ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

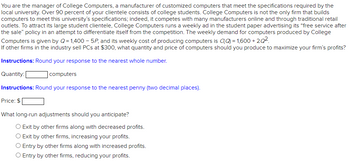

Transcribed Image Text:You are the manager of College Computers, a manufacturer of customized computers that meet the specifications required by the

local university. Over 90 percent of your clientele consists of college students. College Computers is not the only firm that builds

computers to meet this university's specifications; indeed, it competes with many manufacturers online and through traditional retail

outlets. To attract its large student clientele, College Computers runs a weekly ad in the student paper advertising its "free service after

the sale" policy in an attempt to differentiate itself from the competition. The weekly demand for computers produced by College

Computers is given by Q=1,400-5P, and its weekly cost of producing computers is (Q) = 1,600 +2Q².

If other firms in the industry sell PCs at $300, what quantity and price of computers should you produce to maximize your firm's profits?

Instructions: Round your response to the nearest whole number.

Quantity:

computers

Instructions: Round your response to the nearest penny (two decimal places).

Price: $

What long-run adjustments should you anticipate?

O Exit by other firms along with decreased profits.

Exit by other firms, increasing your profits.

O Entry by other firms along with increased profits.

O Entry by other firms, reducing your profits.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The inverse demand curve facing a resort hotel is during the low season and PL = 100 - QL PH = 400 - QH during the high season. The resort's marginal cost is $50 per night in cleaning costs for the room and general maintenance and administration. The resort only has 100 rooms. What is the resort's profit-maximizing peak-load pricing strategy? Illustrate the solution in a diagram. 1.) Using the point drawing tool, indicate the profit-maximizing price during the low season. Label this point 'e.' 2.) Using the point drawing tool, indicate the profit-maximizing price during the high season. Label this point 'e.' Carefully follow the instructions above, and only draw the required objects. C p, $ per night 400- 350+ 300- 250- 200- 150- 100- 50- 0+ 0 MR D 50 ☆ H MR' 100 150 200 250 300 Q, Rooms per night MC DH 350 400 LYarrow_forwardYou are the manager of a monopolistically competitive firm. The present demand curve you face is P = 100 – 4Q. Your cost function is C(Q) = 50 + 8.5Q2. What level of output should you choose to maximize profits? What price should you charge? What will happen in your market in the long run? Explain.arrow_forwardSuppose there are two types of cable TV viewers. The first type places a high value on sports channels (e.g., ESPN, Fox Sports, and the Golf Channel) and a low value on all other channels. The second type places a high value on music channels (e.g., VH1, MTV3, and CMT) and a low value on all other channels. In this case, we would expect cable operators to: use fixed-cost pricing. use "à la carte" pricing. sell sports and music channels in one bundle to both types of viewers. sell only sports channels to the first type of viewers and sell only music channels to the second type of viewers.arrow_forward

- [Suppose] A Cmpany is the sole provider of electricity in the various districts of Dubai. To meet the monthly demand for electricity in these districts, which is given by the inverse demand function: P = 1,200 − 4Q, the company has set up two electric generating facilities: Q1 kilowatts are produced at facility 1 and Q2 kilowatts are produced at facility 2; where Q = Q1 + Q2. The costs of producing electricity at each facility are given by C1(Q1) = 8,000 + 6Q1 C2(Q2) = 6,000 + 3Q2 + 5Q22 Calculate the profit maximizing output levels of each factory? What is the profit maximizing level of price? What is the maximum profit?arrow_forwardYou are the manager of College Computers, a manufacturer of customized computers that meet the specifications required by the local university. Over 90 percent of your clientele consists of college students. College Computers is not the only firm that builds computers to meet this university's specifications; indeed, it competes with many manufacturers online and through traditional retail outlets. To attract its large student clientele, College Computers runs a weekly ad in the student paper advertising its "free service after the sale" policy in an attempt to differentiate itself from the competition. The weekly demand for computers produced by College Computers is given by Q = 1,400 - 4P, and its weekly cost of producing computers is C(Q) = 1,600 +2Q². If other firms in the industry sell PCs at $300, what quantity and price of computers should you produce to maximize your firm's profits? Instructions: Round your response to the nearest whole number. Quantity: [ computers…arrow_forwardMelCo’s Xamoff The global pharmaceuticals giant, MelCo, has had great success with Xamoff, and over-thecounter medicine that reduces exam-related anxiety. A patent currently protects Xamoff from competition, although rumors persist that similar products are in development. Two years ago, MelCo sold 25 million units for a price of $10 for a package of ten. Last year it raised the price to $11, and sales fell to 22 million units. Finally, a financial analyst estimates the cost of production at $2 per package. (a) Estimate the elasticity of demand for this product at $10. Is this price too high or too low? (b) Estimate the elasticity of demand for this product at $11. Is this price too high or too low? (c) Based on your answers to (a) and (b), what can we say about MelCo’s profit-maximizing price?arrow_forward

- Big Boss is a local pet shop, mainly selling cat food. It has a constant marginal cost of $24. She recently runs a promotional campaign using discount coupons. Suppose Big Boss estimates price elasticity of demand for coupon users and non-coupon users are –3.0 and –1.6 respectively. Calculate the prices Big Boss should charge on coupon users and non-coupon users respectively.arrow_forwardWebsite Profit The latest demand equation for your gaming website, www.mudbeast.net, is given by q=-100x + 1500 where q is the number of users who log on per month and x is the log-on fee you charge. Your Internet provider bills you as follows. Site maintenance fee: $50 per month High-volume access fee: $0.50 per log-on Find the monthly cost as a function of the log-on fee x. C(x): = X Find the monthly profit as a function of x. P(x) = Determine the log-on fee you should charge (in dollars) to obtain the largest possible monthly profit. x = $ per log-on What is the largest possible monthly profit (in dollars)? $arrow_forwardYou are managing a firm with market power, and you think the price elasticity of demand for your product is between 1.3 and 1.5. You estimate that your marginal cost is between $55 and $70. The price that you should set would range between $ and $. (Round your answers to two decimal places.) If you refine your estimate of the marginal cost to $80, the price you should set would now range between $ and $ (Round your answers to two decimal places.)arrow_forward

- Parkleigh Pharmacy is an upscale department store in Rochester, NY, that sells personal accessories and home decorations. Kaufmann’s is a departmental store based in Pennsylvania and has several stores in Rochester, NY. Kaufmann carries a broad range of products and caters to middle-class customers. A salesperson at Parkleigh is paid a straight hourly wage (e.g., no sales commission) and 30% discount from purchasing any product from Parkleigh’s store. A salesperson at Kaufmann gets an hourly wage lower than Parkleigh’s hourly wage but gets 5% commission on sales. However, the product salesperson buys from Kaufmann without a discount. Explain why does Kaufmann pays sales commission, and Parkleigh doesn’tarrow_forwardWhat membership fee would maximize profit for the club? Compared to the profit of a similar but single-price monopoly golf club, how much more profit does Northlands Golf Club make?arrow_forwardThe inverse demand curve facing a resort hotel is during the low season and PL = 100-Q₁ PH = 350 – QH during the high season. The resort's marginal cost is $50 per night in cleaning costs for the room and general maintenance and administration. The resort only has 75 rooms. What is the resort's profit- maximizing peak-load pricing strategy? Illustrate the solution in a diagram. 1.) Using the point drawing tool, indicate the profit-maximizing price during the low season. Label this point 'e' 2.) Using the point drawing tool, indicate the profit-maximizing price during the high season. Label this point 'eH Carefully follow the instructions above, and only draw the required objects. p. $ per night 69 400- 350- 300- 250- 200- a 150- 100- 50- 0- 0 MR D MRH 50 100 150 200 250 300 Q, Rooms per night MG DH 350 400 Q ONarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education