FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

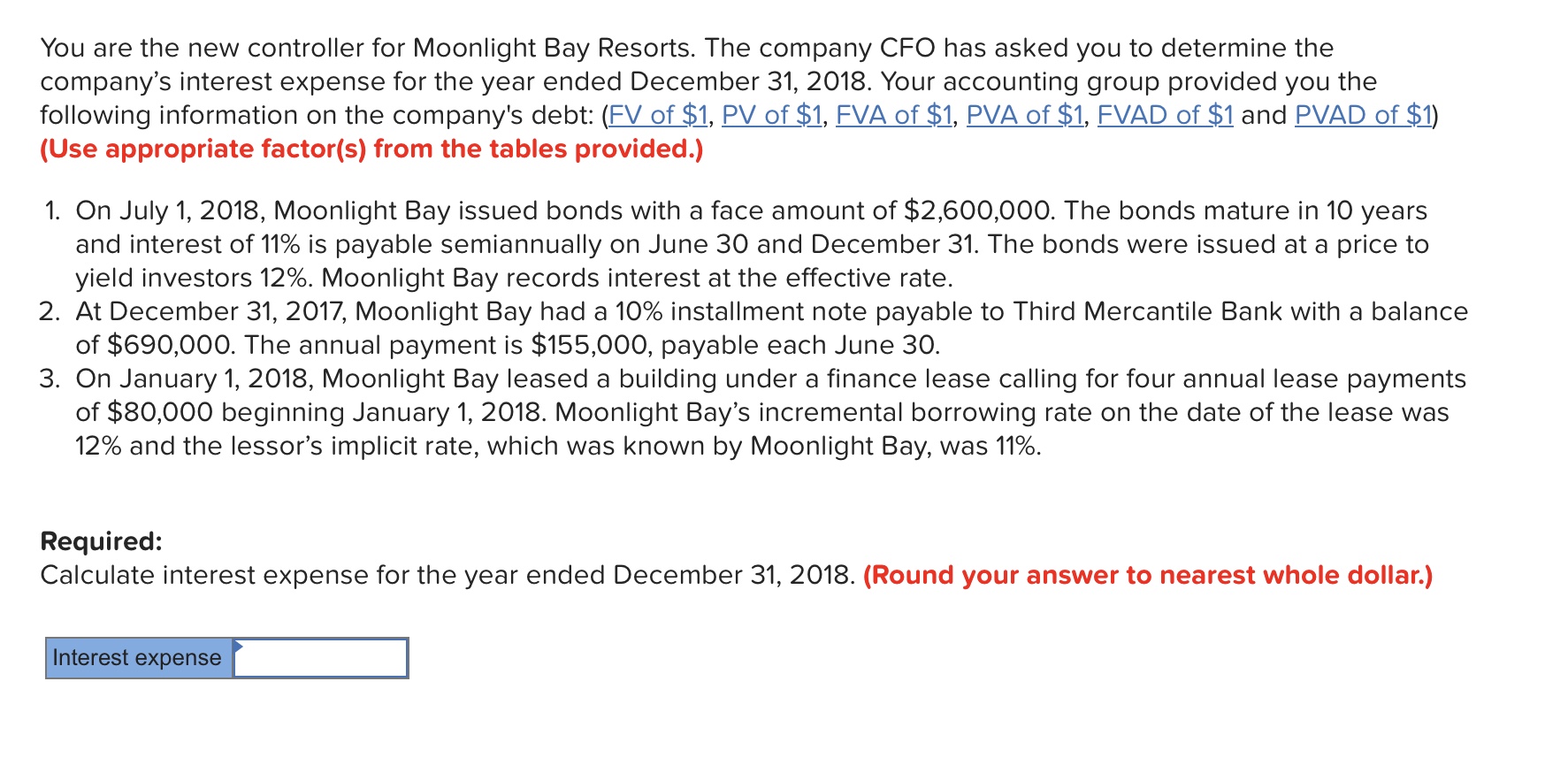

Transcribed Image Text:You are the new controller for Moonlight Bay Resorts. The company CFO has asked you to determine the

company's interest expense for the year ended December 31, 2018. Your accounting group provided you the

following information on the company's debt: (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)

(Use appropriate factor(s) from the tables provided.)

1. On July 1, 2018, Moonlight Bay issued bonds with a face amount of $2,600,000. The bonds mature in 10 years

and interest of 11% is payable semiannually on June 30 and December 31, The bonds were issued at a price to

yield investors 12%. Moonlight Bay records interest at the effective rate

of $690,000. The annual payment is $155,000, payable each June 30.

of $80,000 beginning January 1, 2018. Moonlight Bay's incremental borrowing rate on the date of the lease was

2. At December 31, 2017, Moonlight Bay had a 10% installment note payable to Third Mercantile Bank with a balance

3. On January 1, 2018 Moonlight Bay leased a building under a finance lease calling for four annual lease payments

12% and the lessor's implicit rate, which was known by Moonlight Bay, was 11%.

Required:

Calculate interest expense for the year ended December 31, 2018. (Round your answer to nearest whole dollar.)

Interest expense

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Similar questions

- Based on the following information as of December 31,2020, compute the company’s debt-equity ratio. Assume current liabilities are all interest-bearing. Round to nearest two decimal places. Current assets: 15 Non-current assets: 12 Current Liabilities: 22 Non-current Liabilities: 4 Debt to Equity Ratio = ?arrow_forwardI have obtained Target Corporation’s annual report for its 2018 fiscal year (year ended February 2, 2019). What was Target’s accounting equation for 2018?arrow_forwardAllianze Ltd has the following data information as of 30 June 2022: Current assets of $ 6,970 Net fixed assets of $18,700 Current liabilities of $4,570 Long term debts of $9,490. Required: Calculate shareholders’ equity and prepare a balance sheet for the company for the period.arrow_forward

- The financial statements of Dandy Distributors Ltd. are shown on the "Fcl. Stmts." page. 1 Based on Dandy's financial statements, calculate ratios for the year ended December 31, 2020. Assume all sales are on credit. Show your work. 2 From these ratios, analyze the financial performance of Dandy.arrow_forwardPlease answer complete and properlyarrow_forwardhttps://www.republictt.com/pdfs/annual-reports/RFHL-Annual-Report-2022.pdf Financial Reporting Analysis: Use Republic Bank Limited Annual Report 2022 to answer the Questions. a) Evaluate the company’s latest annual financial statements (balance sheet, income statement, and cash flow statement) and comment on the company's financial performance and position. In your response, use the requirements of IAS 1 as a guide. b) Identify and discuss key accounting principles and standards applied in the company’s financial reporting process indicating their reasons for choosing these and how they were applied. Comment briefly on the appropriateness of the choices made given the company’s industry, location and type (e.g. MNC, regional conglomerate, etc.) c) Critically analyze any significant accounting policies and estimates disclosed in the notes to the financial statements. In your answer, indicate whether the company complied with the accounting standards and conventions.arrow_forward

- You are the new controller for Moonlight Bay Resorts. The company CFO has asked you to determine the company's interest expense for the year ended December 31, 2024. Your accounting group provided you the following information on the company's debt:Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)1. On July 1, 2024, Moonlight Bay issued bonds with a face amount of $ 1,000,000. The bonds mature in 20 years and interest of 7% is payable semiannually on June 30 and December 31. The bonds were issued at a price to yield investors 8% Moonlight Bay records interest at the effective rate.2. At December 31, 2023, Moonlight Bay had a 10% installment note payable to Third Mercantile Bank with a balance of $580,000. The annual payment is $100, 000, payable each June 30.3. On January 1, 2024, Moonlight Bay leased a building under a finance lease calling for four annual lease payments of $65,000beginning January 1, 2024.…arrow_forwardAt May 31, 2019, Acai Associates reported the following amounts (in millions) in its financial statements: Total Assets Total Liabilities Interest Expense Income Tax Expense Net Income 2019 $ 59,000 32,450 642 125 620 2018 $ 57,000 29,070 590 230 4,846 Required: 1. Compute the debt-to-assets ratio and times interest earned ratio for 2019 and 2018. 2-a. In 2019, were creditors providing a greater (or lesser) proportion of financing for Acai's assets? 2-b. In 2019, was Acai more (or less) successful at covering its interest costs, as compared to 2018?arrow_forwardOxmoor Corporation prepared the following adjusted trial balance. Required:Prepare a single-step income statement for Oxmoor for the year ended December 31, 2019.arrow_forward

- Planning Wizards, LLC is an event-planning company. Which of the following would be included in the current asset section of a classified balance sheet dated December 31, 2019? a. 15-month certificate of deposit b. Customer advances on New Year's parties c. Last month rent payment (lease expires in 2021) d. Investment in stocks, to be sold in 2020 e. Income tax refund receivable f. Inventory Select one: d, e, and f e and f a, b, c, e, and f a, b, c, d, e, and f b, e, farrow_forwardAn analysis of the transactions of Cavernous Homes Inc. yields the following totals at December 31, 2019: cash, $3,200; accounts receivable, $4,500; notes payable, $5,000; supplies, $8,100; common stock, $7,000; and retained earnings, $3,800.Required:Prepare a balance sheet for Cavernous Homes Inc. at December 31, 2019.arrow_forwardSweet home Inc., includes the following selected accounts in its general ledger at December 31, screenshot attacahed thanks fas fakopearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education