Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

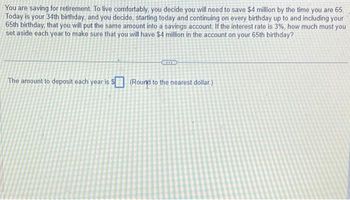

Transcribed Image Text:You are saving for retirement. To live comfortably, you decide you will need to save $4 million by the time you are 65.

Today is your 34th birthday, and you decide, starting today and continuing on every birthday up to and including your

65th birthday, that you will put the same amount into a savings account. If the interest rate is 3%, how much must you

set aside each year to make sure that you will have $4 million in the account on your 65th birthday?

The amount to deposit each year is $(Round to the nearest dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You want to retire with at least $1,500,000 in the bank and figure you will continue working for another 40 years. After all of your expenses you can only afford to save $250 a month. What is the lowest interest rate you will need to earn to ensure you meet your retirement goal?arrow_forwardYou opened a savings yesterday by depositing $10,000. You would like to be able to withdraw $2,000 per year for each of the next 4 years of college and still have $3,000 left in the account when you graduate. What interest rate does this account need to earn?arrow_forwardPlease see Imagearrow_forward

- You are 30 years old today. You want to retire at the age of 55. You expect to live until age 90. You would like to have a monthly income of $9,000 per month in retirement. How much do you have to save per month during your working years in order to achieve your retirement goal? Assume end of period payments. Assume an annual interest rate of 3.5% in retirement and 5% during your working life. How much do you have to save per month during your working years in order to achieve your retirement goal? $ (Round to the nearest cent.)arrow_forwardYou currently have $12,000 saved up in your bank account. You believe that 2 years from now, some of your generous relatives will give you a combined gift of $5,000 as a college graduation present. If you can earn 4.5% annual compound interest on your savings, how many years will it take you, from today, to be able to afford the car you'd like to purchase, which costs $25,000?arrow_forwardHow much do you need to save each year for 30 years in order to have $775,000, assuming you are investing the money in an account that earns 8%? How much of the $775,000 comes from contributions (your out of pocket costs)?arrow_forward

- PLEASE ANSWER ASAP AND CORRECTLY USING ENGINEERING ECONOMICS!arrow_forwardYou want to open a savings plan for your future retirement. You are considering two options as follows: Option 1: You deposit Php 1,000 at the end of each quarter for the first 10 years. At the end of 10 years, you make no further deposits, but you leave the amount accumulated at the end of 10 years for the next 15 years. Option 2: You do nothing for the first 10 years. Then you deposit Php 6,000 at the end of each year for the next 15 years. Compare the amount accumulated in Option 1 and Option 2. If your deposits or investments earn on interest rate of 6% compounded quarterly, and you chose Option 2 over Option 1, At the end of 25 years from now, I will accumulate what amount of money?arrow_forwardA couple wants to set up a college savings account for their grandchild. If the account earns 4.4% interest compounded quarterly, how much should they invest today so that the account will be worth $50,000 in 18 years? Round your final answer to two decimal places.arrow_forward

- You receive a $5,000 check from your grandparents for graduation. You decide to save it toward a down payment on a house. You invest it earning 8% per year and you think you will need to have $10,000 saved for the down payment. How long will it be before the $5,000 has grown to $10,000 ? To double the money you received from your grandparents, it will take years. (Round to one decimal place.)arrow_forwardYou are just starting your first job out of college. You and your best friend are competing to see who will have more in their savings when you retire; you both plan to retire at age 52, just 30 years out. You will need $5 million to retire. If you average an annual return of 7% on your investment, how much do you need to put into retirement savings on an annual basis?arrow_forwardBobby has heard the importance of saving early for retirement. He wants to retire in 35 years. But he really likes traveling. Right now, he spends, on average, about $600 a month traveling. He is trying to decide if he should start saving his travel money for retirement now, or if he can continue traveling a few more years before beginning to save. Assume that he can find an annuity that pays 4.75% compounded quarterly. What is his future value if: a) He waits 20 years to start saving? N: P/Y: I%: C/Y: PMT: End or Begin $201,091.59 $658,935.54 $823,669.42 $1,000,000.00arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education