ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

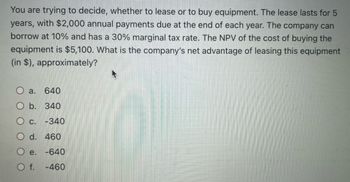

Transcribed Image Text:You are trying to decide, whether to lease or to buy equipment. The lease lasts for 5

years, with $2,000 annual payments due at the end of each year. The company can

borrow at 10% and has a 30% marginal tax rate. The NPV of the cost of buying the

equipment is $5,100. What is the company's net advantage of leasing this equipment

(in $), approximately?

O a.

640

O b. 340

O c. -340

O d. 460

O e. -640

O f. -460

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Force Completion Once started, this test must be completed in one sitting. Do not leave the tes Your answers are saved automatically. Remaining Time: 28 minutes, 03 seconds. Question Completion Status: Moving to another question will save this response. Question 17 Difference between actual amount received and what they would accept is known as O Producer Surplus O Consumer Surplus O Individual Surplus O Managers Surplus A Moving to another question will nous this roopono bike 2.jpg bike.jpg # bike 2 101°F Sunny f5 esc fi ? 0 16arrow_forwardUnits of resource Total Product Marginal Product 0 0 ----- 1 8 8 2 14 6 3 18 4 4 21 3 5 23 2 If the product the firm produces sells for a constant $3 per unit, the marginal revenue product of the fourth unit of the resource is what?arrow_forward18arrow_forward

- 1. Assume you must choose between two mutually exclusive alternatives: A or B. The explicit benefit you receive from alternative A, bª, is equal to $100. And, the explicit cost of choosing alternative A, c*, is $80. Also, the explicit benefit to choosing alternative B, b", is $120. What is the accounting return for choosing alternative A, r^? Given r and b", what is the explicit cost that you are willingness to pay (WTP) for alternative B, WTP"? Please include the formulas from class in your answer. How would WTPB change ifr^ increased by $5? Explain. your Using the original set of values for explicit costs and benefits, what would be your economic return to choosing alternative How does this relate to the concept of consumer surplus? if the price that you were charged was $95? Please interpret.arrow_forward2. For each of the following costs, identify the cost graph that best illustrates its cost behavior as the number of units produced increases. Not all graph have to be used and a graph can be used more than once. Graph 1 Graph 2 Graph 3 ° Activity Base O Activity Base o Activity Base Graph 4 Graph 5 O Activity Base O Activity Base FIGURE 20.2 Rent of warehouse of $10,000 per month Per-unit straight line depreciation costs a. b. с. Per-unit cost of direct materials d. Electricity costs of $5,000 per month plus $.0004 per kilawatt-hour е. Total direct labor costarrow_forwardKindly assist on question 1 and 2 1The difference between zero accounting profit and zero economic profit is that. a) an economic profit of zero indicates a fair return because it includes the opportunity cost of a firms capital. b) an economic profit zero indicates unacceptable rate of return because it does not include the opportunity cost of a firms capital. c) an economic profit of zero indicates more than a fair return because it includes opportunity cost and explicit cost. d) an accounting profit of zero indicates a fair rate of return because it includes the opportunity cost of a firms capital. 2.If a corporation is sued and losses the lawsuit, it's liability to pay. a) is imposed on all stockholders, personally b) is imposed only on the corporate CEO and the board of directors. C) its limited to the assets held in the corporations name. d) is imposed on the bondholders of the corporationarrow_forward

- (Table: Customer Valuations for Lawn Services I) The table shows customer valuations for different lawn services. Consumer Valuations per Season Lawn Cutting Fertilizing $ 800 $400 1,000 250 Consumer Ben Ethan The marginal cost of lawn cutting is $400, and the marginal cost of fertilizing is $200. Suppose the lawn service prices its services separately. In this case, the company should charge $ for fertilizing. O 250 800 600 Bundle $1,200 1,250 400arrow_forward2. Superior Metals Company has seen its sales volume decline over the last few years as the result of fising foreign imports. In order to increase sales and hopefully, profits), the firm is considering a price reduction on uranium-a metal that it produces and sells. The firm currently sells 60.000 pounds of uranium a year at an average price of $10 per pound. Fixed costs of producing uranium are $250,000. Current variable costs per pound are $5. The firm has determined that the variable cost per pound could be reduced by $.50 if production volume could be increased by 10 percent (fixed costs would remain constant). The firm' marketing department has estimated the arc elasticity of demand for uranium to be - 1.5. (a) How much would Superior Metals have to reduce the price of uranium in order to achieve a 10 percent increase in the quantity sold? (b) What would the firm's (i) total revenue, (ii) total cost, and (ii) total profit be before and after the price cut? 8 - 60000arrow_forwardCatriona's botique sold 100 pieces of bookmarks. Her total production cost is 5 pesos including an implicit cost of 2 pesos. Her opportunity cost of capital is 500 pesos. If the slling price of a bookmark is 10 pesos. How much is the economic profit? * O P500 O P300 O P700 O (P200) O Answer not givenarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education