FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Answer this financial accounting question

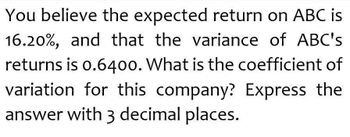

Transcribed Image Text:You believe the expected return on ABC is

16.20%, and that the variance of ABC's

returns is 0.6400. What is the coefficient of

variation for this company? Express the

answer with 3 decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- You believe the expected return on ABC is 16.20%, and that the variance of ABC's returns is 0.6400. What is the coefficient of variation for this company? Express the answer with 3 decimal places.arrow_forwardAnswer?? general accountarrow_forwardUse the Hamada equation to calculate the unlevered beta for JABIndustries, assuming the following data: Levered beta = b = 1.4;T = 40%; wd = 45%. (0.939)arrow_forward

- You have the following information: t1 t2 t3 t4 Walmart Returns 0.06 0.03 -0.01 -0.04 Market Returns -0.04 -0.01 0.08 -0.06 What is the Variance of the Market? Type your answer as decimal (i.e. 0.052 and not 5.2%). Round your answer to the nearest four decimals if needed.arrow_forwardA linear regression of the return on NVIDIA on the return of S&P 500 gives you thefollowing result:RNVIDIA = 0.03 + 1.45*RS&P500 + errorNVIDIA.Suppose that the standard deviation of the S&P 500 return is 0.20 and the standarddeviation of the error term (errorNVIDIA) is 0.10.What fraction of the total variance of NVIDIA is systematic?arrow_forwardExpected Return, Variance, Std. Deviation and Cofficient of Variation:Magee Inc.'s manager believes that economic conditions during the next year will be strong, normal, or weak, and she thinks that the firm's returns will have the probability distribution shown below. What's the standard deviation of the estimated returns?Round your answer to two decimal places. For example, if your answer is $345.6671 round as 345.67 and if your answer is .05718 or 5.7182% round as 5.72. State of the Economy Probability of State Occurring Stock's Expected Return Boom 30% 22.95% Normal 50% 12.90% Recession 20% –8.60%arrow_forward

- Expected Return, Variance, Std. Deviation and Cofficient of Variation:Magee Inc.'s manager believes that economic conditions during the next year will be strong, normal, or weak, and she thinks that the firm's returns will have the probability distribution shown below. What's the standard deviation of the estimated returns?Round your answer to two decimal places. For example, if your answer is $345.6671 round as 345.67 and if your answer is .05718 or 5.7182% round as 5.72. State of the Economy Probability of State Occurring Stock's Expected Return Boom 30% 21.60% Normal 55% 13.50% Recession 15% –11.35% A. 11.04% B. 12.10% C. 9.47% D. 10.52% E. 9.99%arrow_forwardExpected Return, Variance, Std. Deviation and Cofficient of Variation:Magee Inc.'s manager believes that economic conditions during the next year will be strong, normal, or weak, and she thinks that the firm's returns will have the probability distribution shown below. What's the standard deviation of the estimated returns?Round your answer to two decimal places. For example, if your answer is $345.6671 round as 345.67 and if your answer is .05718 or 5.7182% round as 5.72. State of the Economy Probability of State Occurring Stock's Expected Return Boom 20% 24.15% Normal 50% 13.50% Recession 30% –13.30% Group of answer choices 15.68% 16.39% 14.26% 13.54% 10.69%arrow_forwardprovide step by step explaination (no excel)arrow_forward

- Emmons Corporation has a 0.0 probability of a return of 0.49, a 0.4 probability of a rate of return of 0.07, and the remaining probability of a 0.0 rate of return. What is the variance in the expected rate of return of Emmons Corporation?arrow_forwardA probability distribution of possible returns from a share has a variance of 0.0064. What is the standard deviation of this probability distribution? a. 0.08 b. 0.64 c. 8% d. Both (a) and (c)arrow_forwardF1arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education