Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

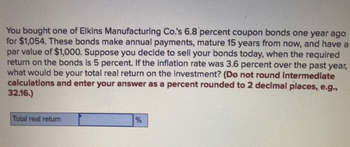

Transcribed Image Text:You bought one of Elkins Manufacturing Co.'s 6.8 percent coupon bonds one year ago

for $1,054. These bonds make annual payments, mature 15 years from now, and have a

par value of $1,000. Suppose you decide to sell your bonds today, when the required

return on the bonds is 5 percent. If the inflation rate was 3.6 percent over the past year,

what would be your total real return on the investment? (Do not round intermediate

calculations and enter your answer as a percent rounded to 2 decimal places, e.g.,

32.16.)

Total real return

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You purchased a zero-coupon bond one year ago for $283.33. The market interest rate is now 9 percent. Assume semiannual compounding. If the bond had 15 years to maturity when you originally purchased it, what was your total return for the past year? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardAfter careful consideration, you decide that you want to diversify your portfolio and invest in the bonds of HCA Healthcare. The bonds pay interest annually, will mature in 25 years, and have a coupon rate of 4% on a face value of $1,000. Currently, the bonds are selling for $910. If you are looking for a required return of 7% for this bond, what is the highest price you would be willing to pay?What is the current yield of these bonds?What is the yield to maturity on these bonds if you purchase them at the current price? (Use the Rate function) If you hold the bonds for two years, and interest rates do not change, what total rate of return will you earn, assuming that you pay the market price? If the bonds can be called in 4 years with a call premium of 6% of the face value, what is the yield to call?arrow_forwardAn investor is considering the purchase of a(n) 6.000%, 15-year corporate bond that's being priced to yield 8.000%. She thinks that in a year, this bond will be priced in the market to yield 7.000%. Using annual compounding, find the price of the bond today and in 1 year. Next, find the holding period return on this investment, assuming that the investor's expectations are borne out. The price of the bond today is $ (Round to the nearest cent.)arrow_forward

- You purchased an annual-interest coupon bond one year ago with 7 years remaining to maturity at the time of purchase. The coupon interest rate is 10%, and par value is $1,000. At the time you purchased the bond, the yield to maturity was 9%. If you sold the bond after receiving the first interest payment and the bond's yield to maturity had changed to 8%, your annual total rate of return on holding the bond for that year would have been O 12.58% O 13.53% O4.01% O 14.64% 5.12%arrow_forwardYou bought one of Great White Shark Repellant Co.'s 7.4 percent coupon bonds one year ago for $1,041. These bonds make annual payments and mature 20 years from now. Suppose you decide to sell your bonds today, when the required return on the bonds is 6 percent. The bonds have a par value of $1,000. If the inflation rate was 4 percent over the past year, what was your total real return on investment? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardYou purchased a zero coupon bond one year ago for $120.36. The bond has a par value of $1,000 and the market interest rate is now 13 percent. If the bond had 17 years to maturity when you originally purchased it, what was your total return for the past year? Assume semiannual compounding.arrow_forward

- Suppose that the coupon rate for a TIPS is 5%. Suppose further that an investor purchases $10,000 of par value (initial principal) of this issue today. Also, there is deflation for the entire period of investment (you can assume 2% average deflation on annual basis). What is the principal that will be paid by the Department of the Treasury at the maturity date?arrow_forwardToday you buy ten zero-coupon bonds which will mature in exactly 5 years. Each of these ten bonds has a face value of $100. The price you pay today for each of these bonds is $82. Assume a year goes by. Now there are only 4 years left before these bonds mature. You sell these bonds in the market for $75 per bond. What is the return you have realized on your investment in these bonds? -7.00% -9.26% -8.54% We do not have sufficient information about interest rates to calculate this answer. -9.33%arrow_forwardYou bought one of Great White Shark Repellant Company's 8 percent coupon bonds one year ago for $1,044. These bonds make annual payments and mature 13 years from now. Suppose you decide to sell your bonds today, when the required return on the bonds is 6 percent. The bonds have a par value of $1,000. If the inflation rate was 3.4 percent over the past year, what was your total real return on investment? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Total real return %arrow_forward

- I would like to understand how to solve this in Excel. Hardware Inc. bonds are selling in the market for $960.45. These bonds carry a 9 percent coupon paid semiannually, and have 15 years remaining to maturity. What is the capital gain yield assuming that the interest rates will remain constant over the year?arrow_forwardBaghibenarrow_forwardYou purchased an 11-year semi-annual interest coupon bond one year ago. Its coupon rate was 7%, and its par value was $1,000. At the time you purchased the bond, the yield to maturity was 6%. If you sold the bond after one year and the bond's yield to maturity had changed to 5% after one year, your annual total rate of return on holding the bond for that year would have beenarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education