FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

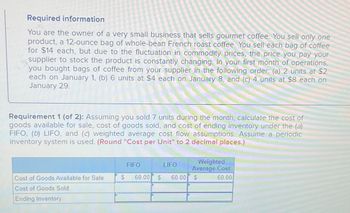

Transcribed Image Text:Required information

You are the owner of a very small business that sells gourmet coffee. You sell only one

product, a 12-ounce bag of whole-bean French roast coffee. You sell each bag of coffee

for $14 each, but due to the fluctuation in commodity prices, the price you pay your

supplier to stock the product is constantly changing. In your first month of operations,

you bought bags of coffee from your supplier in the following order: (a) 2 units at $2

each on January 1, (b) 6 units at $4 each on January 8, and (c) 4 units at $8 each on

January 29.

Requirement 1 (of 2): Assuming you sold 7 units during the month, calculate the cost of

goods available for sale, cost of goods sold, and cost of ending inventory under the (a)

FIFO, (b) LIFO, and (c) weighted average cost flow assumptions. Assume a periodic

inventory system is used. (Round "Cost per Unit" to 2 decimal places.)

Cost of Goods Available for Sale

Cost of Goods Sold

Ending Inventory

FIFO

$ 60.00 $

LIFO

60.00

Weighted

Average Cost

$

60.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- please show all work and preferably on paper Question 2. The marketing manager for Tim Hortons is attempting to price a cup of coffee. She knows that the cost of the coffee is $0.14 per cup, and expenses are 30% of the regular selling price. She would like the coffee to achieve an 88.24% markup on selling price.a) What is the regular selling price for a cup of coffee?b) What is the profit per cup?c) What is the markup on cost percentage?arrow_forwardHello Sir, if you have the answer to this question, please send me an instant message and if not, cancel.arrow_forwardYou own a Brownie shop. You have 2 employees that you pay a salary of $1,000 each, every month. The machine to make them costs $100/ month to lease. You can make 100 Brownies with the machine using $20 of ingredients. Utilities (electric, heat etc.) and Rent for the shop is a total of $1,750 per month. There are no other costs. Brownies sell for $3 each. A: How many Brownies would you need to sell to break even in a month? B: Instead of just breaking even, if you make 3000 Brownies in a month - what is your Gross Margin and your Operating Profit for the month?arrow_forward

- You have a business selling and delivering pizzas to businesses for lunch. You pay $4,000 per month in rent, $320 for utilities, and $2,000 a month for salaries. You also have delivery cars that cost $1,000 per month. Your variable costs are $8 per pizza for ingredients and $4 per pizza for delivery costs. You sell the pizzas for $20 each. Round up if necessary What is the number of pizzas you need to sell to break even for the month If you want to make a profit of 2,000 per month, how many pizzas do you need to sell? Round up if necessary Go back to the original numbers If the price of cheese goes up and your variable costs go by $3 what is your new break even in pizzas if you increase your price to $21 Round up if necessary Golden Company has a fleet of delivery trucks and has the following Overhead costs per month with the miles driven Miles Driven Total Costs March 50.000 194.000 Aprill 40.000 170.200 this is the low May 60.000 217.600 June 70.000 241.000 Use the High-Low method to…arrow_forwardMicrobiotics currently sells all of its frozen dinners cash-on-delivery but believes it can increase sales by offering supermarkets 1 month of free credit. The price per carton is $60, and the cost per carton is $45. The unit sales will increase from 1,160 cartons to 1,220 per month if credit is granted. Assume all customers pay their bills and take full advantage of any credit period offered. a. If the interest rate is 1% per month, what will be the change in the firm's total monthly profits on a present value basis if credit is offered to all customers? (Do not round intermediate calculations. Round your answer to 2 decimal places.) b. If the interest rate is 1.5% per month, what will be the change in the firm's total monthly profits on a present value basis if credit is offered to all customers? (Do not round intermediate calculations. Round your answer to 2 decimal places. Negative amount should be indicated by a minus sign.) c. Assume the interest rate is…arrow_forwardNick Strizzi owns and operates a pizza delivery and take-out restaurant. In 2013, he sold 100,000 pizzas at an average selling price of $15.00. The cost to make each pizza is $3.00 for cheese, $2.50 for spices, and $3.75 for the crust and other ingredients. The annual cost of operating the business is as follows: $ 55,000 $230,000 $ 15,000 $ 30,000 $150,000 Rent Salaries Insurance Advertising Car expenses The income tax rate for 2013 was 18%. Nick is preparing a projected income assumptions are as follows: statement for 2014. The planning Increase in number of pizzas sold 10% Selling price per pizza $ 16.00 Increase in cost of cheese 8% Increase in cost of spices 5% Increase in cost of crust and other 9% ingredients Annual rent $65,000 Increase in salaries 12% Increase in insurance costs 10% Advertising costs Increase in car expenses $35,000 15% Income tax rate 17% 309 Questions 1. Prepare Nick Strizzi's statement of income for 2013 and 2014. 2. Calculate Nick Strizzi's return on…arrow_forward

- The Home Style Eats has two restaurants that are open 24 hours a day. Fixed costs for the two restaurants together total $430,500 per year. Service varies from a cup of coffee to full meals. The average sales check per customer is $8.75. The average cost of food and other variable costs for each customer is $3.50. The income tax rate is 36%. Target net income is $117,600. Q1. Compute the revenues needed to earn the target net income. Q2. How many customers are needed to break even? To earn net income of $117,600? Q3. Compute net income if the number of customers is 170,000.arrow_forwardCharlotte sells widgets which cost $50 each to purchase and prepare for sale. Annual sales are 10,000 widgets, carrying cost are 15% of inventory costs, and Charlotte incurs a cost of $25 each time an order is placed. Suppose her supplier decides to offer a 3% cash discount if products are ordered in increments of 1250. How many widgets should Charlotte order each time an order is placed to minimize costs? I have submitted this question twice and both times was answered with how many orders of 1250 will satisfy the demand of 10,000 widgets. I need to know how to figure out HOW MANY WIDGETS PER ORDER to minimize costs.arrow_forwardHenry Sweet Company currently makes 6-inch candy sticks that it sells for $0.20 each. Henry can make 12-inch candy sticks out of two 6-inch candy sticks by melting them together, which costs an additional $0.03 per 12-inch stick. Henry can sell the 12-inch sticks for $0.45. Henry has enough capacity to make 10,000 6-inch candy sticks per month, and enough demand to sell all of the candy sticks it can manufacture, whether 6- inch or 12-inch. Should Henry sell 6-inch or 12-inch candy sticks, and how much additional profit will its decision bring in per month? Multiple Choice O O Sell 6-inch sticks, additional $100 Sell 6-inch sticks, additional $250 Sell 12-inch sticks, additional $100 Sell 12-inch sticks, additional $250arrow_forward

- In March, the price of a small coffee increased from $2 to $6, and the price of a large coffee increased from $6 to $18 dollars. If I spent a total of $50 on a combination of small and large coffees in January, and now spent a total of $35 on a combination of small and large coffees in march, how many small and large coffees am I able to buy now?arrow_forwardMicrobiotics currently sells all of its frozen dinners cash-on-delivery but believes it can increase sales by offering supermarkets 1 month of free credit. The price per carton is $170, and the cost per carton is $100. The unit sales will increase from 1,120 cartons to 1,180 per month if credit is granted. Assume all customers pay their bills and take full advantage of any credit period offered. a. If the interest rate is 1% per month, what will be the change in the firm's total monthly profits on a present value basis if credit is offered to all customers? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. b. If the interest rate is 1.5% per month, what will be the change in the firm's total monthly profits on a present value basis if credit is offered to all customers? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. Negative amount should be indicated by a minus sign. c. Assume the interest rate is 1.5% per month…arrow_forwardAvocado Company sells guitars to Mexican restaurants. The guitars sell for $600, and the fixed monthly operating costs are as follows: Rent and utilities $4800 Wages and benefits to employees 2300 Other expenses 485 Avocado understand that for every dollar of sales, $0.65 went to cover fixed costs, and anything above that point was profit. What is the amount of revenue that Avocado should earn each month to break even? (Round your answer to the nearest dollar.) O $4285 O $4769 O $5515 O $10,243arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education