Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

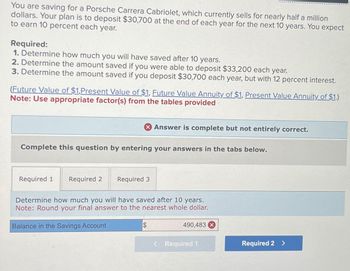

Transcribed Image Text:You are saving for a Porsche Carrera Cabriolet, which currently sells for nearly half a million

dollars. Your plan is to deposit $30,700 at the end of each year for the next 10 years. You expect

to earn 10 percent each year.

Required:

1. Determine how much you will have saved after 10 years.

2. Determine the amount saved if you were able to deposit $33,200 each year.

3. Determine the amount saved if you deposit $30,700 each year, but with 12 percent interest.

(Future Value of $1,Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1.)

Note: Use appropriate factor(s) from the tables provided

X Answer is complete but not entirely correct.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Required 3

Determine how much you will have saved after 10 years.

Note: Round your final answer to the nearest whole dollar.

Balance in the Savings Account

$

490,483

< Required 1

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Assume you won the state lottery and you are entitled to $5,000,000. If you choose not to take the money right away but wish to be paid weekly, you estimate that you will want to receive this cash flow over the next 10 years. How much will your weekly payment be at an interest rate of 5% ?arrow_forwardAssume that you and your family want to go on vacation in 5 years. You are planning to save for the trip. The estimated cost of the trip will be $10,000. You have found an investment that will pay 6% annual interest for the next 5 years. Using Excel, calculate the dollar amount that will be required to invest today to reach the financial expense for your vacation.arrow_forwardSuppose you'd like to save enough money to pay cash for your next car. The goal is to save an extra $28,000 over the next 33 years. What amount must be deposited quarterly into an account that earns 4.7% interest, compounded quarterly, in order to reach your goal? Round your answer to the nearest cent, if necessary.arrow_forward

- Use the following to answer the next two questions: You decide to be in saving for your retirement days. You begin with depositing $300 per month into a savings account that is earning 12% per year compounded monthly. You may deposit faithfully for 25 years at which time you'll retire. Your institution wants to keep your money and as an incentive begins paying 15% per year compounded monthly provided your delay, taking out any money for four years. After four years, you decide to begin withdrawing equal payments for the next 20 years. What are the equal monthly payments that you can withdraw if you want the account to last for 20 years?arrow_forwardYou currently have $12,000 saved up in your bank account. You believe that 2 years from now, some of your generous relatives will give you a combined gift of $5,000 as a college graduation present. If you can earn 4.5% annual compound interest on your savings, how many years will it take you, from today, to be able to afford the car you'd like to purchase, which costs $25,000?arrow_forwardYou need to have $18,000 to pay for your car in 7 years. How much do you need to deposit today in a bank that pays 5% interest, compounded annually, in order to achieve your goal?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education