FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

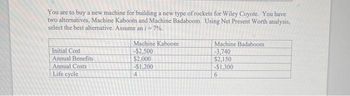

Transcribed Image Text:You are to buy a new machine for building a new type of rockets for Wiley Coyote. You have

two alternatives, Machine Kaboom and Machine Badaboom. Using Net Present Worth analysis,

select the best alternative. Assume an i = 7%.

Initial Cost

Annual Benefits

Annual Costs

Life cycle

Machine Kaboom

-$2,500

$2,000

-$1,200

4

Machine Badaboom

-3.740

$2,150

-$1,300

6

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Please correct answer and step by step solutionarrow_forwardA. Calculate the profitability index for project X. B. Calculate the profitability for project Y C. Using the NPV method combined with the PI aporoach, which project would you select? Use a discount rate of 13 percentarrow_forward1. The manager in a canned food processing plant is trying to decide between two labeling machines. Assume an interest rate of 6%. Use annual cash flow analysis to determine which machine should be chosen. First cost Maintenance and operating costs Annual benefit Salvage value Useful life, in years Machine A $15,000 1,600 8,000 3,000 6 Machine B $25,000 400 13,000 6,000 10arrow_forward

- A manufacturer of automated optical inspection devices is deciding on a project to increase the productivity of the manufacturing processes. The estimated costs for the two feasible alternatives being compared are shown below. Use the internal rate of return (IRR) method to determine which alternative should be selected if the analysis period is 8 years and the company's MARR is 4% per year. Alternative M N Initial costs $30,000 $45,000 Net annual cash flow $4,500 $7,000 Life in years 8 8 (a) IRR of base alternative = (b) IRR of incremental cash flow = (c) Choose Alternativearrow_forwardHow would I solve this? Thanks!arrow_forwardYou are looking at purchasing a new computer for online class. Computer A costs $4000 now, and you expect it will last throughout your program without any upgrades. Computer B costs $2500 now and will need an upgrade at the end of two years, which you expect to be $1700. With 8 percent annual interest, compounded monthly, which is the less expensive alternative and by how much, if they provide the same level of service and will both be worthless at the end of the four years?arrow_forward

- a. Compute annual rate of return, Pay back period b NPV using 14% discounts rate , Is the Project acceptable using this discount rate Compute NPV using 11% discounts rate. Is the Project acceptable using this discount ratearrow_forwardMinden Co. is considering buying new computer software that will assist customers in their product choices. The cost is $50,000. The benefit will be an additional cash inflow of $25,000 for four years, at which point the software will need replacing with a more modern version. The return on average investment is _______________. Question 15 options: 25.0% none of the options 42.5% 50.0% 30.0%arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education