To get in it costs 10,000 today but you will get 10,500 at the end of the year. a) What is the Internal Rate or Return of the investment opportunity? b) Suppose that the risk-free government bond rate is 5 percent. Should you still invest with your friend?arrow_forwardYou are considering an investment with the following characteristics. The investment will cost you $551 today, but will pay you annual benefits of $107 for 11 years starting at the end of the first year. The relevant opportunity cost of capital is 9%. What is the NPV of this investment? Round your answer to two decimals. Enter negative values with a - sign. Don't enter the $-symbol as part of your answer.arrow_forwardPlease show detailed steps and correct.arrow_forward

- You are thinking about investing in a project that will provide you a cash flow of $78922 in 3 years and of $88519 in 4 years. If your required return on investments of this risk is 15.14%, how much are you willing to pay for this opportunity? Round to 2 decimal places. Include a dollar sign ($) or percent (%) as appropriate. Answer:arrow_forwardIf you invest $73,300 in a project which yields an annual return of $13,500, how many years will it take to recover your investment if the annual interest rate is 4.5%? a 7 b 9 c. 5 d 8 e. 6arrow_forwardYou are considering the purchase of real estate that will provide perpetual income that should average $54,000 per year. How much will you pay for the property if you believe its market risk is the same as the market portfolio’s? The T-bill rate is 6%, and the expected market return is 9.0%. Property Value =arrow_forward

- 1. You have an opportunity to invest $50,000 now in return for $60,000 in one year. If your cost of capital is 8%, what is the NPV of this investment?arrow_forwardYou are considering an investment in a clothes distributer. The company needs $106,000 today and expects to repay you $124,000 in a year from now. What is the IRR of this investment opportunity? Given the riskiness of the investment opportunity, your cost of capital is 15%. What does the IRR rule say about whether you should invest? What is the IRR of this investment opportunity? The IRR of this investment opportunity is %. (Round to two decimal places.)arrow_forward(Use Calulator or Formula Approach) You are offered an investment that will pay you $200 in one year, $400 the next year, $600 the next year and $800 at the end of the fourth year. You can earn 12 percent on very similar investments. What is the most you should pay for this one?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education