Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

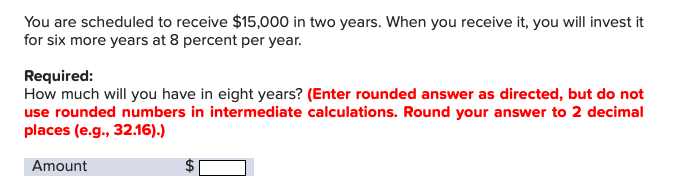

Transcribed Image Text:You are scheduled to receive $15,000 in two years. When you receive it, you will invest it

for six more years at 8 percent per year

Required:

How much will you have in eight years? (Enter rounded answer as directed, but do not

use rounded numbers in intermediate calculations. Round your answer to 2 decimal

places (e.g., 32.16).)

Amount

A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Mitchell Investments has offered you the following investment opportunity: $7,000 at the end of each year for the first 7 years, plus $6,000 at the end of each year from years 8 through 14, plus $3,000 at the end of each year from years 15 through 21. Use Table II and Table IV or a financial calculator to answer the questions. Round your answers to the nearest dollar. How much would you be willing to pay for this investment if you required a 8 percent rate of return?$ If the payments were received at the beginning of each year, what would you be willing to pay for this investment?$arrow_forward6) A couple will need $50, 000 for a down payment on a home in eleven years. They plan to invest $8,000 up front and make a payment at the end of each month for the full eleven years. Assume the account earns 6.89% monthly. (a) How much will the initial deposit be worth in ten years? Round to two decimal places. (b) How much should the monthly payment be? Round to two decimal places.arrow_forwardYou just received an inheritance of $123,456. How long would you need to leave it in an RRSP earning 2.5% compounded semi-annually to earn $800 (end of) monthly for 20 years? Assume the same RRSP interest rates for the payment stage as the deferred stage. Hint: There are two stages here. a) Draw a timeline HERE. Comments b) Describe how you will solve this problem in one or two sentences. Work c) How long would you need to leave it in an RRSP earning 2.5% compounded semi-annually to earn $800 (end of) monthly for 20 years? Work SETTING ON PMT PV CALCULATOR BGN or END P/Y C/Yarrow_forward

- (Comprehensive problem) You would like to have $54,000 in 16 years. To accumulate this amount, you plan to deposit an equal sum in the bank each year that will earn 6 percent interest compounded annually. Your first payment will be made at the end of the year. a. How much must you deposit annually to accumulate this amount? b. If you decide to make a large lump-sum deposit today instead of the annual deposits, how large should this lump-sum deposit be? (Assume you can earn 6 percent on this deposit.) c. At the end of five years, you will receive $20,000 and deposit this in the bank toward your goal of $54,000 at the end of year 16. In addition to the lump-sum deposit, how much must you deposit in equal annual amounts, beginning in year 1 to reach your goal? (Again, assume you can earn 6 percent on your deposits.) a. How much must you deposit annually to accumulate this amount? (Round to the nearest cent.)arrow_forwardYou would like to contribute to a savings account over the next three years in order to accumulate enough money to take a trip to Europe. Assume an interest rate of 20%, compounded quarterly. How much will accumulate in three years by depositing $560 at the beginning of each of the next 12 quarters? Note: Use tables, Excel, or a financial calculator. Round your final answers to nearest whole dollar amount. (EV of $1. PV of $1. EVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) Table, Excel, or calculator function Payment: Future Value: n= FVAD of $1 $ 560 12 5.0%arrow_forwardThe Maybe Pay Life Insurance Company is trying to sell you an investment policy that will pay you and your heirs $30,000 per year forever. If the required return on this investment is 5.6 percent, how much will you pay for the policy? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forward

- Nonearrow_forwardSay that you want to establish a scholarship fund that will make fixed payments forever. To fund the scholarship, you plan to make 12 annual contributions of $9.9k to an investment account with an expected return of 6.0% interest annually. Your first contribution occurs today. If the scholarship fund makes its first payment two years following the last contribution, then what is the fixed annual payment that the scholarship fund will award? (Round to the nearest dollar)arrow_forwardHelen Quick made an investment of $20,542.75. From this investment, she will receive $2,400 annually for the next 15 years starting one year from now. Click here to view the factor table What rate of interest will Helen's investment be earning for her? (Hint: Use Table 4.) (For calculation purposes, use 5 decimal places as displayed in the factor table provided. Round answer to O decimal places, e.g. 25%.) Rate of interest %arrow_forward

- You expect to receive $29,000 at graduation in two years. You plan on investing it at 10 percent until you have $164,000. How long will you wait from now? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forwardIf you invest $10,000 per period for the following number of periods, how much would you have in each of the following instances? Use Appendix C for an approximate answer, but calculate your final answer using the formula and financial calculator methods. In 50 years at 8 percent? (Do not round intermediate calculations. Round your final answer to 2 decimal places.)arrow_forwardSuppose an investment will pay $7,000 in 44 years from now. If you can earn 6.15% interest compounded monthly by depositing your money in a bank, how much should you pay for the investment today?Round your answer to two decimal places. For example, if your answer is $345.667 round as 345.67 and if your answer is .05718 or 5.718% round as 5.72. Group of answer choicesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education