You have been hired by the company LA PLANEACIÓN, S.A., for your track record in Cash Management and for being a CETYS student. With the following information, prepare a Cash Budget by the input-output method:

(IMAGE) ( I think it is easy to understand, especially for a bartleby expert.)

The budgeted monthly sales for the following fiscal year are:

January - 500000

February - 600000

March - 725000

April - 650000

May - 700000

June - 600000

July - 500000

August - 550000

Sales are made: 35% cash and 65% on credit which are collected in the following month. The outstanding receivables from 2020 are on the

The amount of

Purchases are made two months in advance of what is to be sold. The purchase conditions with suppliers are: 40% of purchases are paid in cash, 30% in the month following the purchase and 30% after two months. The balance payable on the account at December 31 consists of credit purchases in November and credit purchases in December.

Cost of goods sold is 55% of sales.

Salaries and commissions are divided into two parts $35,500 of fixed monthly salaries and commissions of 5% of sales for the month. The commission is paid the following month.

The partners are expected to make a stock sale that would bring in $250,000 in April. There will be an extraordinary income in March of $18,000.

Provisional payments equal to 2.25% of the sales of a month are made, deferring the payment to the first 15 days of the following month. The balance of taxes payable at December 31 consists of 75% income tax and 25% employee profit sharing, payable in March and May, respectively.

On February 1, 2021, a new truck will be purchased for cash at a value of $280,000, which has a useful life of four years and a salvage value of $30,000.

Other monthly expenses are:

Rent is $58,000; miscellaneous expenses: 15% of cash sales.

IT IS REQUESTED:

To carry out the six schedules that form the budget of inflows and outflows for the first half of 2021.

(Six schedules, i mean...):

-Cedula cobranza (Collection form)

-Cedula entrada (Incoming invoice)

-Cedula proveedores (Supplier spreadsheet)

-Cedulas salidas (Outgoing spreadsheets)

-Presupuesto efectivo (Cash budget)

-Presupuesto financiero (Financial budget)

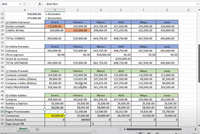

IN THE OTHER IMAGE, IS THE PROGRESS I HAVE OF THE EXERCISE IN EXCEL, SO YOU CAN GUIDE YOURSELF (it is in Spanish, but it is easy to understand, please understand, I know you are capable :))

-(Please understand, if you know finance, you know what I am doing in excel.)

Note:

I want to send more images, so you can better understand what I want you to get (more organized I mean), but bartleby won't allow me to...

If you like you can reject this question to send you more images by posting the same question, what do you think bartleby expert :)?

Step by stepSolved in 3 steps with 2 images

- Please help with question 1 and 2. Both the images are of the same continuing questionarrow_forwardPlease Do not Give image formatarrow_forwardUsing the same above information, what would it look like to complete the following? Schedule of cash payments for direct materials.Cash budget.Budgeted income statement for entire second quarter (not monthly).arrow_forward

- A company has completed the operating budget and the cash budget. It is now preparing the budgeted balance sheet. Please use the below image as your guide for the next 5 questions. )dentify the document that contains accounts receivable A B C D Earrow_forwardCash Receipts Budget and Accounts Receivable Aging Schedule Shalimar Company manufactures and sells industrial products. For next year, Shalimar has budgeted the following sales: Quarter 1 $4,760,000 Quarter 2 5,620,000 Quarter 3 3,060,000 Quarter 4 7,720,000 In Shalimar's experience, 10 percent of sales are paid in cash. Of the sales on account, 65 percent are collected in the quarter of sale, 25 percent are collected in the quarter following the sale, and 7 percent are collected in the second quarter after the sale. The remaining 3 percent are never collected. Total sales for the third quarter of the current year are $5,310,000 and for the fourth quarter of the current year are $7,350,000. Required: 1. Calculate cash sales and credit sales expected in the last two quarters of the current year, and in each quarter of next year. Quarter Cash Sales Credit Sales 3, current year 4, current year 1, next year 2, next year 3. next vear 4, next year 2. Construct a cash receipts budget for…arrow_forwardBudgeted cash payments. Would I begin with Cost of Direct materiasl purchase of April-3,010, May-3,650,June-4,015, 2nd Quarter -10,675?arrow_forward

- please answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardCash budgeting is critical to a company’s financial information needs. The following information was extracted from the records of A & B Manufacturing Company Limited. The opening cash balances on January 01, 2021 was expected to be $30,000. The budgeted sales were as follows: Budgeted Sales Month Year $ November 2020 80,000 December 2020 90,000 January 2021 80,000 February 2021 75,000 March 2021 60,000 April 2021 70,000 Analysis of records shows that debtors settle according to the following pattern: 70% within the month of sale 30% the following month Extracts of the purchases budget were as follows: Purchases budget Month Year $ December 2020 65,000 January 2021 50,000 February 2021 75,000 March…arrow_forwardAswer correctly. Options already selected are not all correct. Revise and answer.arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education