Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

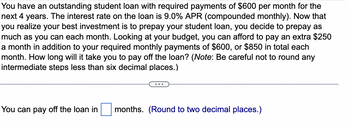

Transcribed Image Text:You have an outstanding student loan with required payments of $600 per month for the

next 4 years. The interest rate on the loan is 9.0% APR (compounded monthly). Now that

you realize your best investment is to prepay your student loan, you decide to prepay as

much as you can each month. Looking at your budget, you can afford to pay an extra $250

a month in addition to your required monthly payments of $600, or $850 in total each

month. How long will it take you to pay off the loan? (Note: Be careful not to round any

intermediate steps less than six decimal places.)

You can pay off the loan in

months. (Round to two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You estimate that you will have $56,500 in student loans by the time you graduate. The interest rate is 4.5 percent. If you want to have this debt paid in full within five years, how much must you pay each month?arrow_forward1arrow_forwardYou are planning to go on a big vacation in 5 years and will want to have spending money of $5,000. If you have an investment account with an APR of 4.38% that compounds monthly, how much would you need to invest now to have enough for your vacation?arrow_forward

- Beginning three months from now, you want to be able to withdraw $2,600 each quarter from your bank account to cover college expenses over the next four years. If the account pays .66 percent interest per quarter, how much do you need to have in your bank account today to meet your expense needs over the next four years?arrow_forwardYou want to buy a car without going into debt. You are budgeting $58,796 for the purchase price and you want to make the purchase in 5 years. You think you can earn 9.79% per year on any savings you generate between now and the car purchase. How much will you have to deposit at the end of each month in order for you to be able to pay cash for that car in 5 years?arrow_forwardStafford loans are the most popular form of student loan in the United States. The current interest rate on a Stafford loan is 4.34% per year. If you borrow $29,000 to help pay for your college education at the beginning of your freshman year, how much will you have to pay at the end of your freshman, sophomore, junior, and senior years for this loan? This is a total of four years over which the original loan will be repaid. The annual loan payment will be ______arrow_forward

- You want to save 10,000 for a down payment on a home by making regular monthly deposits over 4 years. Take the APR to be 7.5%. How much do you need to deposit each month?arrow_forwardYou have an outstanding student loan with required payments of $500 per month for the next 4 years. The interest rate on the loan is 9.0% APR (compounded monthly). Now that you realize your best investment is to prepay your student loan, you decide to prepay as much as you can each month. Looking at your budget, you can afford to pay an extra $200 a month in addition to your required monthly payments of $500, or $700 in total each month. How long will it take you to pay off the loan? (Note: Be careful not to round any intermediate steps less than six decimal places.) You can pay off the loan in months. (Round to two decimal places.) ←arrow_forwardTotal expenses for a year at college will be $9,000. You plan to pay $2,600 from your savings and finance the rest at a 5% simple interest. If you make 12 equal payments in one year, how much is each?arrow_forward

- You have decided to start saving for retirement. Your bank is willing to set you up with an IRA with a 9.2% APR. You need to have $925, 000 in the account in 45 years to be able to retire. 2a. How much of your remaining monthly budget do you want to put into the account each month? 2b. Why did you decide on this number? Support your answer with at least 3 sentences.arrow_forwardA college savings education plan claims that had you invested $375 per month in the plan for the last 16 years you would have accumulated $280,000. Assuming the investments were made at the end of each month, calculate the effective annual rate of return an investor would have received on a compounded basis using either Goal Seek or Solver.arrow_forwardIf you save $25 per week by bringing your lunch to school for 4 years, 12 months per year, andyou deposit the money at the end of each month into a savings account that pays 2% annualinterest, compounded monthly, then how much will you have at the end of the 4 years?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education